How to Identify Your Best Customers: A Systematic Process for B2B SaaS Companies

Last updated: October 3rd, 2023

For B2B SaaS companies, “identifying your best customers” is often an ambiguous endeavor. At best, most will create SaaS buyer personas to base their marketing around — but there’s a lack of refinement that we believe can be the root cause of many marketing issues that companies struggle with.

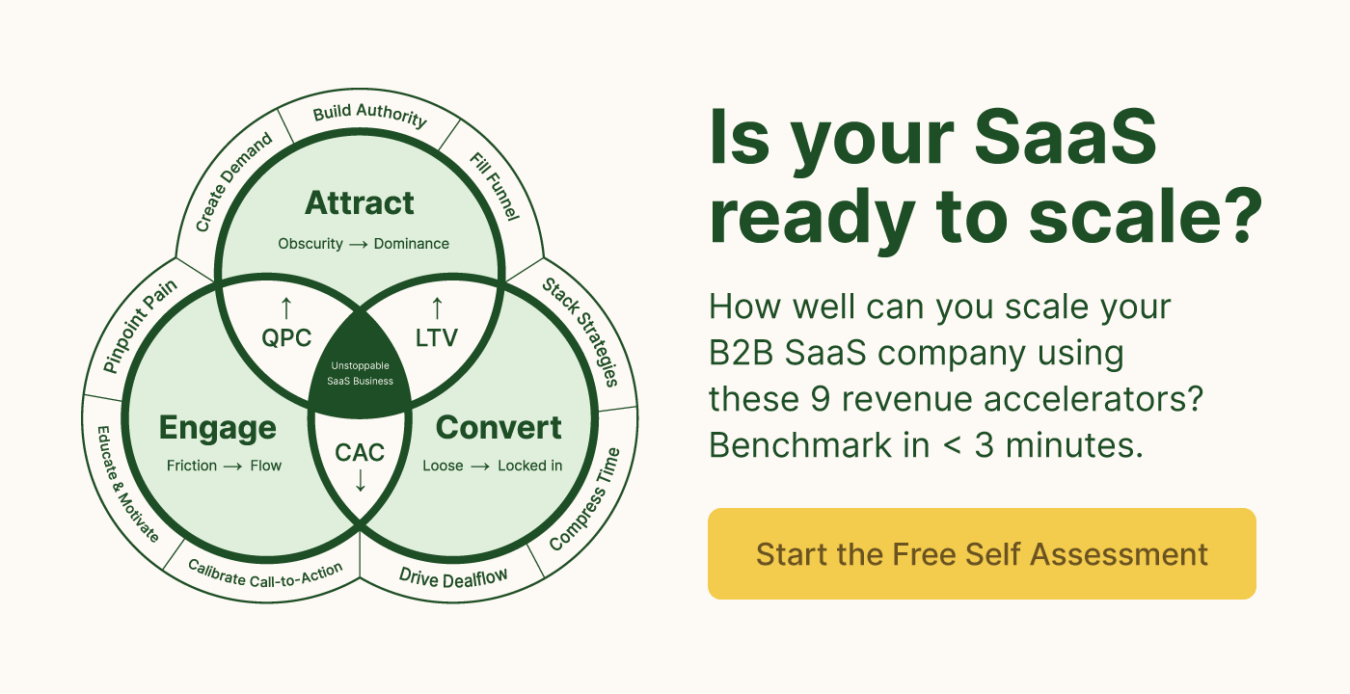

Some of these issues include (but are not limited to):

- Seeing low engagement and an increasing customer acquisition cost (CAC) through your PPC channels.

- Only converting a low proportion of trial users into new customers.

- Being stood up for demo appointments, or seeing a low demo conversion rate.

- Experiencing a high customer churn rate and an average customer lifetime value (LTV) that’s lower than you’d expect.

If you’re experiencing any of these symptoms, or if you’re an early-stage company that wants to future-proof against these issues, this article will provide you with a systematic process to strategically identify your best customers based on real data and customer feedback.

We’ll show you how to collect the necessary data for analysis:

- Comb through customer relationship management (CRM) data to identify your highest paying and highest LTV customers.

- Get your sales and customer success teams to help you pinpoint your actual best customers (not just the customers they most prefer to sell to and serve).

- Conduct an email survey to get valuable feedback from existing customers who’ve given you a high net promoter score (NPS).

Then we’ll show you how to synthesize all of this information so that it’s actually useful.

But before we dive in, let’s talk about some misguided assumptions we’ve seen on this topic.

If you’d like to learn more about how we help B2B SaaS businesses identify, target, and serve more of their best customers, get your Free Marketing Plan today.

3 Misconceptions About Identifying Your Best Customers

While these three assumptions seem intuitive, when you take a deeper look you can see they’re not always accurate.

1. Highest LTV Customers Are the Best

A lot of SaaS companies think their best customers are the customers who have the highest LTV, but this isn’t always the case.

Especially for lower-priced SaaS services, some of your customer base just never unsubscribed and rarely (or never) log in to actually use your product. Or they purchased one service and never added on any additional services or upgrades.

LTV should be considered, but it’s not the only metric to look at when you want to identify your best customers. You need to pair this payment metric with other metrics like usage, net promoter score, and expansion revenue per account.

2. Customers Who Require the Least Amount of Attention Are the Best

It’s tempting to think that customers with the lowest amount of complaints are the best. After all, low maintenance customers require less of your time and resources, right?

But often those who invest the time to make complaints, ask questions, or offer feedback show above average customer engagement and are the ones who care most about your service.

So failing to look more closely at high-touch customers is a mistake — some of your best customers can be found here.

3. Customers Who Are the Easiest to Close Are the Best

Lastly, the customers who are quickest to become new users might strike you as your best customers. And it’s likely some of them will be.

But you shouldn’t ignore customers with a slightly longer sales cycle either. Often the best enterprise customers will take time to close.

4 Tactics to Analyze and Identify Your Best Customers for B2B SaaS

When you combine these analysis tactics with comparing and contrasting the results (covered in our synthesis section below), you can:

- Refine your SaaS customer personas

- Improve your targeting and audience creation for PPC campaigns

- Increase customer retention, average LTV, and monthly recurring revenue (MRR)

The goal is to get more ideal customers and less average and poor customers over time. Let’s kick things off with tactic #1.

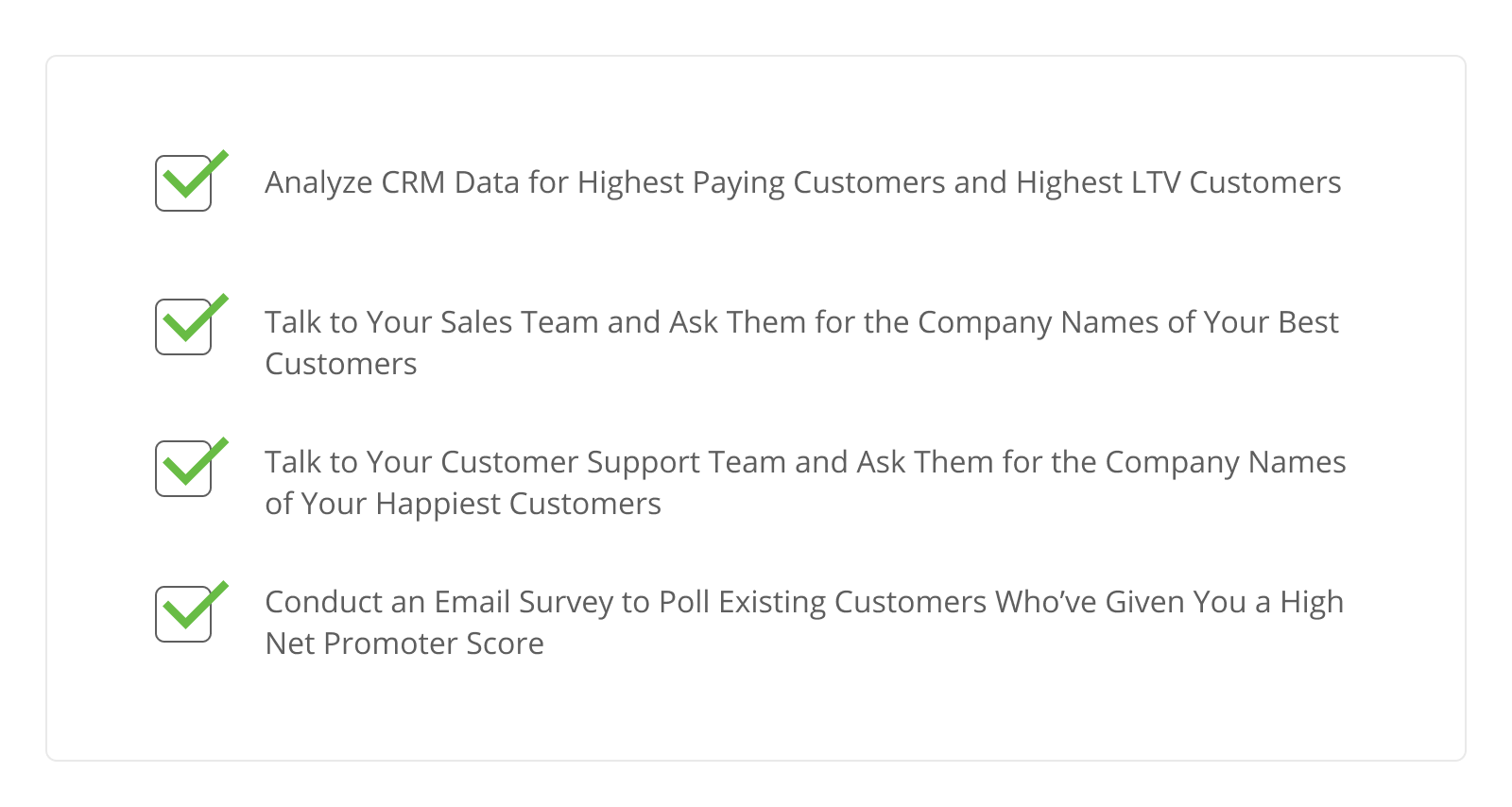

1. Analyze CRM Data for Highest Paying Customers and Highest LTV Customers

As we mentioned above, LTV isn’t everything. But it is one of the things you want to look at in the customer analysis phase. And the great thing about this step is that there is very little friction. There’s no need to talk to people, you can hop right into HubSpot or Salesforce (or whichever CRM you already use) and begin collecting data.

The objective of this step is to: comb through your CRM to locate customers who have paid the most and also those who have been with you the longest. And take notes throughout this entire process (this applies to the following steps as well).

Questions you should seek to answer include:

- Which customers have relative longevity?

- Which customers have made upgrades and purchased additional services or addons?

Then, like each of the following steps, you’ll add these customer names to your list. You can do this in Google Sheets, an Excel sheet, or your tool of choice.

Your notes can be simple or more detailed — it’s up to you. Sometimes keeping them simple can be sufficient for spotting commonalities (eg. Company X, pays Y, customer since 2XXX). You can include these notes right in your spreadsheet.

2. Talk to Your Sales Team and Ask Them for the Company Names of Your Best Customers

In this step, you want to avoid phrasing your question like, “Hey, what kind of customer do you love selling to?”

If you ask it this way, they’ll likely say, “I like dealing with the decision maker at the top of the organization who has a budget and wants to buy right now. They’ll usually be a Fortune 500 company with room to upsell.”

The issue with this is it’s what the sales person wants, not necessarily what they have and deal with on a regular basis.

Rather, the objective of this step is to: find the companies who wanted a solution, gave you meaningful friction through asking good questions, and who were closed within an ideal or reasonable sales cycle.

It’s best to take an open ended approach to say, “Let’s walk through your last number of X deals (eg. all of your 2019 deals). Beginning with the highest deal values, who did you close and what was the interaction like?”

Questions you can ask include:

- What can you tell me about the conversation you had?

- What was the buying cycle like and how long did the onboarding process take?

- What questions did they ask?

- What concerns did they share?

Next, you’ll create another tab in your spreadsheet and add in these company names.

3. Talk to Your Customer Support Team and Ask Them for the Company Names of Your Happiest Customers

The approach here is to speak with your SaaS customer success managers and go through the help desk software your company uses.

You want to look at the following customer success metrics:

- Individual support tickets

- Customers’ answers to post-support surveys (happy/sad faces, 1-5 ratings, etc.)

- Any internal tags related to customer satisfaction or company role (eg. Evangelist, Super User, Frustrated, Daily User, Manager, Check Signer)

Questions you should seek to answer include:

- Who are the companies who have rated support experiences highly?

- What are the questions these customers asked?

Then, once again you’ll take notes and add these customers to a new tab on your growing list.

4. Conduct an Email Survey to Poll Existing Customers Who’ve Given You a High Net Promoter Score

For this step, you’ll look at your net promoter scores and read through the answers to why people gave you those scores. If you want, you can use a word cloud tool to see what the most repeated words are that pop up with your 8’s, 9’s, and 10’s.

The objective of this step is to:

- Figure out the company names of those who gave you scores of 8 or higher

- Figure out what those companies love about your product

- Then email them and see if they’ll tell you more about their customer experience

For example, you can send them a short email saying: “Hi [First Name], We’ve identified you as a high success user of product X. We’re reaching out to customers for feedback to improve our product. And we’re wondering if you’d be open to sharing a bit about your experience with us so far. We have just one question to begin…”

Questions you can ask include:

- What do you love about the product?

- What was especially useful?

- What aspects made it easy to use?

- What was it like before/after you were using our product?

Like the previous steps, you’ll take notes throughout and add the company names of those who gave you scores of 8 or higher to another tab in your list.

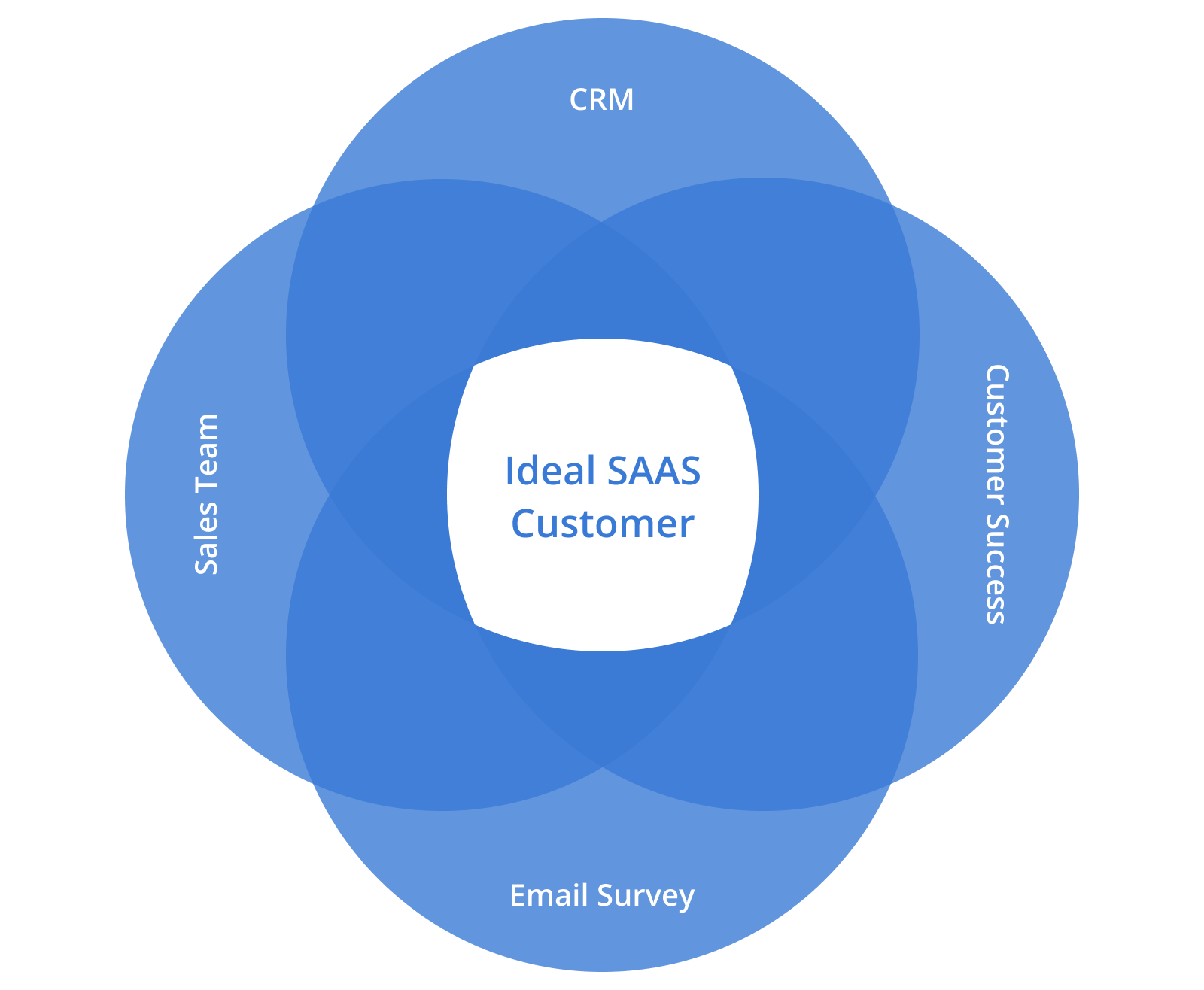

Synthesis Phase: How to Use this Information Once It’s Collected

First and foremost, you can now look at the different tabs within your spreadsheet to see where there is overlap between the different sources of customer data you’ve explored.

For example, you can ask, “Which customers did our sales team identify as being some of our best, that our customer success team also identified to be among our happiest customers?”

You’ll also look at:

- How does our high NPS list match up to our list of happiest customers?

- How does it match up against our best customer list from our sales team?

- How does our list of highest paying and highest LTV customers compare to the lists from our sales and customer success teams?

You can see where we’re going with this. You’re just looking for the commonalities between the lists you’ve created. And the companies who show up on multiple lists are likely to be a much more accurate representation of your best customers.

From here, this list can be used to do three important things:

- Update your SaaS buyer personas to accurately reflect the qualities you’ve learned about your best customers

- Make updates to your SaaS website based on what you’ve discovered

- Refine your audience creation across your acquisition channels (eg. create Facebook lookalike audiences based on this list)

In addition, you can begin allocating more budget in your paid acquisition channels to target companies who are most similar to this list and most likely to be the right customers (covered in our article on Account Based Marketing for SaaS).

We hope you’ve found this article helpful and that you’ll use it to your advantage. If you’d like to learn more about how we help B2B SaaS businesses identify, target, and serve more of their best customers, get your Free Marketing Plan here.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.