How B2B SaaS Companies Should Actually Set Their Marketing Budgets

Last updated: September 12th, 2025

“About 5-10% of projected revenue should be dedicated to your marketing budget.”

This is the typical startup marketing budget advice.

The only problem is that most early-stage companies lack solid data to create accurate revenue projections.

Additionally, without historical data, marketing spend is typically distributed across various channels randomly.

Some channels never gain enough data to identify insightful patterns, making it impossible to improve performance.

As a result, growth flatlines, and the marketing budget can’t grow, making scaling even more difficult.

In this post, we’ll explain why this marketing budget advice is flawed and how we recommend most Series A B2B SaaS companies establish and distribute a marketing budget.

Why Conventional Budget Advice Fails Pre‑Revenue SaaS

Creating a marketing budget equal to 5-10% of projected revenue works for established companies with predictable profit and loss statements (P&Ls).

The problem is that early-stage B2B SaaS companies have very little historical data to make accurate revenue predictions or predict which marketing channels will work.

To be more specific, here are four variables that make it unrealistic for startups to use the 5-10% of revenue rule:

- Unknown CAC Baseline: Until you’ve tested a few marketing channels, you don’t know if landing a demo signup will cost $80 or $800.

- Uncertain Sales Velocity: You don’t know how quickly a deal will close. Prospects may buy in a week, or it may take six months to complete the SOC-2 review.

- Unstable Win Rates: You’re likely still improving your demo process, iterating your proof of concept, and altering pilot structures. All of these variables impact forecasts.

- Product‑Market Fit Is a Spectrum: Without historical data, you may pivot your ICP several times before discovering a consistent close rate.

The reality is that your revenue is likely to be low as an early-stage startup.

If you use a revenue percentage based marketing budget, you won’t have enough budget to gather sufficient data to identify statistically significant patterns.

As a result, you won’t really know what worked and what failed.

Months later, the board will ask why growth flatlined, and a reasonable explanation is that there simply wasn’t enough data collected to identify patterns and double down on what works.

In this post, we’ll outline how we approach setting marketing budgets for SaaS companies.

The “One‑Customer Revenue” Rule

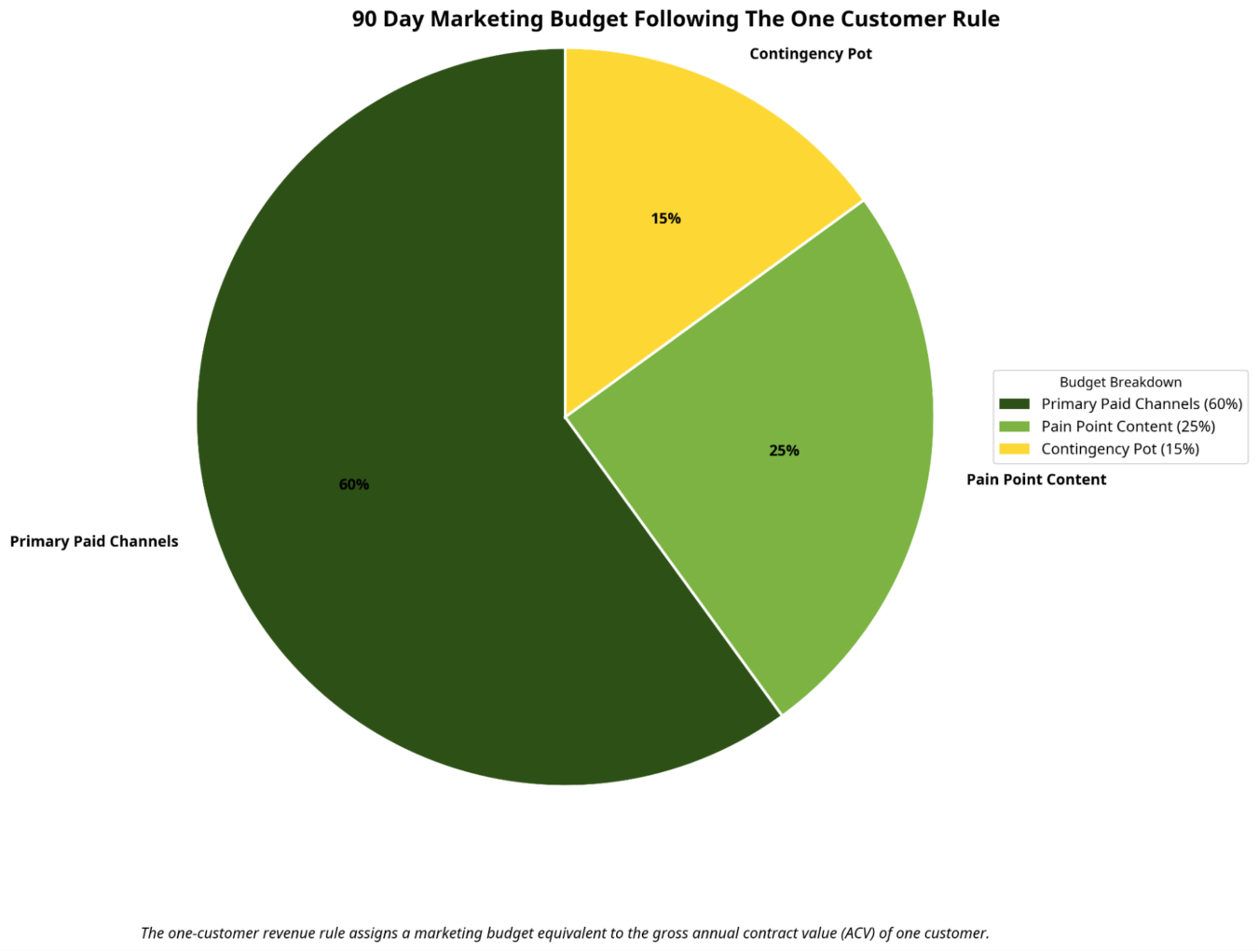

The one-customer revenue rule assigns a marketing budget equivalent to the gross annual contract value (ACV) of one customer.

For example, if a single customer’s ACV is $36,000, your Q1 marketing budget is $36,000.

However, keep in mind that the one-customer rule is only applicable to pre-revenue startups, as they don’t yet have any data to understand what works on a specific channel.

How To Efficiently Deploy a 90 Day Marketing Budget

The next question that arises is, “How should we spend our marketing budget?”

Unlike a mature company, you don’t have substantial historical data to determine which channels deserve more budget. Virtually every marketing channel is a new test.

Here’s how we begin and adjust budget allocation:

60% of Budget ($21,600) = Primary Paid Channel(s)

As a startup, you likely don’t have any organic marketing traction, so paid media is often the most effective method to start acquiring customers.

Done correctly, paid media can drive immediate pipeline and build enough demand for the next quarter.

For most businesses, Google ads (combined with bottom of the funnel content) is the best place to start.

However, LinkedIn ads can also help you stay top of mind and build trust and demand for the next quarter.

Therefore, about 60-70% of the $21,600 is dedicated to Google ads, and the remainder of the spend is usually allocated to LinkedIn.

However, the exact percentage varies depending on industry maturity, competition, and your audience’s habits.

The bottom line is that our goal is to fill 3-4 times the revenue goal for each month.

Most SaaS companies have a three month sales cycle and a win rate of 30%, so you can assume the pipeline generated in the first month will deliver one customer by the end of the third month.

25% of Budget ($9,000) = Pain Point Focused Content

“We need sales – not brand awareness. So why should we invest in thought leadership content at this stage?”

This is a common (and valid) objection we receive from early-stage startups.

However, paid traffic coming to your website won’t convert if there isn’t any content to build trust and capture leads.

This is particularly true for B2B SaaS companies, as sales cycles are often lengthy and deals require extensive nurturing, education, and leadership buy-in.

That said, we keep an 80/20 approach to content creation at this stage.

Four deep-dive blog posts discussing key audience pain points and product differentiators, along with one downloadable guide, are sufficient to anchor ads and email nurtures.

15% of Budget ($5,400) = Contingency Pot

This fund exists to test two highly specific ideas, such as sponsoring a niche Substack or purchasing a half-page slot in an industry-specific Slack job board.

If you’re unsure how to allocate this, consider the alternative channels your competitors are investing in.

If your test works, you can reallocate the Budget accordingly in the next quarter.

Additional Elements Required For a Successful GTM Plan

As you’re mapping out a go-to-market strategy, you also need conversion to infrastructure to capture the traffic you’re earning, as driving traffic to a generic landing page is a waste of money.

To maximize conversions, we implement a landing page blueprint that targets your highest value ICPs.

We also implement a 14 day lead to MQL email nurture workflow that turns a click into a calendar booking without human chase notes.

Once you’re capturing traffic, you also need data that shows you what’s working and what needs to be cut.

A HubSpot starter plan, a Dreamdata or Attribution App subscription is usually sufficient data, though you’ll also need to dedicate time to enforce UTM discipline.

Tracking Weekly Efficiency (Weekly Budget Scorecard)

Marketing budget is often wasted due to inconsistent execution.

To ensure poor performance blame isn’t incorrectly placed on the channel or strategy, we use the weekly budget scorecard to ensure execution is consistent.

From a tactical perspective, this is a 30 minute Monday meeting that reviews the following scorecard:

| KPI Type | Metric | Red Flag | Green Target |

| Input | Content velocity | < 1 long‑form / week | ≥ 2 assets / week |

| Ad spend pacing | < 70 % of plan | 95‑105 % of plan | |

| Engage | Landing‑page CVR | < 1.8 % | > 2.5 % |

| Convert | Demo‑to‑SQL % | < 25 % | > 35 % |

| Finance | Rolling CAC | > payback target | ≤ target |

Quarter‑End Assessment and Adjustments

After 90 days, assess your marketing strategy’s performance.

Did the spend produce at least one closed‑won match for your ideal customer profile?

If the answer is no, you learned where friction exists in your marketing funnel at the expense of just one customer’s ARR.

If the answer is yes, you are neither a genius nor lucky; you simply paid the market’s tuition fee.

Regardless, this data should give you sufficient information to understand which channel produced the lowest cost per SQL or served as a critical touchpoint before the prospect became a qualified prospect (e.g., a BOFU piece of content that attracted a qualified lead, even if they didn’t immediately convert).

You should also better understand channel mechanics and messaging that resonated with your audience to improve performance in the next quarter.

Common Marketing Budget Pitfalls (and How to Dodge Them)

The most common error we see SaaS companies make is prematurely hiring a senior executive.

Spending $180,000 on a VP of Demand Gen before your channel economics are proven significantly increases burn, but doesn’t necessarily bring clarity.

Outsource specialist execution until metrics stabilize and you’ve identified messaging that resonates before hiring an executive in-house.

Another pitfall is investing in too many channels simultaneously.

If your competitors have a presence on Twitter Spaces, Quora threads, Reddit AMAs, and programmatic display, you’ll feel tempted to invest in those channels as well.

Resist the urge.

Investing in too many marketing channels spreads your resources too thin and makes it impossible to thoroughly test any single channel. As a result, you won’t see any meaningful patterns and therefore won’t be able to improve performance.

Limiting yourself to three channels until CAC stabilizes ensures you have a sufficient set of data to make better optimizations.

When to Pivot from Efficiency to Velocity

Staying frugal for too long hands first‑mover advantage to faster‑spending competitors, so when should you scale and how?

We recommend B2B SaaS companies increase spend when the following three checkpoints are true:

- LTV:CAC ≥ 4:1 for two consecutive quarters.

- Channel CAC variance ≤ 25 %. There aren’t wild swings from quarter to quarter.

- Sales forecast confidence ≥ 80 %. Your weighted pipeline (active sales opportunities multiplied by the probability of closing) reliably lands within 10% of actual closed won revenue.

Once you’re ready to scale, double spend for two quarters, focusing on the best‑performing channel and adding one new adjacent channel to diversify risk.

How To Allocate Budget to Scale From $1 Million to $10 Million ARR

After you cross roughly $1 million in ARR, you know which messages resonate and which channels your ICP uses to discover your solution.

Now, you just need to figure out how to profitably make the growth compound.

Base Your Budget On New Revenue, Not Total Historical Revenue

As you’re growing rapidly, create incremental revenue targets for your marketing budget rather than basing it off total historical ARR.

In practical terms, teams identify a meaningful but sustainable percentage of the ARR you plan to add over the next twelve months.

The precise percentage varies by cash runway and gross‑margin profile.

So rather than cite a single number, use this rule:

Spend enough to consistently generate sufficient pipeline for the sales team without extending the CAC payback beyond the window your investors expect.

For example, let’s say your sales team needs $300,000 in new pipeline each quarter to reliably hit revenue targets. If your average deal size is $30,000, that means you need at least 10 opportunities in the pipeline every quarter.

If your current CAC is $7,500 per customer and your investors expect a 12-month payback, you might set a quarterly marketing budget of about $75,000.

This ensures the sales team has enough opportunities to work while keeping CAC payback within the investor-approved window.

Introduce Maximum CAC Thresholds For Each Channel

Once you reach $1 million ARR, every channel now has a history.

Calculate the CAC per channel over a three-month period and use that data to establish a maximum CAC threshold.

For example, if LinkedIn acquisition creeps 25% above its long‑term average for two consecutive months, reallocate the LinkedIn budget to the next‑best performing channel until you diagnose the problem that causes the CAC to increase.

These maximum CAC thresholds allow you to scale profitably.

Determine Your Sales Team’s Capacity and Don’t Overwhelm Them

Each sales rep can only work with about 8 to 10 opportunities per month without quality slipping.

If you send sales more opportunities than they can handle, they’ll start losing deals.

Unfortunately, if your close rate decreases, your CAC will increase significantly.

To avoid this scenario, aim to keep the projected pipeline within 120% of your AE’s capacity.

Sample Scaling Model From $1 Million to $10 Million

If your target is $250,000 in new ARR each month and your historical win‑rate is 20% at an $18,000 ACV, you require about 70 opportunities monthly.

(70 opps × $18,000 ACV × 20% win = ≈ $250,000 ARR)

With an average $3,000 CAC you will spend $210,000 per month, or 30% of the ARR goal, right on budget.

Get More Help Establishing and Scaling Your Marketing Budget

Setting a marketing budget is critical to profitably scaling a B2B SaaS company.

If your budget isn’t large enough, you won’t scale fast enough to keep up with your competitors.

On the other hand, if you spend too much too fast without data to understand what’s working and what isn’t, you’ll waste money.

If you want more help setting a marketing budget that allows you to scale profitably, reach out to the team at Powered By Search.

We’ve helped dozens of B2B SaaS companies scale from early stage startups to eight figures and beyond.

You can claim your free marketing plan today to learn how to profitably scale with maximum efficiency.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.