Chasing Low CAC Stalls Growth: How to Use CAC as a Growth Lever

Last updated: September 30th, 2025

Marketers are often forced to cut CAC, but chasing cheaper prospects comes with a high opportunity cost.

While you’re spending resources chasing cheaper prospects, your competitors are winning qualified, in-market prospects.

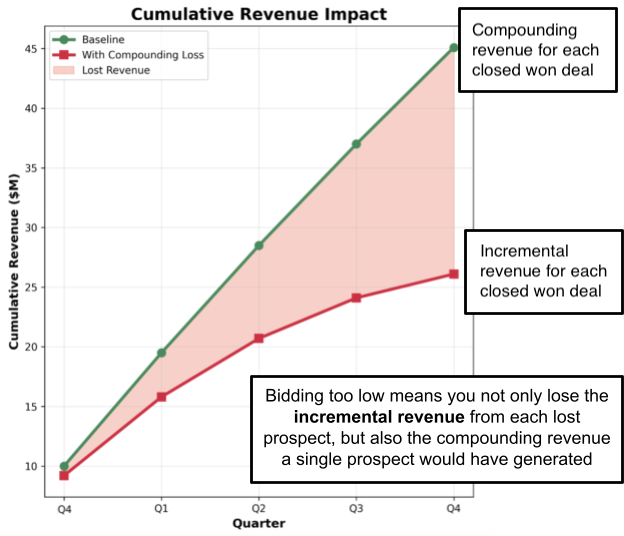

This is a problem because B2B companies have a finite pool of buyers, and only about 5% of them are in-market at any given time. Once those prospects choose a provider, it’s unlikely they’ll come back in-market for several years due to contracts and switching costs.

Therefore, limiting CAC shrinks the pool of in-market prospects you can target and costs you several years of compounding revenue, because those prospects won’t return to the market for several years.

Essentially, chasing a lower CAC allows your competitors to eat your lunch.

Instead of asking “How can we cut CAC?” a better question is “How can we efficiently maximize CAC to capture market share and generate more compounding revenue?”

In this post, we’ll discuss how to determine a realistic CAC for each prospect so that you can remain competitive, capture more market share, and ultimately generate more compounding growth.

Why a Low CAC Is a Red Flag

Not only does cutting CAC stall growth, but it is fundamentally a fruitless quest. Even if you create an amazing ad that dramatically outperforms your competitors, they will eventually notice and copy you.

As a result, your ads will become less efficient over time, and CAC will increase again.

This is why a low CAC is often a red flag.

Assuming you’re in a competitive market where CAC stabilizes over time, a low CAC is usually the result of one of the following scenarios.

First, you might have come across a growth hack. We have a more detailed explanation on why growth hacking isn’t a sustainable strategy, but the bottom line is that as soon as all of your competitors learn the hack (and they will), it won’t work anymore.

Andrew Chen’s Law of Shitty Clickthroughs also supports this theory, claiming that any marketing strategy declines in efficiency over a long enough time period.

Secondly, if you do have a significantly lower CAC than your competitors, you’re probably acquiring low quality leads and therefore have a leaky bucket.

A leaky bucket essentially means that you might have some leads coming in, but you’re probably experiencing some of the following issues:

- Your opportunity to conversion rate is poor

- The sales cycles are long and resource intensive

- Churn is high and LTV is low

In the rare scenario where you’re truly in a market with a low CAC (i.e., the cost to acquire a customer is dramatically lower than its LTV and it has a short payback period), you’re leaving money on the table by not increasing CAC to capture as much market share as possible.

The only other reason you might have a significantly lower CAC than your competitors is if you have invested in organic marketing and brand building, and optimized your buyer journey more effectively than your competitors.

If you’ve followed the core principles of our Predictable Growth Methodology and optimized the buyer journey to seamlessly lead the prospect to the point of sale, you’ll convert a higher percentage of qualified leads in less time.

Yet rather than leveraging your organic presence and seamless buyer journey to keep CAC low, use it to your advantage to capture more market share.

The Playbook to Establish a Realistic CAC Target and Leverage it For Growth

Once the conversation shifts from reducing CAC to leveraging it for growth, establish realistic CAC targets for prospect cohorts based on historical data.

Otherwise, you may overspend on unqualified leads or continue underspending on the most valuable prospects.

Here’s the step by step playbook we use to establish a realistic CAC target and leverage it for growth.

Step 1. Cohorize Prospects and Assign CAC Target Accordingly

Not all prospects are equally valuable and therefore don’t deserve the same CAC.

Even categorizing prospects by generic SMB, mid-market, and enterprise cohorts does not provide a detailed enough representation of the value of that prospect.

Instead, create cohorts by:

- Company size (51-200, 201-500, 501-1000, 1001-5000, 5001-10000, 10000+ employees)

- Vertical and complexity

- Motion (SLG vs. PLG assist).

Step 2. Establish Baseline CAC Using Data

Finance teams often pressure marketers to reduce CAC, but there’s rarely any discussion as to how the finance teams arrived at a specific CAC target.

Finance rarely bases CAC targets on the ACV of a customer or their payback period, which can set unrealistic expectations.

To establish realistic CAC expectations, get real data to answer these questions:

- What is our ACV?

- What is our payback period?

- What is our average LTV?

For example, if you have a 4:1 payback expectation on your LTV, it implies that your CAC should be equal to one year of contract value if the average lifetime value is four years.

However, this usually isn’t the case. Often, the CAC target is only, say, one tenth of the first year of CAC.

By underfunding CAC, you’re limiting your ability to grow.

An Example of How To Set CAC Targets

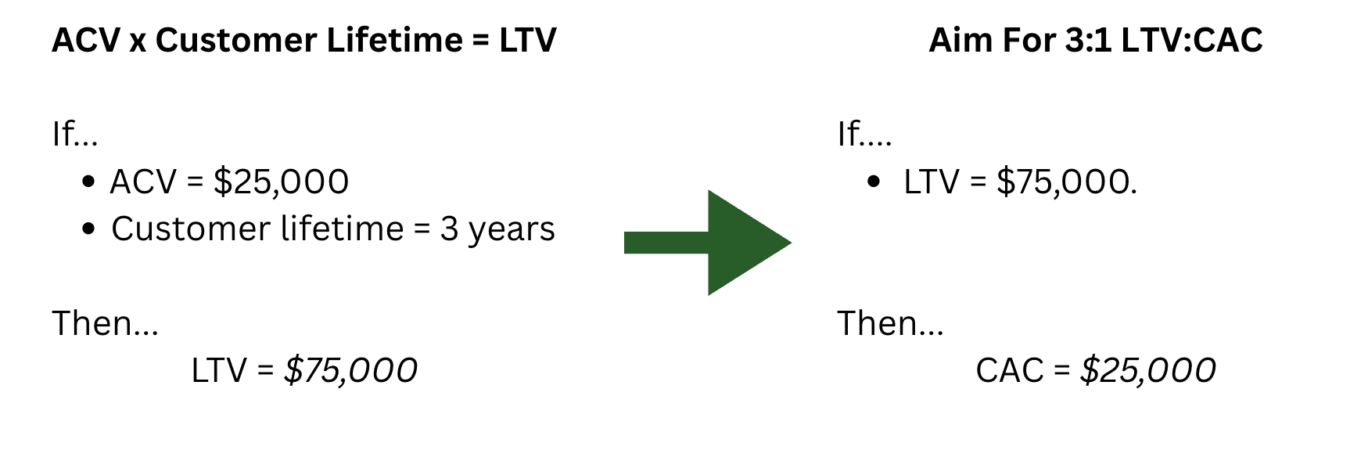

Let’s say your baseline ACV is $25,000 and the average LTV is three years. In this case, the total value of that customer is $75,000.

Let’s say we’re aiming for a 3:1 LTV:CAC ratio.

In this case, you can spend up to $25,000 to acquire a customer.

However, if you go upmarket and your ACV is $50,000, your LTV becomes $150,000. In that case, you can spend up to $50,000 to acquire a customer.

Finance might counter that not all of the LTV is pure profit, so you can also show them a model with gross profit at about 80% to set a stricter cap.

In that case, the CAC for the first scenario with a baseline LTV of $75,000 would be $20,000 and the second scenario where the LTV is $150,000 would be $120,000.

What Should My Payback Period Be?

This question is also important to answer with your finance department, because a realistic payback period depends on a company’s funding.

For bootstrapped startups, profit is the only fuel available for growth, so they’re forced to become profitable quickly, meaning they tend to have a shorter payback period.

In contrast, PE-backed and VC-backed startups can afford a longer payback period and focus on capturing more market share, because they have external funding.

Here are some general targets you can aim for depending on your company’s funding:

- Bootstrapped: 6-9 months payback typical.

- PE-backed: ~9-16 months.

- VC-backed: ~12-24 months (market share land-grab tolerance).

To keep your team aligned, everyone should know these simple equations:

- CAC ≈ (ACV × PaybackMonths) / 12.

- Payback (months) ≈ (CAC / ACV) × 12 (assumes annual upfront).

To put these equations in practice, let’s say you’re a bootstrapped business aiming for a 6 month payback period and your ACV is $150,000. In this scenario, your CAC would be $75,000.

In contrast, if you are a VC backed company with the same ACV, but a target payback period of 24 months, your CAC would be $300,000.

You can also change the CAC target to see how it impacts your payback period. For example, if your target CAC is $50,000 and your ACV is $100,000, you can expect a payback period of 6 months.

In general, we recommend staying above a 3:1 LTV:CAC ratio as going below that tends to lead to unprofitability in the long run.

Step 3. Account For The Prospect’s Stage in The Buyer Journey

The baseline CAC gives you real data based on the potential deal size, but it doesn’t account for the full cost or time delay to attract, nurture, and convert a lead.

It might be more profitable to pay $2,000 for a qualified lead that is ready to convert immediately rather than $300 for a lead that might convert until six months later.

This is because the time delay to close the prospect equates to lost revenue, and there are also hard costs associated with nurturing prospects in the form of the sales team’s time and remarketing materials.

Step 4. Commit to The Established CAC Targets For Each Cohort

Now that you’ve determined an appropriate CAC for each cohort, taking into consideration the deal value and their current stage in the buyer journey, commit to spending that CAC target to acquire those customers.

By focusing on maximizing new revenue, you’ll capture more market share faster and, in turn, see faster compounding growth.

Step 5. Set Weekly Leading Indicators

Once you’ve set new CAC targets for each cohort, make sure you’re capturing the right leads and aren’t just overspending on junk leads.

Here are a few red flags to watch to ensure you’re acquiring high quality, in-market prospects rather than cheap, unqualified prospects:

- Rising cost-per-opportunity

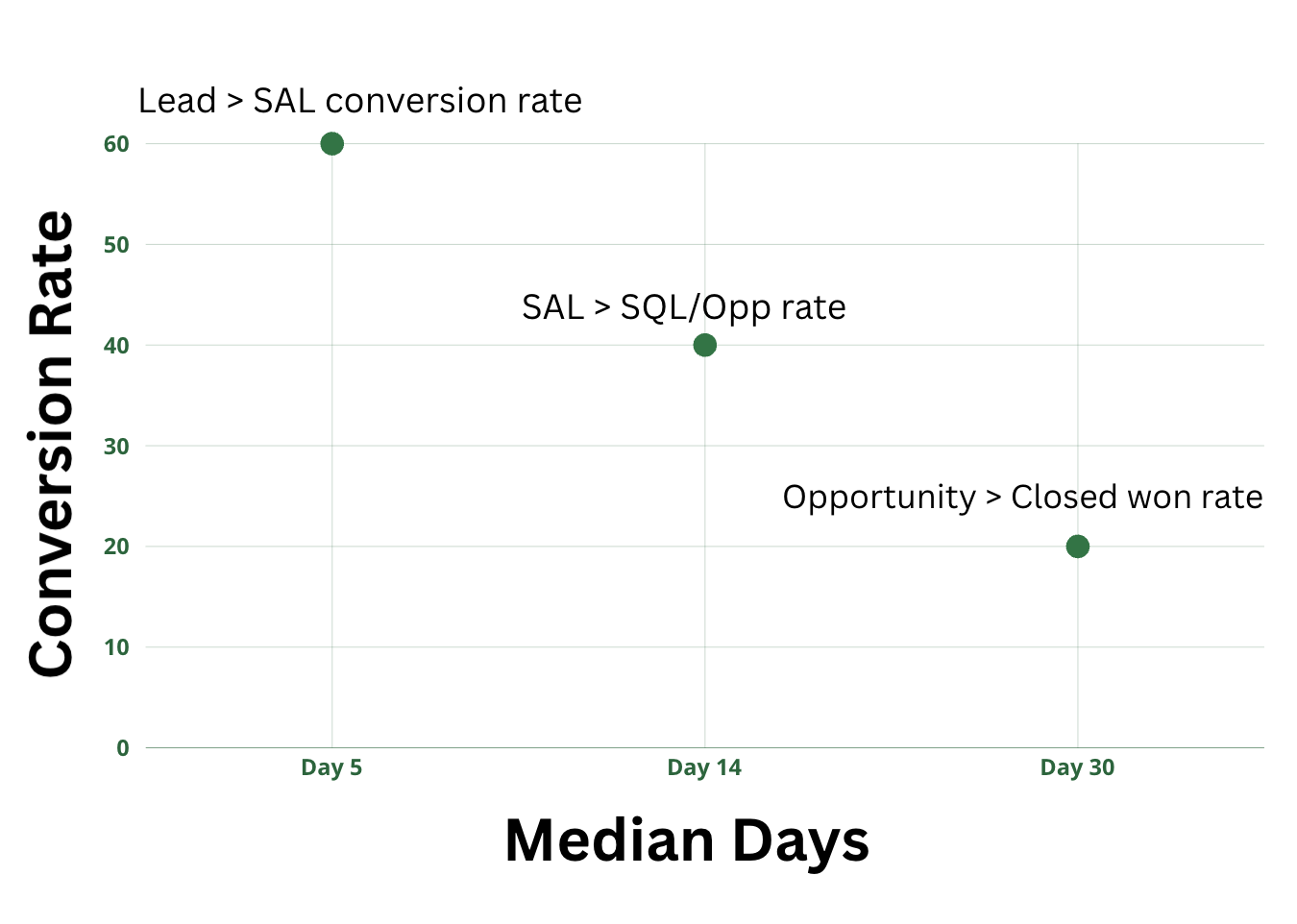

- Sharp drop-offs between stages (Lead > SAL > Opportunity > Closed Won).

- Qualitative feedback from sales regarding “junk intent”

We monitor the metrics above by looking at cohort cost per opportunity trends by source and segment, as well as stage-to-stage conversion and velocity each week.

For each cohort, publish and track:

- Lead to SAL rate

- SAL to SQL/Opp rate

- Opportunity to Closed Won rate

- Cost/Opportunity value

- Median days in stage and total cycle length

These metrics can also show you if you can increase CAC to grow more aggressively.

If the ladder is smooth and less than the threshold sales cycles, you can justify increasing CAC as your funnel is clearly working (assuming churn for that segment stays above the threshold).

Step 6. Run Paid Experiments to Increase Deals From Top Cohorts

The goal of this article is to shift the narrative from cutting CAC to strategically increasing CAC to acquire better prospects and generate more compounding revenue.

So how do you effectively increase CAC without wasting ad spend?

If your weekly leading indicators are on track, we increase CAC by running paid experiments for the top cohorts.

The answer lies in vigilantly tracking leading indicators.

If your weekly leading indicators, like SALs, opportunity creation rates, and conversion velocity, are on track, you’ve earned the right to increase CAC.

However, instead of increasing CAC across the board, target only your top cohorts, as these accounts have the strongest ICP fit, highest LTV potential, and the fastest sales velocity. As a result, you’ll capture more market share which will ultimately lead to higher compounding revenue.

Here’s how to tactically increase CAC among your top cohorts:

- Identify your top cohorts: Filter by ICP fit, deal size, win rate, and velocity.

- Run paid experiments against these cohorts: Think LinkedIn ABM campaigns, competitive conquesting, or layering in higher-intent signals.

- Monitor payback rigorously: Instead of exclusively looking at CAC, calculate the payback period as well. How long does it take to break even on your acquisition costs?

- Adjust with precision: If the payback aligns with your LTV:CAC model, continue scaling. Otherwise, pull back.

This approach reframes CAC not as a static cost to minimize. You’ll finally view it as an investment lever, one that, when pointed at the right cohorts, accelerates pipeline, revenue, and long-term growth.

Step 7. Close The Loop With Sales

The final step in the process is aligning with sales to ensure you’re sending them qualified leads that both teams agree are worth pursuing.

This means building a feedback loop where marketing doesn’t just measure volume, but actively validates whether the pipeline being created fits the ideal customer profile (ICP) and is in the right buying stage.

Specifically, ask these questions every time leads are passed to sales:

- Do these leads align with the assigned cohort?

Specifically, do the leads align with the industries, revenue ranges, and employee bands we’ve defined in our ICP? Are we excluding companies that look like “good fit” SaaS at first glance, but don’t actually buy (e.g., martech or B2C-heavy businesses)?

- What stage in the buyer journey are these leads?

Did they come in via high-intent actions (demo request, pricing inquiry) or are they earlier-stage leads who need nurturing? Sending low-intent leads to sales erodes trust and wastes time.

- Does sales agree with lead quality?

Are AEs or SDRs reporting back that these are “garbage demos,” or are they advancing through to opportunities? Marketing must be accountable for not just filling the funnel, but filling it with leads sales can close.

Answering these questions upfront prevents overspending on low-quality leads, reduces friction between sales and marketing. As a result, your budget is weighted toward accounts with the highest lifetime value potential.

Next Steps To Leverage CAC For Growth

You can reduce CAC by minimal percentages or spend competitively to acquire customers and focus on growing compounding revenue.

We realize that committing to a higher CAC can be tricky, as you need to know your numbers to first get the finance team on board and then ensure you aren’t overspending on junk leads.

This is where working with a partner like Powered By Search can help.

Unlike marketing agencies that simply create, run, and optimize marketing campaigns, we take a data driven approach to growth and can help you understand your numbers and determine competitive CAC targets to maximize profitable growth.

Contact us today to learn how we can help you use CAC as a growth lever.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.