How B2B Marketers Can Increase Pipeline Efficiency and Predictability

Last updated: October 13th, 2025

“We paused a set of LinkedIn campaigns 9-12 months ago, and just saw demo conversions last month.”

This is just one conversation we had with a client recently that reflects the messy reality of B2B buying.

You may have plenty of leads engaging with your content and marketing assets right now, but if they get stuck in your marketing cycle and don’t move forward efficiently, you’re missing out on compounding revenue.

As a result, you’ll have limited resources to reinvest in customer acquisition and ultimately lose market share to your competitors.

This means that your growth opportunity lies in increasing pipeline efficiency and moving more right fit prospects through the buyer journey in less time.

In this post, we’ll discuss how chasing leads is costing you revenue and how to rebuild the buyer journey to increase pipeline efficiency.

Why Chasing New Leads Isn’t Generating Pipeline

In the predictable revenue era of the 2010s, the solution to generating more pipeline was pure volume.

B2B marketers created more content, sent more emails, and published more lead magnets to increase pipeline.

The rising noise meant the number of touchpoints per lead increased, though the number of closed won deals remained constant.

This broke the formula of more touchpoints equals more pipeline.

So how do you fix this problem and predictably and efficiently generate pipeline?

Instead of striving to increase touchpoints, focus on improving speed and efficiency.

In other words, move more leads to the next stage of the buyer journey as quickly and efficiently as possible, rather than simply increasing prospect touchpoints.

For example, instead of celebrating 1,000 webinar signups, focus on how many of those attendees moved to the next stage of the buyer journey and how much time it took them to take that step.

This mindset shift fundamentally increases efficiency because the cost of moving an existing lead to the next stage of the buyer journey is lower than the cost of acquiring a new lead.

Additionally, it forces marketing to better align with sales and capture more qualified prospects rather than chasing cheaper prospects.

By targeting more qualified prospects and removing bottlenecks to speed up the buyer journey, you’ll be able to scale more efficiently.

To help our clients capture more pipeline more efficiently and predictably, we use the following 30/60/90 day playbook.

The 30/60/90 Day Playbook to Improve Pipeline Predictability and Efficiency

There are three stages in the 30/60/90 day playbook to improve pipeline predictability and efficiency:

- Improve efficiency: Identify and remove bottlenecks to increase the number of leads flowing through the funnel.

- Strengthen your foundation: Realign on who your ICP and anti-ICP is and then readjust marketing efforts to better align with best fit prospects.

- Scale: Instead of generically increasing content volume and CAC, tie branding efforts to revenue and increase CAC on the highest value prospects.

0-30 days: Generate Fast Wins By Identifying Inefficiencies and Unblocking Flows

In the first thirty days, the goal is to identify where your prospects are getting stuck and unblock them.

Step 1: Measure Existing Buyer Journey Metrics

Start by defining two metrics:

- Stage to stage conversion percentages

- Average days between stages

The goal is to increase the percentage of prospects who reach the next stage of the buyer journey and decrease the time spent between stages.

For example, let’s say you’re currently getting 50 of your 1,000 webinar attendees to take the next step and book a demo in the seven days following the webinar.

In this case, you’re metrics are:

- 5%: Stage to stage conversion percentage

- 7 days: Average days between stages

To track these metrics, RevOps should set up stage-aging fields and SLA flags in your CRM. Then, create a dashboard that shows the movement (stage conversions, median days, and stall percentages) by segment and source.

Step 2: Recover Near Customers

A core principle of building pipeline predictability and efficiency is retaining and nurturing existing leads rather than chasing new leads.

Tactically, here’s how we retain and convert a higher percentage of customers:

- Recapture demo no-shows: Send no-shows a follow-up email that provides a helpful recap of the demo, a link to reschedule the demo, and an objection-handling video. Here’s an excellent example of an ad designed to recapture no-shows: Source

- High-intent retargeting: Retarget leads that visited demo and pricing pages with conversion ads or Calendly-in-ad. Source

As you create lead reactivation campaigns, be sure to segment your retargeting campaigns and tailor the messaging to the last topic consumed, rather than using generic drips.

For example, if the prospect’s last touchpoint was a webinar on optimizing for LLM visibility, make sure that the retargeting messaging is related to LLM visibility rather than generic SEO tips.

Aim to increase no-show rebooks by 20% and convert at least 2% of the retargeted leads into meetings.

Step 3: Use Hyper Specific Offers and Messaging

A key reason chasing lead volume over efficiency sets marketers up for failure is that it incentivizes broad, generic offers and messaging that generate a lot of engagement, but fail to attract the right attention.

By attracting the wrong customers, you’ll see low conversion rates, regardless of how well you’ve optimized your retargeting. In fact, zero leads are better than low quality leads, because you’ll waste even more resources retargeting leads that won’t ever convert.

To ensure you only invest in the right-fit leads, eliminate vague offers and reframe webinars and lead magnets with outcome-based language.

For example, instead of “How to get more leads on LinkedIn,” reframe it to something like “Do these 7 fixes to lift LinkedIn CVR this month.”

Improving topic specificity will also allow you to keep lead forms short (which can lift conversion rates) while still ensuring prospects are high quality.

Aim to improve landing page conversion rates by 20% on high-intent pages, and reduce webinar registration-to-MQL drop-off by 15%.

Step 4: Test and Refresh Ad Creative

If you aren’t constantly testing different ad creatives, you’re experiencing inefficiencies due to ad fatigue.

Implement bi-weekly creative drops by testing new hooks, formats, and messaging angles.

Keep a log of the highest and lowest performing creatives to double down on what works and avoid retesting messaging, creative, and formats that underperformed.

Ideally, over 60% of your ad spend should be allocated to ads that are less than 30 days old, and build a creative backlog of over 20 assets to test.

Step 5: Align Executives on Key Metrics (CMO, CFO, and CRO)

Before rolling out any changes, your entire executive team needs to align on what success looks like.

Tactically, this means defining targets for win rates, payback guardrails by segment, and MCL (marketing cycle).

While most teams track the sales cycle in detail, fewer people understand what the marketing cycle is or how to track it.

Understanding the MCL is crucial for budget timing (e.g., how long it takes a prospect to mature into an opportunity from their first touchpoint) so that you can set realistic expectations with finance and sales.

To calculate the MCL, define the first meaningful touchpoint. It is usually the first website visit, but it could also be ten ad impressions. Tools like Fibbler, Hockeystack, and Dreamdata can help you calculate impressions if you decide to use impression count as the first meaningful touchpoint.

You can then use historical data to measure your marketing cycle and set targets accordingly.

For win rates, 25% to 30% is the most common benchmark, but it varies depending on the company’s maturity, budget, and GTM motion.

We also discussed payback periods at length in our article on determining CAC, but here are some general targets to aim for depending on funding:

- Bootstrapped: 6-9 months payback typical.

- PE-backed: ~9-16 months.

- VC-backed: ~12-24 months (market share land-grab tolerance)

This step should be more than just a verbal meeting, as verbal agreements are easily forgotten and impossible to track.

Instead, create a signed document outlining these target metrics and a dashboard to match it.

31-60 days: Rebuild Your Pipeline Foundation and Increase Momentum

The old marketing playbook was increasing content output with the goal of increasing lead volume.

As we discussed earlier, increasing lead volume at the expense of lead quality decreases pipeline efficiency.

So during this step, rebuild your marketing foundation so that your messaging clearly defines who you do and do not help. Defining who you don’t help will significantly improve pipeline composition.

Clarifying messaging and positioning will also lay the foundation for branding investments, which will ultimately help you build pipeline consistency and improve performance marketing efficiency.

Step 1: Clarify Your ICP and Anti-ICP

Create a list of your highest LTV customers and define:

- Titles of decision makers involved in the buying cycle

- Company size

- Company industry

- Specific pain points they came to solve

Next, analyze the leads that did not convert in the last 30 days (since improving the efficiency of your marketing cycle) as well as your worst customers (e.g., lowest LTV, longest sales cycle, and high maintenance).

Then, look for commonalities across those customers to make an anti-ICP list using the same metrics used to define your ICP.

Keep in mind that your ICP and anti-ICP lists shouldn’t just be purely demographic data. It should also include pain points that you solve significantly better than competitors, and pain points you do not solve for the anti-ICP list.

Using this data, update your targeting, including account lists, titles, and exclusion lists.

Embrace a narrow ICP. Ideally, over 70% of qualified pipeline should come from priority segments.

Strive to improve the opportunity to closed won gap by 10% relative to past quarters.

Step 2: Invest in Authority Assets to Build Brand

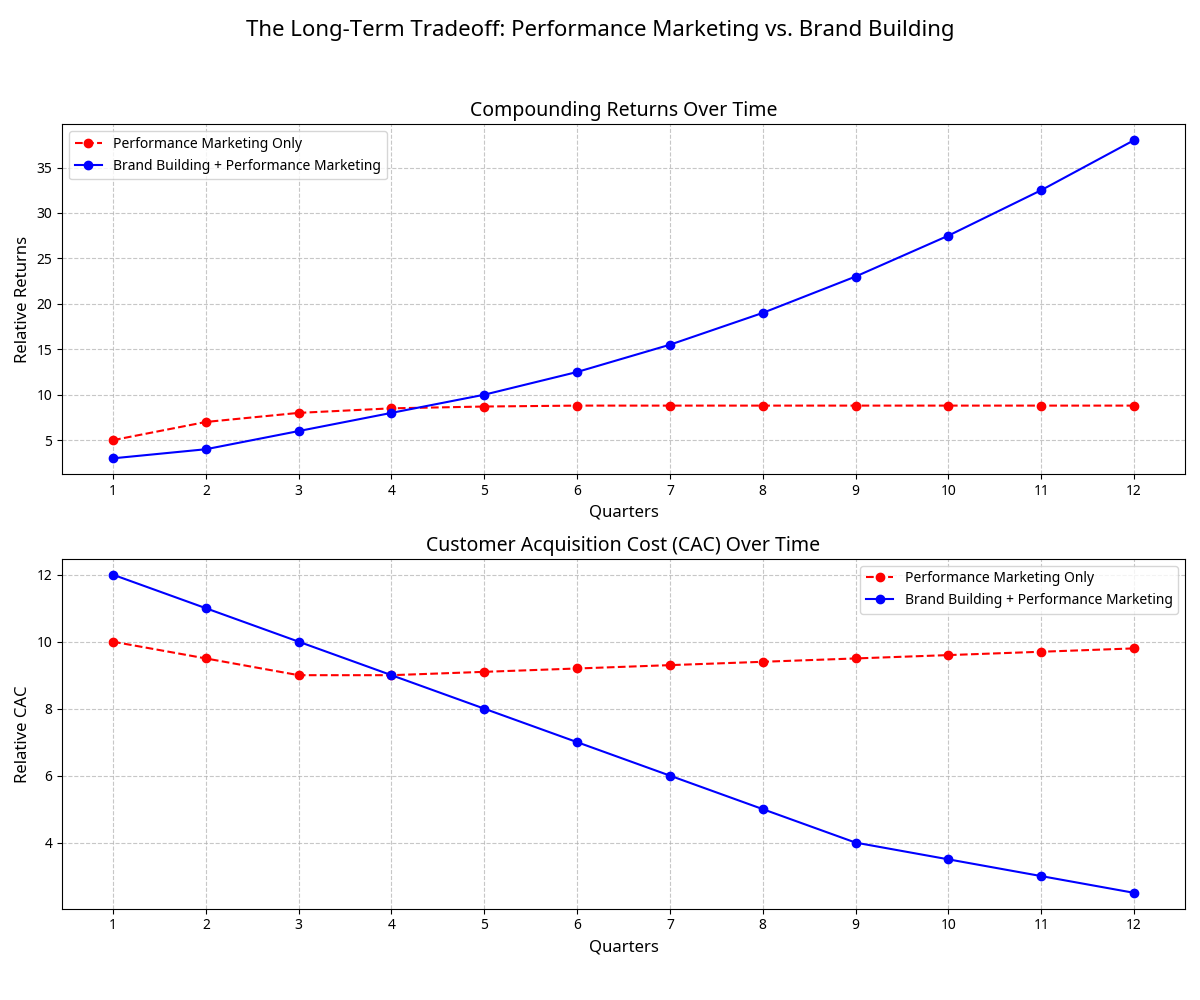

In an effort to hit quarterly targets, marketers often put all of their eggs in the performance marketing basket and neglect brand building.

Over the next four to eight quarters, this tradeoff will catch up and you’ll find competitors who invested in brand building will experience higher compounding returns and lower CAC while yours remain flat.

Allocate about 20-30% of your monthly budget to branding assets to build category presence.

Ship one POV editorial and one proof asset (e.g., case study, teardown, benchmark, etc.) each week.

Then, redistribute that content to your email list, across LinkedIn, and through partners.

Target to increase branded search by 10-20%, direct traffic by 10%, and the “seen you everywhere” selection in your CRM notes by 10%.

Step 3: Channel Reallocation (CMO and RevOps)

Improving efficiency is as simple as doing less of what doesn’t work and more of what works.

Pull budget from any sources where the opportunity to win rate is less than 10% for two consecutive quarters and reallocate it to Google Ads for high purchase intent keywords.

Aim to capture 60-70% impression share for those critical keywords.

Step 4: Improve Nurture Efficiency Through Topical Relevancy

Marketers often make the mistake of retargeting leads with generic nurture flows that aren’t congruent with the pain point the prospect engaged with.

For example, if the prospect engaged with a post on improving content marketing efficiency, don’t retarget them with a resource on link building. Retarget them with a content efficiency checklist.

Instead, create nurture sequences that are relevant to the topic of the ad or asset the prospect engaged with.

Step 5: Gives Sales The Resources Necessary to Close Leads Faster

Even if you send sales excellent leads, they won’t close if reps don’t have the right responses to encourage prospects to move forward.

To solve this problem, provide sales reps with a concise one-pager that addresses common objections, ROI calculators, and competitor comparison sheets.

Remember that everyone is on the same team, so if sales can’t close the leads, it’s your problem too.

61–90 days: Scale What Works

After building an efficient system, scale it by increasing opportunities in the pipeline, shortening the sales cycles, and establishing a repeatable cadence.

Step 1: Build a Coverage Engine (CRO + CMO + RevOps)

Once you’ve built an effective system, ensure it continues to move forward effectively.

Specifically, establish weekly checkpoints by prospect segment and sales rep to monitor:

- Lead volume: There is a sufficient number of qualified opportunities.

- Opportunity velocity: Deals are moving forward at the established acceptable cadence.

- Deal size: Identify opportunities to expand the deal size.

You should maintain a 3-4x pipeline coverage for the next quarter’s bookings based on your win rates and average deal size.

Step 2: Invest Heavily in The Highest Value Prospects

Your highest value prospects may be worth 2x, 3x, or more than your average customer and therefore warrant more attention and a higher CAC.

As we discussed in our resource related to the benefits of investing in higher CAC, it’s essential to first acquire high quality prospects and then improve targeting and messaging to optimize CAC.

Reversing the order (acquiring cheap customers first) doesn’t work as you’ll fill your pipeline with junk SQLs, and ultimately see higher CAC due to lower win rates.

That said, increase ad spend strategically by launching named account programs and target individual decision makers with multi-threading sequences.

This will help you increase enterprise pipeline which will result in more market share and higher compounding revenue.

Step 3: Offer Portfolio and Experimentation

Delivering a hyper-specific solution tailored to a prospect’s problem is one of the best ways to increase closed won deals.

Create a living offers map that ties a specific problem to an offer that then directs the prospect to a relevant asset and CTA.

Not all of these offers will work, so run 2-3 monthly experiments with clear hypotheses and success metrics to determine whether to scale or shut them down.

The goal is to find 1-2 scalable offers that beat your control by about 20%.

Step 4: Connect Branding Efforts to Revenue

Marketers often hesitate to commit budget to branding efforts because revenue attribution is notoriously difficult.

To track the efficacy of branding efforts, look at the closed-won and closed-lost reasons in your sales data.

Here are some examples of phrases that highlight branding as the key reason for a closed-won deal:

- “You seemed more credible”

- “You were the most well known”

- “You looked like the market leader”

Add up all of the revenue generated from closed-won deals with phrasing like this and then you’ll know exactly how much revenue you can attribute to brand.

You can also use this method to measure how much revenue you’ve lost due to a lack of brand presence.

Here are some examples of notes that indicate that you lost a deal due to a lack of brand awareness:

- “We went with the category leader”

- “They were more established”

- “We heard of them before”

Add the deal values of all of the closed lost prospects that use that phrasing to understand the cost you’ve paid for a lack of brand presence.

To illustrate the value of brand investment to executives, you can then provide the following three metrics:

- Percentage of qualified opps lost due to brand perception

- Percentage of wins where brand strength is cited

- Percentage of conversion rates for known versus unknown buyers

If you are consistently losing two out of three qualified deals due to lack of awareness or credibility, you can show executives that you have a brand problem rather than a performance problem, which will justify increasing brand awareness spend.

Step 5: Strengthen Governance Among The Executive Team

Once your team has established goals, don’t keep moving the goalposts, as doing so will slow progress and erode trust.

Instead, lock in red, yellow, and green thresholds and then wait for the next quarterly review to make any definition changes.

Eliminating mid-quarter metric roulette allows the systems in place to generate compounding revenue.

Realistic Outcomes From This Pipeline Efficiency Playbook

After implementing this system to improve pipeline efficiency, here’s an overview of the average lift we typically generate for clients.

Your results may vary depending on your existing pipeline efficiency, so consider these metrics industry benchmarks.

- Deal Movement: The slowest stages in your sales process speed up by about 20-30%, and about 5-10% more leads make it from “sales accepted” to real opportunities.

- Pipeline Quality: Around 70% of opportunities come from priority segments and you cut about 1-2 of the lowest yielding sources.

- Brand Momentum: You see a 10-20% increase in direct search and branded queries. Additionally, most of your ad budget is allocated toward new creative from the last 30 days.

- Financials: You have 3-4 times more pipeline coverage for next quarter’s goals, your payback period is within the established limits, and you’re measuring CAC at the opportunity level rather than just the CPL.

Get More Help Increasing Pipeline Efficiency and Predictability

This is the step by step playbook we use to help B2B SaaS companies build predictable pipeline efficiently.

While the process itself is fairly straightforward, there are plenty of nuances to each step that will impact your results.

For example, identifying the largest revenue leaks, creating messaging that resonates, and investing in branding efforts that attract industry attention are all tasks that require experience to execute with maximum efficiency.

If you want a partner who has worked with dozens of SaaS companies to build efficient, predictable pipeline, reach out to us today.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.