What Most SaaS Companies Get Wrong About Marketing Budgets—and the Data-Based Method for Finding the Right One [Plus: calculator for your own budget]

Last updated: July 9th, 2019

At least until they reach a certain scale, B2B SaaS companies tend to be unsure of how to approach their paid marketing budget. By now, many of them are familiar with the 3:1 “Golden Ratio” for customer lifetime value (LTV) and customer acquisition cost (CAC). It’s a metric—widely attributed to Trello founder Joel Spolsky—to which we enthusiastically subscribe. But getting SaaS marketing budgets right can be tricky, and knowing the proper metric is only the first step.

For one reason or another—uncertainty about which channels to invest in, a narrowly product-centric approach to business, bewilderment about how to calculate their LTV-to-CAC ratio—founders of small and mid-size SaaS companies often significantly underinvest in marketing. Whether the product of shortsightedness or naivete, the result is virtually always sub-optimal growth.

Of course, it’s possible to err in the other direction; a company with an LTV-to-CAC ratio of 1:1 is in trouble—they’re barely breaking even. But when they’re operating at the Golden Ratio or better, SaaS companies should spend as much as possible to acquire customers. Failing to do so effectively cedes market share, as competitors grab up new users by marginally increasing their marketing spend.

For B2B SaaS companies, the stakes are especially high because products tend to be stickier than B2C. Once a customer signs up for a service, they’re going to be locked out of the market for some time. If a company starts using Drift, for example, it’s going to be a while before they consider jumping to HubSpot. Once they signup with Keap (formerly Infusionsoft) and integrate it into their site and marketing campaigns, it takes a lot of effort to switch to ActiveCampaign.

Even if a business customer has some quibbles with a SaaS product, the costs of switching to a new service will often far outpace those of staying with their current service, making the customer unenthusiastic about jumping ship. Just think of the headaches that would be involved in moving a team off of Slack, or of trying to sub in an alternative to Google Analytics.

Creating solutions that customers come to consider indispensable is what makes SaaS such a satisfying—and high-value—sector. But it also makes the business of winning clients a particularly urgent one.

For B2B SaaS companies, a sufficient marketing budget is essential to ensure growth rates are optimized and doors aren’t unnecessarily left open for competitors, and in this article, we’ll share our strategy for getting it right. Along the way, we’ll cover a number of important stepping-stone issues:

- What most B2B Saas companies get wrong about marketing budgets

- How to work backward from target MRR to the right marketing budget

- How to think about pay-back periods

Note: If you want to learn about how our team can help your company arrive at the right marketing budget, you can contact us here.

If you like to listen to your blog posts, you can check out this post as an episode of SaaS Marketing Bites here:

What Most B2B SaaS Companies Get Wrong About Marketing Budgets

When companies approach us, they always need guidance, but they’re often not sure what kind. They know their marketing isn’t doing what they want it to, but they don’t know why, or how to think strategically about fixing it. We begin by asking questions.

We’re ultimately looking to achieve that 3:1 LTV-to-CAC ratio, so first on our list is:

What’s Your LTV?

Many clients don’t know, or they say that it depends, which is understandable. There are a variety of formulas for LTV. Many are long and drawn-out, requiring a variety of variables: average purchase value, average purchase frequency rate, customer lifespan, monthly salesforce expenditures, etc.

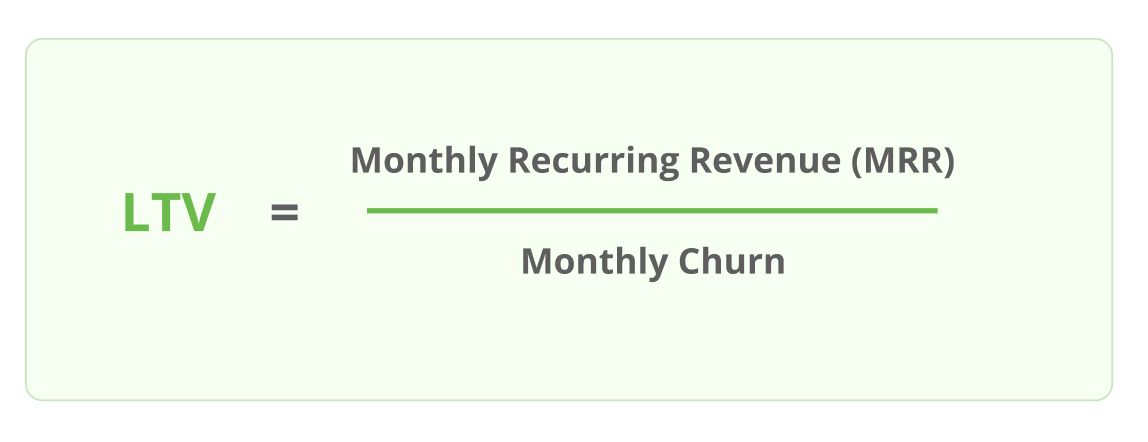

The relevant information is often scattered across various departments, organized on one or another hard-to-find spreadsheet. Sometimes the underlying data is less than cut-and-dried, marred by things like office politics, human error, and emotional decision-making. We cut through the noise with a cocktail-napkin formula for LTV that we consider to be about 98 percent accurate: monthly recurring revenue (MRR) divided by monthly churn.

Because the former is a measure of growth and the latter a sign of decay, there’s no SaaS founder who isn’t intimately familiar with these figures. And once they know their LTV, it’s often immediately clear that they’re underfunding their marketing budget.

Not infrequently, this comes as not much of a surprise. Some founders even have some (usually arbitrary) idea about how much they want to increase their spending. For SaaS companies in the $1 million to $10 million annual revenue range, the figure for increased marketing spend tends to come in around $10,000 to $15,000. But even if their current LTV-to-CAC ratio suggests that they ought to spend significantly more—if it’s 5:1, say, or even 8:1—that’s not necessarily a bad place to start.

Better to ramp up gradually and observe the effects—almost always more demos, and at a stable or lower cost—than to charge off into the unknown. But SaaS companies with arbitrary ideas about setting a marketing budget also often want to focus on simply apportioning that budget across a handful of near-arbitrarily chosen channels. Which is to say they still aren’t thinking strategically.

How to Work Backward from Target MRR to the Right Marketing Budget

If a founder knows their current MRR—and, as we mentioned, they all do—chances are they also have a target for MRR growth. From that number, we can work backward, step by step, to find a marketing budget that will reliably produce the target.

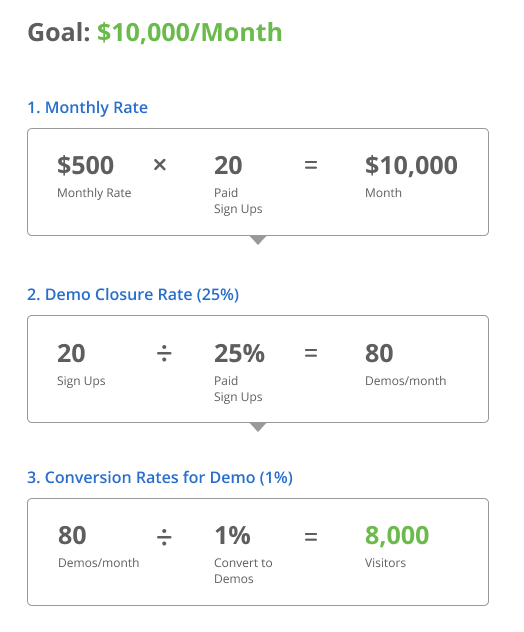

For example, if a SaaS company wants to add $10,000 in revenue a month and their product has a subscription fee of $500, that means they need to sign-up an additional 20 users per month. To figure out how to get there, we first ask, “What percentage of demos do they close?”

Founders tend to overestimate their answer at somewhere in the neighbourhood of 70 to 80 percent of demos for good prospects. The total figure—the one we need—is generally closer to 30 or 40 percent, suggesting that they’re demoing too many prospects that aren’t sales-ready. But that’s a subject for another day.

Once we know what fraction of their demos a SaaS company is closing—let’s call it 1 in 4—we can calculate how many demos per month they need to reach the number of new users required to hit their target for MRR growth. To extend our example, a company that needs 20 new users a month and closes just 1 out of 4 demos will need to do another 80 demos each month. Of course, that could be a lot, or a little, depending on the company’s size and growth rate.

(We can also use a company’s demo closure rate to find cost per sale. If that same SaaS company spends $1,000 on 20 demos, signing up about five new clients, that makes their cost per sale $200; small to mid-sized SaaS companies generally spend somewhere between $50 and $500 per sale.)

The next step is to ask what fraction of website visitors ultimately convert to demos? For our new clients, the answer, generally, is: a tiny one. SaaS companies that are only beginning to focus on marketing don’t usually have the kinds of website lead magnets—teaser content, tutorials, etc.—that we find essential to boosting conversions. They often convert only 1 out of every 100 visitors or so (sometimes much less, sometimes more, this varies widely).

But the answer nonetheless points us toward a click goal—the number of new visitors needed to produce the demos necessary to reach the MRR growth target. To get it, we simply divide the required number of demos by the fraction of visitors that convert to demos. With the parameters of our example, it looks like this: 80÷0.01=8,000.

So the question now becomes: How much will it cost to get those 8,000 visitors?

Typically, this is answered by first figuring out which channel(s) best fits the company’s customers: LinkedIn? Facebook? Quora? The best bet is to test a variety and see which yield the highest conversion rates on demos. Once that step is complete, calculating the budget necessary to reach the target MRR growth is easy. We simply multiply the number of clicks we need by the blended average cost per click across the channels that have proven effective (For those that need more accuracy, you could, of course, multiply this out on a channel by channel basis, estimating traffic from each channel).

So to recap, our strategy to find the right marketing budget for a B2B SaaS company consists of these eight basic steps:

- Identify a target for MRR growth

- Determine the number of new users required to hit that target

- Identify the rate of demo closure

- Use the demo closure rate to calculate the demos required to reach the needed number of new users

- Identify the fraction of website visitors that convert to demos

- Calculate a click goal by dividing the number of demos required to hit the MRR growth target by the demo conversion rate

- Test traffic channels to find the best customer-channel fit

- Calculate a marketing budget by multiplying the click goal by the blended average cost per click across effective channels

By the time a company approaches us for help, they’ve typically tried a number of marketing solutions without achieving the results they were looking for. Their reluctance to invest in marketing often comes from a sense that the things that make marketing succeed or fail are somewhat mysterious. As a result, they price a marketing budget based on what they feel comfortable with, not realizing that what makes them feel comfortable is going to disappoint their expectations for MRR growth every time. But by using those MRR expectations as the basis for calculating a marketing budget, SaaS companies can work backward, step by step, to end up right where they want to be.

SaaS Marketing Budget Calculator

You can apply the above formula very simply using this easy to use calculator:

How to Think About Payback Periods

The 3:1 Golden Ratio for LTV-to-CAC is based on the idea that once a B2B SaaS company has profited twice as much from a customer as they invested in acquiring them, any additional profit is gravy. And when we’re working with a client that has a high LTV-to-CAC ratio—3:1 or greater—we encourage them to plow a good portion of that profit into marketing.

Using the formula outlined above to create a marketing budget designed for their growth goals, they generally ramp up quickly—from $10,000 or $15,000 to $25,000 or $30,000, and so on. Once they see a favorable pattern develop, skepticism about bigger marketing spends tends to evaporate, and they set their sights on more aggressive MRR growth targets.

Naturally, it behooves SaaS companies, to the extent they can, to limit their payback period—the interval over which a company recoups the cost of acquiring a customer (CAC). It’s only then, after all, that profitability begins. But for SaaS companies that don’t have VC funding at their disposal, a long payback period can also severely limit the possibility of acquiring customers. A founder can hardly be expected to outlay for additional marketing while they’re eating ramen noodles and waiting for existing customers to pay them into the black.

We should note that payback period is independent of LTV to CAC ratio. Two companies, one with a high monthly price and short average customer lifetime and another with the inverse (low price, high lifetime) could have the same payback period.

It’s worth noting, too, that the Golden Ratio works great for VC-funded companies, and less so for unfunded ones. SaaS firms without tons of cash on hand to spend acquiring customers understandably tend to be more sensitive about recouping their CAC in a timely fashion, and for them, CAC payback period may well be a more important metric than LTV-to-CAC ratio. Generally speaking, a good payback period rule of thumb for these companies is 3-4 months.

A well-funded B2B SaaS company could theoretically have a payback period many times longer and still be a picture of fiscal health. But some funded founders nonetheless adopt a scarcity mindset. This can be prudent; it’s important to maximize return on investment. But it can also lead to self-defeating short-sightedness. A founder who’s always fretting about their payback period, despite having ample funds at their disposal, probably isn’t very confident in their service and isn’t likely to devote appropriate spending to marketing. The result is a perpetual negative feedback loop: Fearing that the market won’t reward them, the founder is likely to lose share in it.

If you want to learn about how our team can help your company arrive at the right marketing budget, you can contact us here.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.