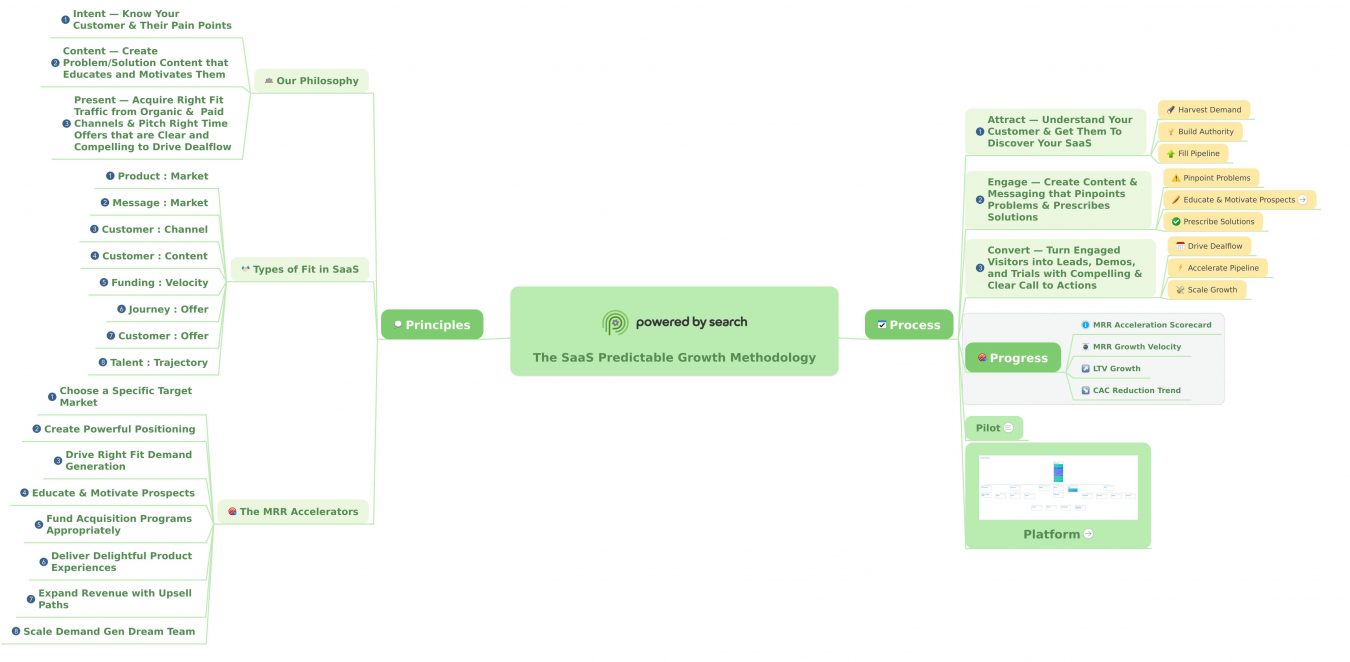

Our Methodology

A proven process for growing demo and trial based SaaS & B2B technology businesses using paid and organic demand generation.

If you have happy customers who enjoy using your products and a low monthly churn rate, you’ll find this page useful. In it, we transparently share an overview of our proven process which we use to grow demos and trials for all of our clients.

There are no sustainable growth hacks.

Growth hacks are by nature, tactical.

Tricks that interrupt your prospects, newfangled landing page layouts, or killer copywriting words. Don’t forget “big data” and AI that magically increase your conversion rates at the click of a button.

Before our clients start working with us, they often talk about how they spent too much time, money, and effort in magic bullet type solutions, often going nowhere fast.

What would you rather have — A tactic that gets outdated so fast you don’t have enough time to find the next one… or a predictable, practical, and pragmatic process that is easy to understand and easy to deploy?

We designed the Predictable Growth methodology specifically for businesses that grow by getting more demos or free trials. It documents the exact process from getting someone who doesn’t know about your company to find you, and then become interested enough to want to talk to your sales team or to try your product before becoming a paying subscriber.

This process has worked selling products ranging from $1K ACV to $100K ACV (annual contract value). It is far from a magic bullet because it requires the combination of the strategy, tools, and talent (on our team and yours) to create lasting growth in any industry.

Our software and technology clients regularly see up to a 100% to 500% growth in their demo and trial acquisition, without diluting customer fit, and while reducing CPA (cost per acquisition)

In summary, our process works.

Step 1: Evaluating Your MRR Accelerators (so you know exactly what to optimize for growth)

Did you know that there are 7 other types of fit in scaling a software or technology business other than Product-Market fit?

Many founders believe that if they build a better product, the customers will come. That’s why they keep adding more features to the product to make it more ‘well-rounded’ so it appeals to a broader audience.

We believe that this approach stalls growth and increases the risk of building features that your ideal customers don’t want to pay for.

We believe that your marketing will impact far more people than your product ever will. That’s why we have identified the following areas of fit, which we call MRR Accelerators. Why accelerators? Because the tighter the fit, the faster you’ll demonstrably grow your monthly recurring revenue.

You can take the SaaS Scalability self-assessment to find out the gap between where your MRR is today, and what you’ll need to do to increase it to your target MRR.

Here’s why we believe working on your positioning, perfecting the conversation and content about your prospects’ pain points, and promoting the content you already have is crucial to growing your demos and trials:

You need to specifically uncover the weakest aspects of your current marketing strategy and understand why they aren’t working.

Most of our clients come to us with a specific idea of what they want us to work with them on first (eg: building an Adwords program, redesigning their website, or decreasing their Facebook Ads cost).

What we often find is that the initial ask while helpful, may not be the most important aspect to work to pursue first. The opportunities are hidden in the 7 other types of fit, ranging from fixing poor positioning, to appropriately funding a channel that was previously underfunded.

Get the SaaS scalability score for your company in this easy to use self-diagnostic tool.

You don’t know why your current website visitors aren’t converting into more demos and trials.

Many of our clients come to us with a hunch about why their current website isn’t performing as they expect it to. They may see a competitor adopting a best practice they aren’t currently deploying into the market or having pursued a specific marketing channel (Facebook, Adwords, or SEO) without any success.

The truth is that without the data, these hunches aren’t good enough for you or your company. What you need is evidence that can pinpoint the chokepoints in your current customer journey.

You don’t click your own ads, read your own articles, or buy from your own website as a customer.

As a founder or marketer, it’s easy to think about your marketing funnel clinically, and therefore misdiagnose what’s missing or holding back ideal customers from converting into more demos or trials.

It’s difficult to have the same perspective, pain points, need for proof, or buying process as your customers do, and that’s precisely why it’s so important to understand.

Step 2: Understanding your Customer’s Intent and Pain Points

Everything you need to know to succeed at getting more demos and trials already exists within your company. We just need to take the information that sits fragmented between your product, engineering, customer success, and analytics teams and pull them together into an insightful narrative.

It’s not enough to just get everyone to meet (and that’s no small task), you need to be able to capture your team’s inputs into a meaningful canvas that can guide your marketing.

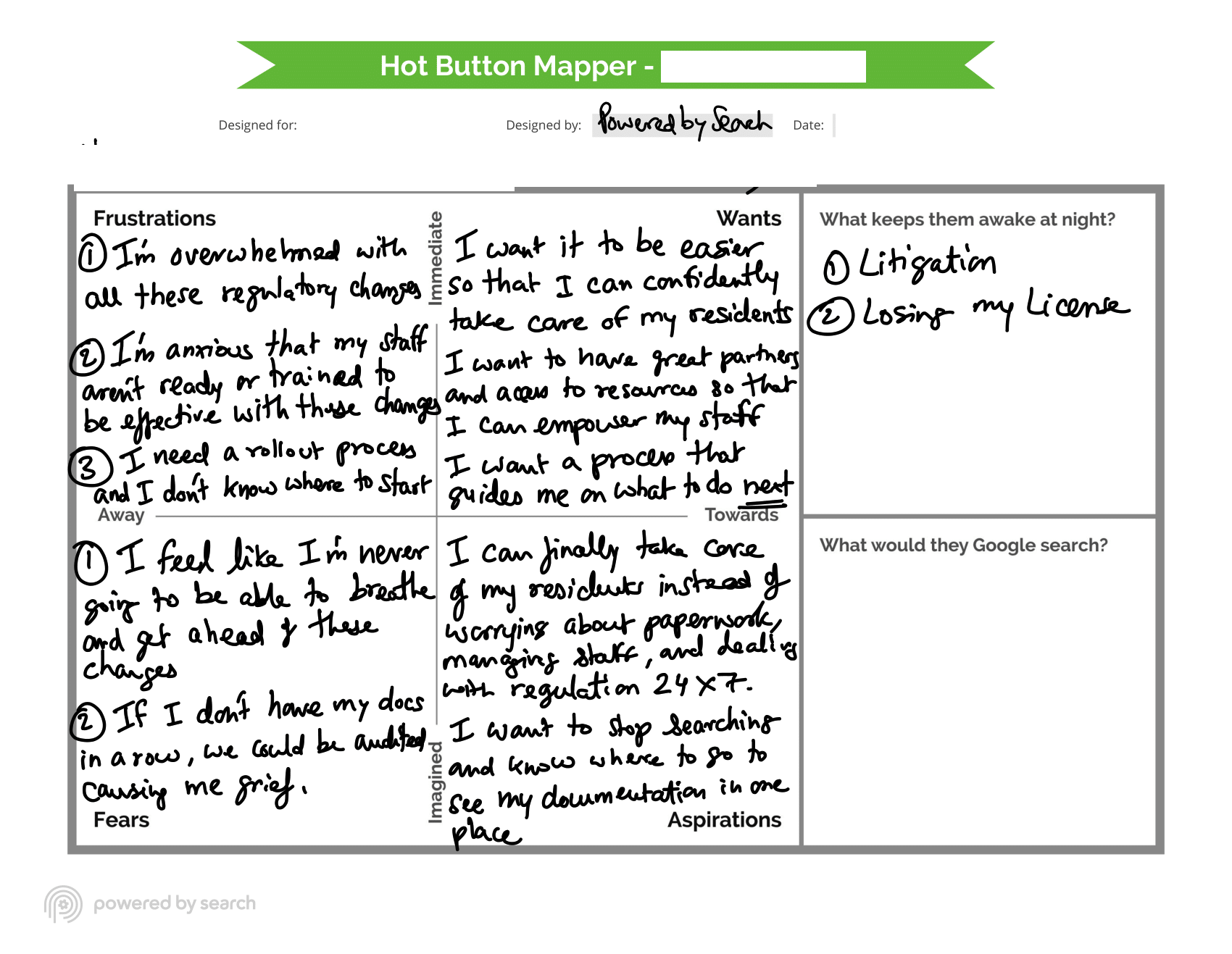

Seek to understand your customer’s Fears, Frustrations, Wants, and Aspirations. It’s important to think bigger than how your customers may use your product alone, because your solutions may small albeit value role in moving customers away from their fears and frustrations, and towards their wants and aspirations.

We’re trying to answer the question “what does my customer truly desire”? You’ll want to do this so that you can align the key aspects that make your products desirable to the key desires that your customers have.

Once you’ve identified the key topics that revolve around their problems, pain points, and desires, you’ll want to start diving deeper into keyword research that becomes the foundation of your key-driven channels like Organic Search (SEO), Google Adwords, or content channels like Youtube and Quora.

You’ll also want to identify the key alternatives your customers may resort to using if they weren’t to sign up for your product. Next, brainstorm why each of these is a worse off solution than your product suite. You should then pinpoint the exact benefit your target customer avatar will receive from using your product instead of the most apparent alternative.

Here’s an example from an actual client (name redacted for privacy)

So to summarize, here are the sub-steps:

- Identify Your best customer’s global motivators (i.e their fears, frustrations, wants, and aspirations)

- Identify key alternatives they may be using and why they are inferior to the value your product provides them.

- Conduct keyword research after identifying the core topic areas of your customer’s problems, pain points, and desires.

- Codify the key benefits your solution provides to the alternatives, competitors, and free solutions your future customers may be using.

- Create a customer avatar that codifies your team’s joint input and drives future marketing strategy, content, and angles.

We’ve found that running a facilitated workshop that gets everyone building a deep customer avatar together has been the approach that yields the most success. If you’d like us to help you with this, contact us here.

Step 3: Pinpointing Why Your Visitors Aren’t Converting

Your visitors have a digital footprint that they leave every time they interact with your website. With the right approach to researching these footprints, you can trace their digital body language.

When you identify the exact places where the footprints stop in their tracks, you’ll find the conversion gaps in your website’s buyer journey.

The journey starts well-before the visitor ever lands on your website, so it’s important to trace back further to the origin point. For your company, this may include the following examples

- An impression on a Google, Facebook, or Linkedin ad

- A referral click from a review based website like G2 or Capterra

- An organic search click to an article on your blog from Google

You can find all of this data in your analytics platform and in your CRM system.

If you don’t have this data handy or it isn’t tracked properly, contact us to discuss a project to track your data properly.

You may be losing your best customers in the process because your website has some pretty predictable choke points. At Powered by Search we like to categorize these chokepoints into the following areas:

User Experience Issues

Have you ever wanted to complete a task on a website but found it difficult or impossible to do so? This is happening to your website’s visitors and holding you back from getting more demos and trials.

Here are some common areas you’ll want to investigate

- Is your website fast enough to load on desktop and mobile devices?

- Is your mobile website as usable as your desktop user experience?

- Is it clear to visitors why they are on a given page, what they can do, how the described content on the page works, and what they should do next?

- Do your forms ask for too much information too early in the buying process?

- Do your forms work as expected with proper error handling?

- Do visitors have to jump around your site to multiple different pages to get the information they need?

User Confusion

In order to have a high percentage of users who visit your website convert into demos and trials, you must present the right offer to the right prospect, at the right time.

Remember, a confused mind never buys.

We see many SaaS and Technology websites make the mistake of asking for the sale too early in the buyer engagement process (often as the only call to action on their home page). If this sounds like your website, you’re leaving a lot of money on the table.

At a high-level, you should be investigating the following areas:

- Is your navigation clear and consistent without your users having to guess where to click?

- Is it clear to users what will happen once they request a demo (i.e when it will be scheduled, how long it might be, and whether it’ll be customized to their needs)? If you are promoting free trials, is it clear if a credit card is required?

- Does your website offer an alternative call to action to users who aren’t ready yet to request a demo or sign-up for a trial?

- Are your call-to-actions congruent (i.e do they read the same) in the journey between your ads, your landing pages, and subsequent sign-up related pages?

- Does your design use commonly accepted terminology, symbols, labels?

Value Proposition Friction

You lose potential customers when your website pitches the wrong offer to the wrong person at the wrong time.

Auditing your website for mismatches between the intention of the user, the stage of the buyer journey they’re at, and the key offers you’re making them can reveal some very profitable opportunities to grow MRR.

You can capture these mismatches in three ways:

- Conduct a user experience experiment through a tool such as User Testing to observe how a potential ideal customer may complete or evaluate a key sequence of pages on your website.

- Ask your website visitors for their input through micro-surveys that do not capture any personally identifiable data. We use RightMessage and Hotjar to ask users questions on key pages to understand their objections, issues, and satisfaction.

- Interview newly converted customers to understand why they almost didn’t sign-up for trial or book a demo.

Once you have conducted your marketing research, the following litmus test is useful for optimizing your website’s value propositions.

- Is your current copy including features, benefits, and value propositions well aligned with how your products help your ideal customer avatar move away from their fears and frustrations, and towards their wants and aspirations?

- Are the control group’s value propositions the one’s ideal customers care about the most?

- Is there a testing protocol or roadmap to refine and iterate copy and imagery for value propositions?

- Does each page appropriately identify conversion blockers such as issues or objections and address them with benefits that ideal customers see as tangible and practical value drivers?

- Does your conversion process have appropriate proof points including case studies, testimonials, awards, certifications, guarantees, and risk reversal?

(For example: if you were to become a client, we will showcase strong case studies, testimonials, transparent processes (like you’re reading right now).

Step 4: Educating and Motivating Ideal Prospects

Your website’s visitors are at different stages of their buying journey. In order to guide them to becoming customers, you need to first educate them on why they should consider your company and products, and then motivate them to take the steps necessary to investigate fit and finally become a customer.

The best way to do this is through sharing content that elegantly guides a user from the first time they visit your website, to the point at which they start consuming your content, liking and trusting your company more, and finally converting into a sales-ready prospect or free trial user.

Your content must be original, authoritative, substantial, enjoyable, and accurate for you to sufficiently lay down the path for a visitor to convert into a paying customer.

When evaluating your own content, look for the following traps

-

- Do you have too much ‘me too’ content that is derivative of what a quick google search in your niche might yield? You know you might be falling into this trap when you’re trying to increase the volume of publication at the expense of quality.

- Does your content offer a strong point of view that aligns with your positioning? (i.e how you are meaningfully differentiated versus your competitors)

- Do you have product pages that exist for the sake of existing (or because someone told you this was good for SEO; it isn’t)?

- Do you have text boxes or content modules that leave the user with more questions than answers?

- Would you read your own content or share it with a new hire within your company?

- Do you have a content review process to check for accuracy?

Many of Google’s recent algorithmic updates such as the EAT and Medic updates have negatively affected websites that did not take the content guidelines above seriously.

Step 5: Driving Right Fit Traffic through Paid and Organic Channels

Not all traffic is created equal. Your traffic maths need to work out so that you’re ROI positive, and the higher your ACV (annual contract value), the more you should be willing to pay on a cost per click basis to acquire traffic.

We define a right-fit click as a visitor who you have targeted specifically because they fall within your ideal customer avatar, either using targeting parameters in paid advertising platforms or by the means of writing an ad that attracts the ideal customer and repels those who aren’t.

We strongly advocate that every SEO initiative should first be validated by a Google Ads PPC campaign bidding on the same keywords that you intend on ranking for via SEO.

You can evaluate the quality of fit for your traffic by asking the following questions:

- Is the channel the right fit for your target audience? For example, B2B audiences respond well to Google, Linkedin, Quora, and Twitter, but do not do as well on Reddit, Snapchat, or Spotify Ads.

- Does traffic from this channel have a low exit rate or bounce rate?

- Does traffic from this channel have a high conversion rate relative to other channels?

- Is the cost of acquisition from this channel ROI positive?

- If the ROI is positive from this channel, are you funding it appropriately (i.e spend more if it is positive, and spend less if it is not working)

- Does your audience analytics (in Google Analytics, Facebook Audience Insights, or Linkedin Ads Insights) demonstrate a close overlap between actual visitors and your ideal customer avatar characteristics? (Aside: we’ve frequently found that many of our clients come to us thinking they’re targeting properly when in fact they’re attracting the wrong type of individual within their account-based marketing approach)

- Does the channel drive enough volume to hit trial, MQL or SQL goals?

In our experience, most channels are complementary and non-zero-sum. This means that you can and should be investing in multiple channels to create an omnichannel traffic acquisition and conversion approach.

You should also be paying special attention to remarketing and how to meaningfully use it to win-back visitors who did not convert into a demo or trial on their first interaction. We’ve spoken at Google on the topic of doubling conversions using targeted remarketing.

Step 6: Creating a Proof of Concept Pilot Project

“Will it scale?” is a common trope in conference rooms across the world, and yet often this is exactly what kills your ability to scale. Instead, consider that if you can follow a process to turn a click into a customer exactly as intended, you can duplicate that process over and over again.

The Pilot Project is a simple, paired down version of your overall demand generation program. It’s meant to demonstrate the tight fit between 3 of the 8 different types of fit that accelerate MRR. It’s meant to get quick wins that create momentum that you can keep building on.

You’re going to go after the most immediate, highest-need audience. Keep in mind that these audiences will be the most hotly contested so you’ll only be decreasing your CPA (cost per acquisition) moving forwards.

Customer: Channel Fit — The objective is to test and learn from a few paid media channels to get benchmark metrics AND profitably drive demo or trial conversions. You will definitely want to test Google Adwords, and Facebook Ads and Instagram. You may optionally want to test Linkedin Ads if your LTV (lifetime value) is over $5000 and you have a payback period that is between 3-6 months (or less).

Customer: Content Fit — By dialling in customer: content fit, you’ll increase your conversion rate of turning anonymous visitors into known leads, capturing them into a database or ESP (email service provider).

You will drive clicks from paid media channels to a landing page where the user is able to receive valuable content (typically a guide, cheatsheet, whitepaper, or calculator) by opting in with as few pieces of information as possible. We recommend a first name and business email address because asking for fewer fields dramatically increases conversion rate.

Journey: Offer Fit — The objective is to take advantage of your newly converted MQL (marketing qualified lead) and to educate and motivate them to book a demo or to start a free trial. You shouldn’t waste the opportunity to do this on the thank you page of a content upgrade (some people call this a lead magnet).

Adopting the customer’s point of view, you’ll want to increase clarity, decrease confusion, and increase compelling elements of why the visitor should sign up for a trial or request a demo. In our experience, using video to explain key value propositions that are aligned with the intention that drove the user to download the content upgrade work best.

It’s natural to have many of the visitors who land on your thank you page drop off and not opt-in for starting a trial or requesting a demo. That’s why you’ll want to have a follow-up campaign (now that you have their email or phone number).

As part of our playbook, we send a follow-up email that is SPER (short, personable, expecting a response) that goes out from an SDR/BDR’s email or directly from the founder. The objective of the email is to start a conversation with the user who downloaded the content upgrade. This tactic alone is responsible for a significant bump in trial and demo requests.

If you’d like to work with us to run the pilot project for you, go ahead and claim your free SaaS Strategy Session to begin the process.

Step 7: Measuring Results, Generating Insights and Compounding Results

Too many marketers are misled by vanity metrics that don’t really have anything to do with growing your MRR. That’s us and our clients typically care about three directional metrics

MRR Velocity — Are you adding more MRR compared to last month and the month before that? The faster you can add MRR the more valuable your company will get, and the easier it will be to demonstrate traction that can be used for a funding round or for an exit.

To be specific, you’ll want to look at marketing’s contribution to overall MRR. You’ll only be able to do this if you’ve set up tracking, attribution, and analytics properly so that your analytics, marketing automation, and CRM platforms are all synced and talking to each other accurately.

If you have broken data, contact us for a data and analytics audit and we’d be happy to explore if and how we can help.

CAC Reduction — Your CAC is a function of your marketing and sales costs. Salaries are typically what causes the most sensitivity to your CAC trend. After labor, you’ll likely find that advertising dollars (i.e media spend) have the highest sensitivity (i.e the effect on the magnitude of change in your CAC).

To dramatically lower your marketing sourced CAC, while keeping sales team costs constant, you’ll want to optimize the following:

- Invest in specialized and focused expertise (eg: hiring a consulting firm or agency) to augment your existing demand generation team’s abilities without adding multiple FTE’s who take between 3-6 months to ramp up.

- Increase your conversion rate by dialling in your journey: offer fit. For example, if your conversion rate increases from 2% to 4% you’ll cut your marketing sourced CAC by nearly 50%.

- Increase your conversion volume from lower average acquisition cost channels such as referral channels and through SEO. For example, one of the first things we do with SaaS clients is to build out robust product comparison pages for the bottom of funnel visitors trying to decide between our client’s product and that of competitors. We also create ‘alternative to ____’ pages that position our client’s products to users who are dissatisfied with competitors.

If your cost of acquisition for Demos and Trials is too high, contact us for a FREE SaaS Strategy session where we’d be happy to explore if and how we can help reduce your overall CAC.

LTV Growth

Your best customers pay you more, stay with you longer, and refer more business to you. That’s why attracting right-fit customers is so important.

Many companies mistakenly attribute all of their LTV growth to a better product: market fit. That’s true on some level, but you can increase LTV by making no changes to the product at all, and by choosing a better more dialled market (i.e a different audience).

That’s the power of positioning. Often when we are approached by a SaaS company with a great product (i.e low monthly churn being a leading indicator) we get to work on improving their positioning because it is the foundation on which you can significantly accelerate demo and trial conversion.

Generating Insights vs Choking on Data

Too many of our incoming clients have accepted a low-bar for measuring their marketing, often relying on dashboards chock-full of data but devoid of a compelling narrative, and lackluster insights.

You need to derive insights by observing trends, patterns, and relationships in your data. Once you have insights, it’s important to check if they’re actually useful. Here’s the question we train marketers to ask:

“So what?”

The insight is only actionable if it definitely provides guidance on what you should be doing next to hit a predetermined goal or objective.

One tell-tale sign that your reports need an upgrade are ‘top 10’ reports. If the data remains mostly the same between reporting periods, then these types of reports are limited in their usefulness.

When we speak with senior clients or founders and ask “would you rather be interesting or useful”, they almost always answer “useful”.

Step 8: Creating your MRR acceleration roadmap (assigning what will happen when, and who will be responsible for results)

Even the best insight falls by without a proper plan to execute them to a high degree of success. Take all the insights you’ve generated and then prioritize them based on the following order:

- The biggest impact changes in the shortest time frame

- The easiest to deploy changes with the least dependencies

- The most proven ideas based on past historical data (a.k.a if it’s worked before, do more of it again).

Once you’ve ranked the list you’ll need to assign them to the relevant teams. We highly recommend creating briefs that explain the best and worst-case outcomes of pursuing each initiative so that everyone on the team understands the stakes involved.

In our experience, the day to day of running a marketing operations team can often get in the way of these larger “important, not-urgent” initiatives. Here are a few project management approaches we use regularly to keep up the momentum:

- Every initiative should have one Directly Responsible Individual.

- Every initiative should be broken down into tasks. Each task shouldn’t take longer than a week to complete.

- Every initiative should have a small project team (no more than 3-5 people ideally), where everyone is aware of who does what, and by when.

Conclusion

The Predictable Growth Methodology adds millions of dollars in $ARR (annual recurring revenue) for our clients every single year. The process is not easy to execute but it is straightforward, and it requires intelligence, curiosity, the know-how, and perseverance of marketers and their stakeholders to follow through.