SaaS Payback Periods: The Ignored Metric Your Company Needs to Measure to Maximize Your Marketing

Last updated: November 5th, 2020

For many SaaS founders, payback periods are an afterthought. In our experience, plenty of them don’t measure this key SaaS metric at all.

If they do, it’s often because they offer business-intelligence or financial solutions to customers, so they’re already tapped into these more nuanced financial metrics. Or it’s because they have CFOs who reference this figure in their financial reports.

But payback period is a key metric you shouldn’t ignore — no matter what kind of SaaS company you run. Whether you’re a bootstrapped or venture-backed business, knowing your payback period will help you make critical budgetary decisions.

At Powered by Search, this isn’t a metric we set aside for finance people to handle. As a marketing agency, we take our clients’ payback periods seriously. Before entering an engagement with any company, we always want to know what their current and target payback periods are first.

Doing so gives us a better idea of their expectations, and helps us plan which SaaS marketing strategy and tactics to deploy.

In this article, we’re going to explain the significance of understanding your SaaS’ payback periods in the context of marketing, risk management, and fundraising. Below, you’ll learn:

- What acceptable payback period ranges are for VC-backed and bootstrapped business models.

- A simplified formula you can use to calculate your own payback period.

- And finally, one fast way you can improve the payback period for your own SaaS business.

Note: We help B2B SaaS businesses breach their growth ceilings through SEO and paid media. If you’d like to learn more, reach out and schedule a free SaaS scale session with us today.

Prefer to listen to an audio version of this post? Here’s the episode from our podcast:

Why Payback Periods Matter

Not knowing your payback period can have major consequences for your SaaS business. This is especially true when it comes to customer growth and acquisition.

Speed to market matters so much in today’s competitive landscape. Once a company acquires new customers (especially in the B2B space), those customers are unlikely to leave as long as they’re kept happy.

Make no mistake: it doesn’t matter if you have better marketing collateral, and it doesn’t matter if you have a better product. If your competitors enjoy shorter sales cycles and get to customers before you, it’ll be an uphill battle trying to convince them to switch.

But knowing your payback period helps to address this issue and gives you that first-mover advantage. Below are three important reasons why:

1. Empowers You to Set Reachable Goals Around Your Marketing

In our article on SaaS marketing budgets, we discussed the idea that SaaS founders often don’t know or consider how long it will take to recoup marketing expenses. Because of this, they make their estimates based on what they’ve heard elsewhere in their industry.

That’s fine to do if you run a SaaS company that’s just starting. But once it has some momentum, it’s best to set KPIs and budgets based on internal data.

If you’re having trouble doing this, you can use payback periods to help. For example, we often ask SaaS founders about their expectations for their cost per demo or trial. Many of them underestimate, assuming it will cost a third of what it actually should be.

But let’s say you sell a solution that costs $200 a month. You also happen to know that you convert 5% of free trial users into customers and that you’re targeting a payback period of about 10 months.

You can determine your customer acquisition costs by multiplying your revenue against your anticipated payback period. In this case, that’s:

$200 x 10 = $2,000 to acquire one customer

And since you know your conversion rate is 5%, multiply that by your customer acquisition cost to get your cost per free trial. So in this instance, that would be:

$2,000 x 5% = $100 cost per free trial

Now instead of pulling numbers out of thin air, you have a realistic target and budget based on real data.

2. Improves Your Management and Judgment of Risk

Your SaaS payback period isn’t a lifetime value (LTV) metric. It has nothing to do with the quality of customers who buy your service. Instead, it has everything to do with risk management.

For example, if you’re growing a SaaS business valued between $1 to 5 million, you probably don’t have a lot of extra cash lying around. This can put you in the unenviable position of having to make tough decisions about opportunity costs like:

- Should you hire more engineers or should you hire more salespeople?

- Should you invest in refactoring your code or upgrade your marketing?

Trade-offs like these cost both time and money. Because on one hand, you have targets centered on a high growth rate, cash flow, and development. But on the other, you have a bank account with insufficient working capital. As a founder and CEO, it’s your job to decide what takes priority.

Understanding how much you can afford in CAC (Customer Acquisition Cost) can help. But your CAC will only tell you part of the full story. That’s because CAC can vary depending on whether your marketing strategy is inbound or outbound heavy.

But what if you also knew how long it took to recover your acquisition costs? Wouldn’t that bring some semblance of certainty around your marketing? Wouldn’t that give you peace of mind knowing that your risk was much lower than you thought?

Knowing your payback periods can provide you with more confidence about your marketing. That, in turn, can enable you to make better decisions around your opportunity costs. You can be in a stronger position to take more calculated risks.

3. Arms You with Evidence You Can Use If Raising Capital

Your SaaS payback period can also serve as proof regarding the health of your company. If you’re seeking funding, knowing this timetable is valuable evidence you can present when pitching investors.

Let’s say, for example, you sell a SaaS product with a retention of 24 months before a customer churns.

Most SaaS companies have gross margins (revenue minus cost of (goods) sold) in the >80% range. Therefore, what matters is not how to increase gross margin percentage, but rather how to get paid back your CAC the fastest.

If you have 24 months of LTV and get paid back in 6 months, you would break even in 6 months and then have 18 months of margin expansion on a single customer.

In this case, this means that you make $4 for every $1 in CAC over the lifetime of the customer.

Knowing your payback periods puts you in another league from your competitors by allowing you to present your company to potential investors in a way that demonstrates a proven path to profitability.

What’s An Acceptable CAC Payback Period for Your SaaS Company?

Not knowing much about payback periods often creates a false dichotomy between bootstrapped and VC-backed businesses. Because it’s their money on the line, bootstrapped companies assume they always have to be more cautious when spending. Meanwhile, VC-backed businesses tend to believe they can be more gung-ho.

But as we discussed earlier, you must adjust your risk tolerance based on your understanding of your own payback periods. This is true regardless of whether your SaaS business is bootstrapped or VC-backed.

In general, it’s true that bootstrapped businesses can’t afford long payback periods. But that doesn’t mean they should always optimize for the shortest time-frame possible.

Expecting to reach a short payback period of one month, for example, isn’t realistic. In our experience, it’s more reasonable for bootstrapped businesses to aim for payback periods between six to nine months.

On the other hand, VC-funded businesses do have a little more runway. They can afford longer payback periods, but many tend to overestimate them.

A shorter payback of under 12 months for most VC-backed companies is unrealistic. In reality, they’re best served when shooting for a benchmark range between 12 to 18 months.

Here’s How to Calculate Your CAC Payback Period

You don’t need complex formulas, Excel spreadsheets, or a background in accounting to calculate your business’ payback period. All you really need is a back-of-the-napkin formula that’s true most of the time. Here’s why:

- First, it’s best to lean on mental shortcuts like Occam’s Razor when it comes to solving problems. The simplest explanation is usually the right one.

- The second reason is momentum. When your marketers have a formula they can use without relying on your finance people, they’re empowered to make better decisions with your ad budget.

Is there going to be variance when you use this back-of-the-napkin formula? Of course. But it’s unlikely to yield more variance than five to 15%. And the value of having an easier formula that brings more attention and utility to this metric makes it worth using in many contexts.

The Simplified Payback Period Formula We Use

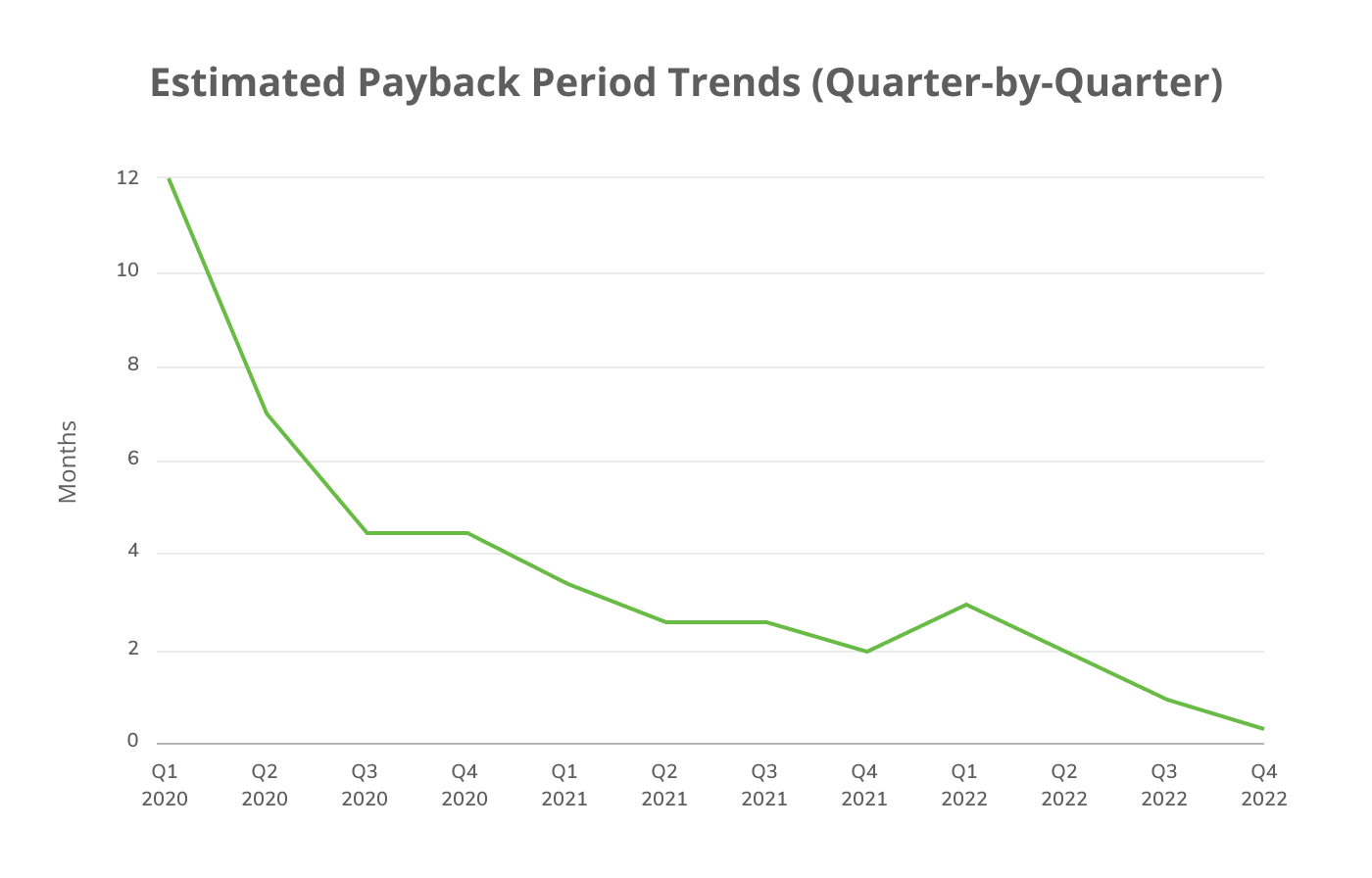

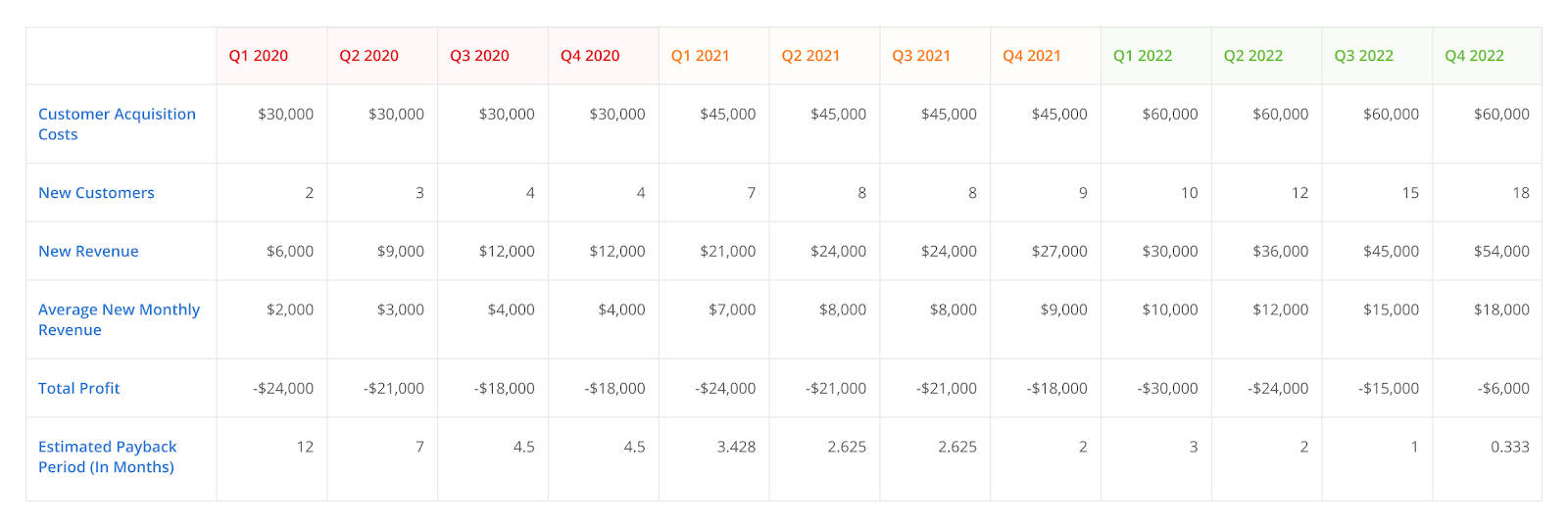

To calculate your payback period, do so by quarter. Here’s the simple formula we recommend:

Payback Period =

Quarterly CAC – Total New Quarterly Revenue / Monthly New Quarterly Revenue

Here’s how to put this formula to work:

- Step 1: First collect and tally your customer acquisition costs in a given quarter. This should include everything from in-house employees, contractors, marketing technology, and marketing spend.

- Step 2: Find out how many new customers you gained plus your total revenue for that same quarter.

- Step 3: Get your average monthly revenue by dividing your total revenue by three (the number of months in a single quarter).

- Step 4: Use the numbers you’ve collected and calculate your payback period using the formula we shared above.

- Step 5: Rinse and repeat this process for another quarter of the year.

We encourage SaaS companies to calculate their payback periods on a quarter-by-quarter basis. Again, simplicity is the aim here. And the simplest way to understand payback periods is by asking what customer acquisition looked like during a 90-day period.

Most businesses can make good, measurable progress in a single quarter. It’s also a useful breakdown because you can spot if you’re trending toward or away from profitability when charting your data.

Here’s a hypothetical example. Let’s say you’re a brand new company selling a SaaS solution that costs $1,000 a month. In your first quarter of business, you acquired two customers and you spent $10,000 a month in CAC to earn them.

The breakdown of the numbers you’d use in the formula looks like this:

- Quarterly CAC: $30,000 ($10,000 x 3 months = $30,000)

- Total Quarterly Revenue: $6,000 ($1,000 x 2 customers x 3 months = $6,000)

- Monthly Quarterly Revenue: $2,000 ($6,000 / 3 months = $2,000)

Take those figures and plug them into our napkin-math formula. Here’s what you get:

$30,000 – $,6000 / $2,000 = 12-month payback period

A Key Lever You Can Pull to Improve Your SaaS Company’s Payback Period

Pricing can have the biggest impact on your payback period. More than marketing and more than development, it’s the one variable you can influence that can change in almost an instant.

If it makes sense for you, try offering an annual prepay option to your customers. This is one of the best ways to get an immediate injection of cash into your company. Architecting an annual prepay option will decrease your payback period because it gives you a blended base of existing customers. Some will pay in installments while others will pay in lump sum amounts.

Keep in mind that annual prepay works best for SaaS products that are mission-critical to customers. Mission-critical means that a customer will use the product multiple times over the course of a month. Examples of this are project management platforms like Asana or messaging software like Slack.

Annual prepay doesn’t make sense for businesses that have limited uses in a single year. It would be impractical for a financial audit tool, for example, to offer upfront payment to customers. People only get audited once a year.

What’s Your Next Move?

Now you have a better understanding of what payback periods are and why they’re so important. We’ve discussed how it’s a metric you can use to empower your marketing team to factor in when making budgeting decisions. We’ve also covered why and how to measure this metric on a quarterly basis.

If you don’t know the payback period for your SaaS company, consider trying our formula for yourself. Because the faster you can get to work on optimizing it, the better.

To recap, recommended payback ranges are:

- Six to nine months for bootstrapped businesses

- Twelve to 18 months for VC-backed businesses

Once you’ve sorted that, start thinking about how to dial in your growth channels. That might mean investing more in earned, owned, or paid media. It also might mean investing in product-led initiatives like affiliate programs. Or, it could mean investing in developing new tools you can cross-sell to your existing users.

Whatever you choose, always pick the growth channels that are most effective in decreasing your payback periods. There’s opportunity in the deltas between where you want to be and where you stand today.

Opportunity costs can be painful, but facing them doesn’t have to be. Knowing and understanding your payback periods is one way to soften their blows against your business.

Note: We help B2B SaaS businesses reach their growth ceilings through SEO and paid media. If you’d like to learn more, reach out and schedule a free SaaS scale session with us today.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.