The Key to Understanding Your B2B SaaS Marketing Metrics (Hint: It’s the Relationships between Them That Matter)

Last updated: April 21st, 2021

Many B2B SaaS companies tend to analyze their metrics in a vacuum. They examine their KPIs independent of each other, unable to see the forest beyond the trees.

But whether you’re measuring your cost per click or organic search rankings, your metrics are connected in ways that influence one another. That’s why it’s best to analyze them based on the context of the relationships they have.

Doing so gives you a more accurate picture of how effective your marketing really is. As a result, you’ll be able to make better decisions about what levers to pull in pursuit of your prime objectives.

In this article, we’re going to examine three essential relationships between SaaS marketing metrics that are often misunderstood:

You’ll learn why there’s an inverse relationship between volume and quality.

We’ll also explain why budget and cost of acquisition have a direct correlation.

Finally, we’ll discuss the reason that engagement and conversion metrics are often at odds with one another.

But before we discuss that, let’s examine the metrics that many SaaS marketers overrate and how to analyze them instead.

Unsure of how to set and evaluate marketing KPIs for your B2B SaaS Company? Schedule a Free SaaS Scale Session to learn about what we can do to help.

Prefer to listen to an audio version of this post? Here’s the episode from SaaS Marketing Bites:

5 metrics B2B SaaS marketers overrate (and how to look at them with fresh eyes)

Many B2B SaaS companies pay close attention to these five metrics:

These metrics do matter, but they’re paid more attention than they deserve. Here’s how B2B SaaS companies should be thinking about these marketing metrics differently.

1. CPC

Cost per click is the marketing metric that most companies obsess over. They often want to drive down their CPCs and acquire cheaper clicks.

You rarely hear companies ask how they can get the most expensive clicks possible. But when a click is expensive, there are certain assumptions you can conclude, and not all of them negative.

High CPCs could mean that your ads are reaching a highly coveted audience. When the space a click occupies is hotly contested, there will be more advertisers with bids driving up the average CPC.

They could also be a signal that your ads are reaching an audience with higher intent. Not only are they reaching the right people, but they’re reaching them at the right time to pitch an offer.

The company that can bid the highest and acquire traffic will often win the market.

So while it’s ideal to get cheaper clicks, know that it’s not an absolute must.

As long as you can make the numbers work, there’s no reason why you shouldn’t pay a premium on clicks, especially when you can convert at a profit.

2. Ad Position

Another metric that tends to get more attention than it should is ad position.

Less mature SaaS marketers often waste time worrying about where their ads rank in paid search. They place heavy weight on ranking in the number 1 spot of their targeted keywords.

When they find out they’re not, it’s a cause for panic.

They usually find out they’re not ranking first by searching for themselves on Google.

But what they don’t realize is that they’re doing themselves more harm than good. By searching for their targeted keywords and not clicking their ads when they appear, they’re creating wasted impressions.

The result is a vicious cycle: lower click-through rates leading to lower-quality scores which then drives higher CPCs.

Instead, they should stop worrying about ad positions all together. They’re better served focusing on click through rates as a KPI.

Higher CTRs are an indicator that your ads resonate with your target audience while lower CTRs are a signal that they don’t.

3. Organic Keyword Rankings

When it comes to SEO for SaaS, many companies tend to have a myopic perspective of keyword rankings, tending to be laser-focused on ranking for keywords with the highest search volume.

Often, these are head terms: keywords that include the name of a category plus other words like software or platform (eg. ‘CRM software’ or ‘CRM platform’)

Other times, they are use case search terms. For example, one of our clients wants to rank for the keyword ‘power dialer’ because they sell sales dialer software.

But by focusing on head terms and higher volume keywords, they overlook the importance of all the long tail keyword opportunities out there.

These are the keywords with much lower search volume that can still be hyper relevant for your business. In aggregate, they can outweigh the number of searches that any single head term generates by itself.

That’s why it’s best to chase keywords that address pain point related topics instead. They may not appear to have any search volume, but they can be better indicators of purchase intent.

4. Traffic Volume

Most companies are obsessed with growing their traffic. Decision-makers frequently believe that their marketing only works when there are more people who see and talk about their SaaS product.

But focusing on increased volume often equates to lower quality traffic and leads.

Instead, it’s better to optimize for customer-content fit first. Better fit traffic yields better quality leads, which then yields better quality customers. Scaling traffic can be a priority later — but only once quality has been figured out.

5. Conversion Rate

It’s common for us to have conversations with companies who worry about low conversion rates.

But generally, they’re looking at how many demos or trials they received relative to the total number of visitors their website generated.

This paints an incomplete picture because people who come to your website land there with different motivations.

Some people browse your website for research and education. Meanwhile, others have landed on your page by accident and aren’t the right visitors.

It’s best to look at conversion rate in more segmented terms, examining it at a page level.

For example, it’s worth paying more attention to conversion rates of your core product pages because people who visit those have actual purchase intent.

If you’re not converting on those pages, you need to understand why.

3 Relationships between SaaS marketing metrics that you need to understand

Most companies don’t understand the key ways in which their metrics are influenced by one another. As a result, they can move one lever and get great results, yet pull another and suffer unwanted consequences.

SaaS companies should make an effort to better understand the relationships between:

Relationship #1: Volume and Quality

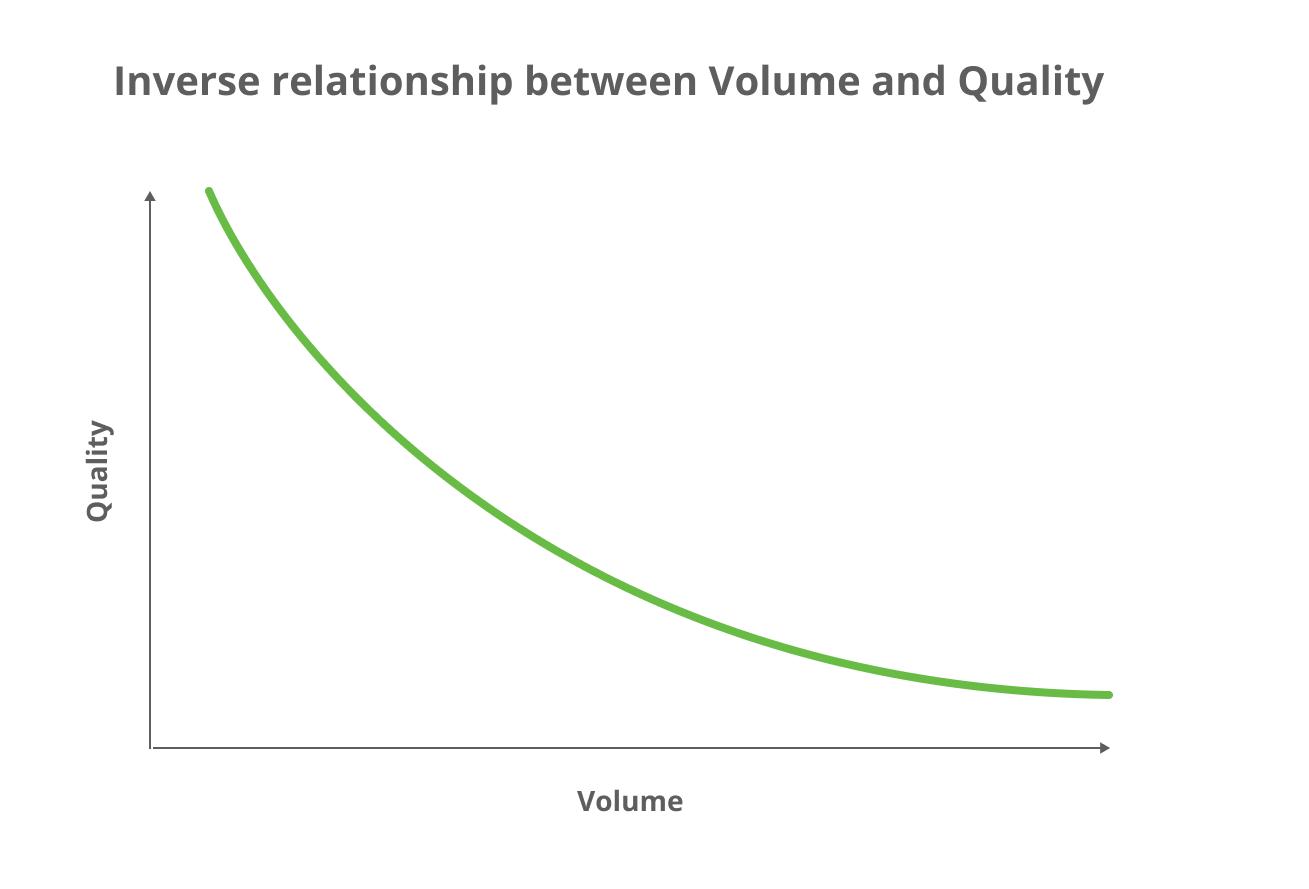

There’s an inverse relationship between these two aggregate metrics. When one goes up, the other goes down, and vice versa.

Take traffic and conversion rates as an example. As you scale traffic to your website, your conversion rates on your website will decrease.

That’s because you’re moving away from no-one-else-but to new green space audiences.

No-one-else-but visitors are prospects with high intent who typically come smaller in number. Green space audiences, meanwhile, may be potential buyers, but they’re less educated about what you do and have lower intent (and take longer to convert).

In spite of this, most companies optimize for traffic volume first. They worry about generating quality visitors later, which can result in future disaster.

Instead of optimizing for volume, it’s best to optimize for quality.

For example, pursue ranking for organic keywords that have low search involvement yet signal higher purchasing intent. These might be topics around customer pain points, like comparison pages between you and your competitors.

When it comes to traffic, this might mean you’ll generate fewer visitors to your website. But you’d at least be bringing in more of the right potential prospects.

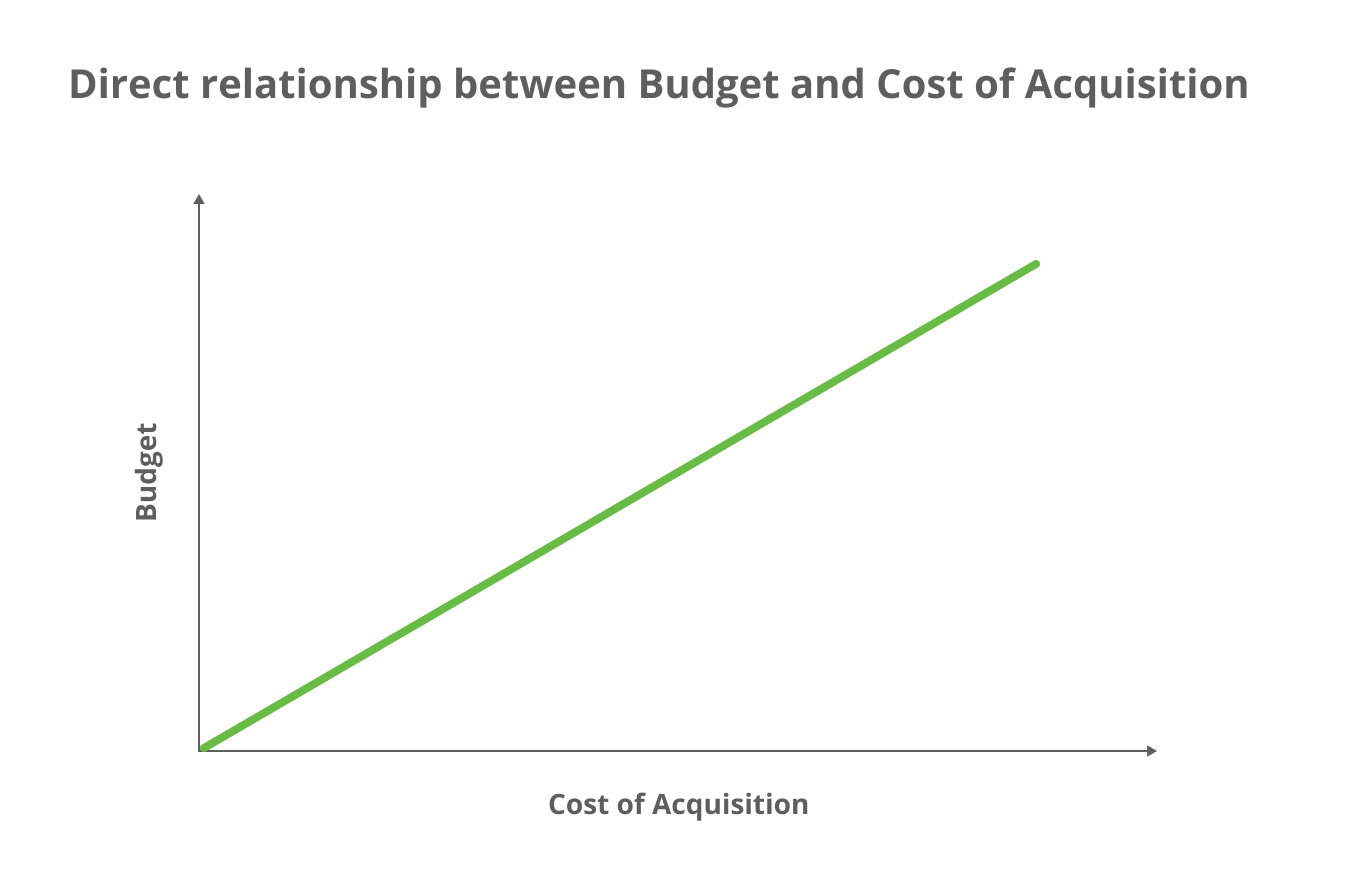

Relationship #2: Budget and Cost of Acquisition

Many SaaS companies that want to spend more on advertising also want lower CPAs. But frequently, the opposite happens.

Why?

Because increasing your ad budget expands your reach to new audiences who’ve never heard of you before. This lack of familiarity means that the cost of acquisition will almost always go up.

Unlike volume and quality, there’s a direct relationship between these two metric categories. When one goes up, the other goes up as well.

An example of this is annual contract value and sales cycle.

Let’s say you sell a high ACV product that’s valued around $100,000. Based on your existing data, you know that it takes you about nine months to close a deal.

But by month three of a new campaign, most companies start to wonder why they haven’t closed any new leads. Remember, the reason this is happening is because you sell a high ACV solution. If you were selling a $1,000 solution, the results would be totally different.

From point of discovery to close, high ACV products always take longer to sell. There’s much more at stake for a customer when the price tag is expensive. A customer is going to want to do a heavy amount of research before committing to such a product.

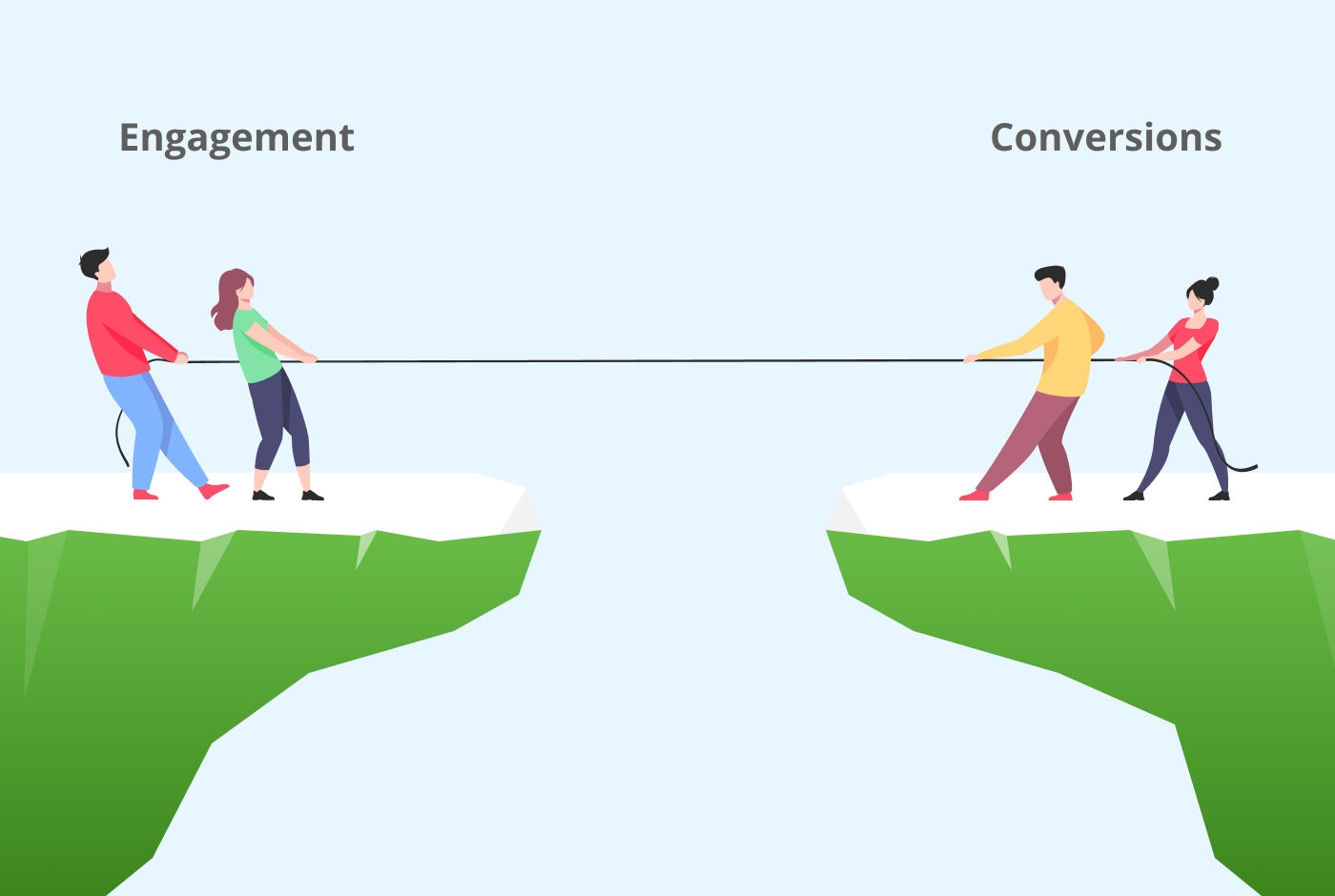

Relationship #3: Engagement Rate and Conversion Rate

Marketing decision makers often assume that there’s a direct correlation between engagement and conversions: high engagement should lead to high conversions, right?

But these two metric categories are often at odds with one another.

Unlike the other two relationships we’ve discussed so far, engagement and conversion tend to have no influence on each other.

Imagine that you write an informative blog post that drives both traffic and captivates the attention of anyone who reads it.

Visitors are staying on the page, which leads to improvement in engagement metrics such as time spent on site.

But just because someone is reading that post doesn’t mean they’re going to buy what you’re selling.

This is especially true if the blog post you wrote covers a top-of-funnel subject. Visitors landing on your page at this stage of your marketing funnel may be unaware they have a problem that your SaaS product can solve.

That’s not to say that there’s no purpose for engaging content.

Engaging content like info graphics or top-of-funnel articles and videos are useful for generating brand awareness. Meanwhile, pain-point related content such as competitor comparison pages are much more effective in generating direct response conversions.

A better way to analyze your SaaS marketing metrics

Keep in mind the content we’ve discussed in this article are for SaaS companies who’ve already reached product/market fit. These are businesses that have proven themselves to be sticky among their target audiences, but are now wondering how to make the marketing really tick.

If that’s you, start by working backwards from the end of your funnel to determine your own benchmarks. Look at the relationships between metrics we covered in this article when you do.

But remember that these relationships are a function of your existing positioning, messaging, calls to actions, and calibrated offers. Make sure those are in order first before you start optimizing for more visitors.

We’ve all landed on SaaS websites of businesses who are unclear about who they are and what they do.

Don’t be one of those companies.

What’s the point of spending a budget on ads if you aren’t clear about the problems your product can solve?

Still feel confused about how to best analyze your SaaS marketing metrics? Schedule a Free SaaS Scale Session to find out how we can help.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.