The Crucial Step Often Missed in B2B SaaS Keyword Research (Plus Our 5-Step Research Process)

Last updated: April 26th, 2024

Between Moz, Backlinko, and Ahrefs, there are many great resources that explain the process for doing SaaS keyword research, but we’ve noticed that the majority of them skip what we see as the first crucial step.

The first step is to talk to the people in your company who talk to customers (sales and customer success teams). When you skip this step, diving straight into the analytics and keyword research tools, you miss valuable insights that can inform the rest of your research process.

Plus, you’re leaving data on the table that’s already been validated (having come directly from the mouths of your customers).

But for this to actually work, you shouldn’t expect off the cuff conversations with sales and customer success people to do the trick. You need to have your discussions with actual CRM and help desk data in front of you. We discuss this further in Step 1 of our research process below.

In this article, we’ll cover:

- 4 Keyword Research Mistakes to Avoid

- The 5-step Keyword Research Process That We Use for Our Clients

- How to Organize Your Keywords Into Useful Groups for Implementation

We know that keyword research can feel overwhelming, so we’ve kept the explanations below as approachable as possible. No matter what your experience level is with keyword research, you will gain valuable and actionable insight into how to do it well.

Note: We do keyword research as part of our search engine optimization (SEO) and PPC services for B2B SaaS companies. To learn about how we can help you increase recurring revenue through your top marketing channels, get your Free Marketing Plan here.

4 Common Keyword Research Mistakes for B2B SaaS Companies to Avoid

In our article on SaaS SEO mistakes, we shared our view on how we think it’s useful to learn what not to do when you want to increase the impact of your SEO efforts.

While we discussed the following mistakes there, we want to reiterate the ones tied directly to keyword research so you can keep them in mind as you follow the process laid out below.

The big mistakes we often see being made in keyword research include:

1. Not Learning From Relevant Existing Data

Some SaaS companies will focus all of their keyword research on external sources like SERP statistics and competitor keywords.

But if you don’t review the existing data that you already have, you’re missing the chance to see which keywords are already getting clicks and impressions (which you can optimize for) and which are not (which you can avoid or deemphasize).

Your existing relevant data includes sources such as:

- Current customer data: Found in your CRM and help desk software

- Organic keyword data: Found through Google Search Console

- Paid search data (PPC): Found through Google Ads or Analytics

- Website internal search data: Found in the content management system (CMS) that you use for your website (eg. WordPress)

2. Not Learning From Your Competitors

There is a lot you can learn from the specific keywords that your competitors are optimizing web pages and landing pages for, targeting in their PPC campaigns, and targeting in their SEO strategy.

By not reviewing keyword data from your competitors, you’re missing the opportunity to see what’s working for them, what keywords they’re focusing on, and also which ones they are not (which could be potential opportunities for you).

3. Thinking That Keywords with High Search Volume Are Always Better

It’s easy to fall into the trap of focusing your keyword research around finding relevant terms that have a high volume of monthly searches. After all, a high volume of searches will likely lead to a higher volume of traffic, right?

The problem with this way of thinking is two-fold:

- High volume keywords typically have a higher level of keyword difficulty (meaning they’re more competitive and difficult to actually rank for).

- More traffic does not necessarily equal more revenue (which is ultimately the point of all this).

Often search terms that have a high level of buying intent (meaning the phrase indicates the searcher is looking to make a purchase), are specific and lower in search volume — but these are terms where conversion rates can be significantly higher and thus are more aligned with your bottom line goal of generating revenue.

4. Ignoring High Intent Keywords with Low Search Volume (Long-Tail Keywords)

This is a continuation of the previous mistake, when B2B SaaS companies choose not to target keywords that are hyper relevant to their business because the search volume is low.

We sometimes find that ranking for search terms with a monthly search volume of 500 can be more profitable than terms with a monthly volume of 5,000.

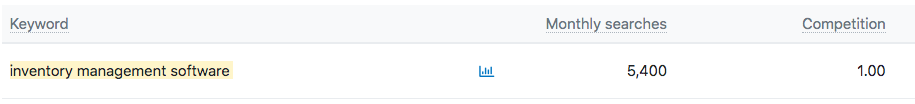

For example, let’s say you’re a B2B SaaS company that makes open source inventory management software. You might think you should prioritize targeting the keyword “inventory management software.”

But similar to SaaS positioning, you’re likely to see higher conversion rates when you’re more specific.

By placing the modifier “open source” in the target keyword phrase, instead of attracting anyone on the market for inventory management software, you can attract the people who are looking for the exact type of inventory management software you offer — making them much more likely to buy.

With the above mistakes in mind, what follows is a detailed overview of our keyword research process that’s been designed to avoid them all.

A 5 Step Keyword Research Process for B2B SaaS Companies

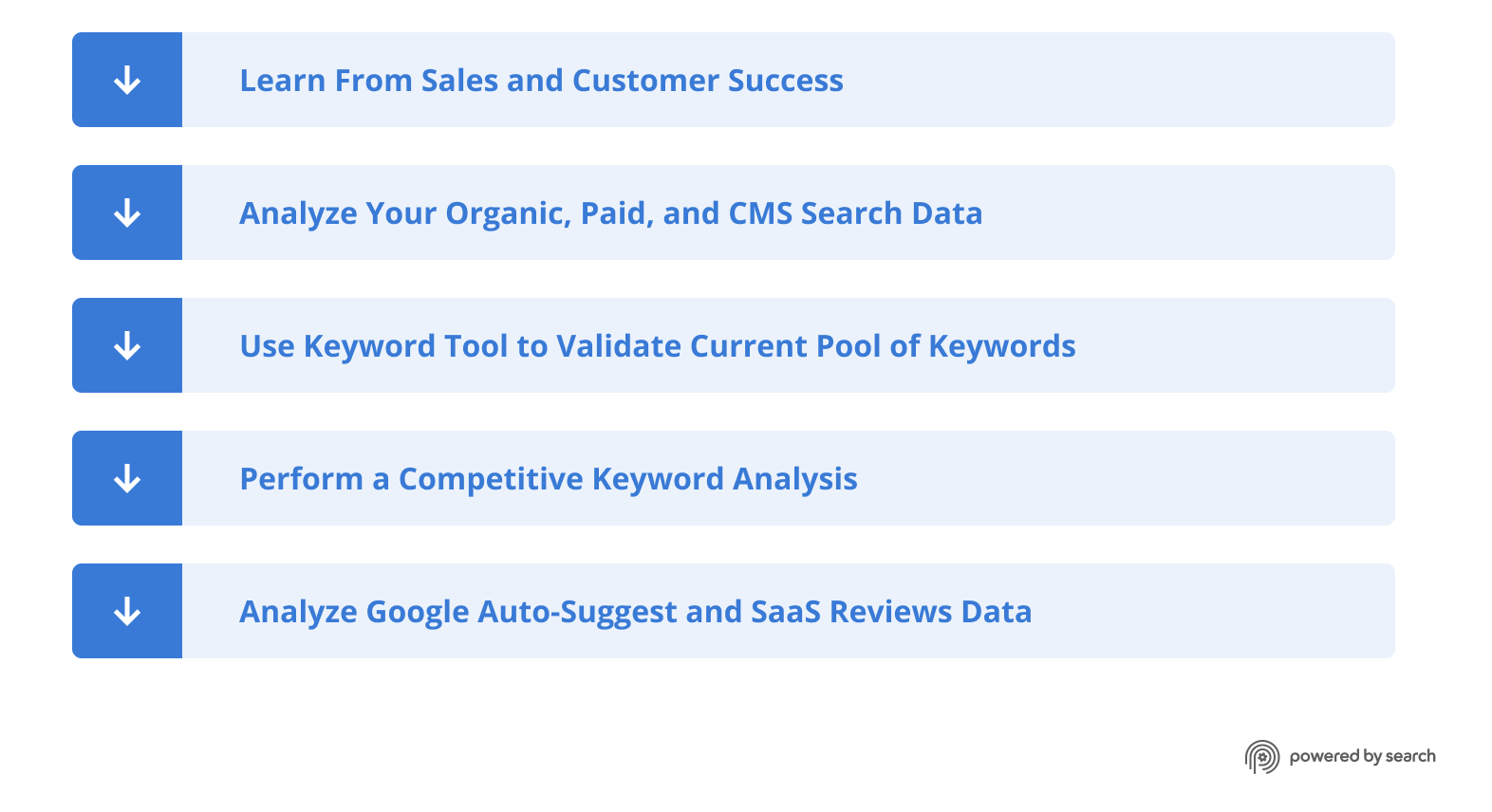

The way we approach keyword research for clients is to begin with a deep dive into their existing internal data. As we mentioned above, this is their customer, organic keyword, PPC, and CMS data.

Once we’ve dug into the key existing data sources, we’ll move into using SEO tools to determine which of the keywords we’ve collected so far are the most viable based on search volume, competition, and intent.

From there, we’ll begin our analysis of external sources of data such as competitor keywords (for both organic and PPC), Google auto-suggest data, and SaaS reviews sites.

Note: Throughout this process we’ll collect all of the keyword phrases that look promising in a spreadsheet. Workflows for how you collect and organize your keywords throughout this process vary, and we’re not going to dig too deeply into this here.

The bottom line is that you can use a simple spreadsheet with multiple sections or tabs to organize and prioritize your keywords throughout this whole process. When you’ve finished the scope of your research process, you’ll need to actually decide on which will be your primary target keywords, and how you’ll go about integrating those into your SaaS website and content marketing (more on this below).

Step 1: Learn From Sales and Customer Success (the Step That’s Often Missed)

In our article on how to identify your best customers, we laid out our process for leveraging CRM data, talking to sales and customer success teams, and conducting email surveys with customers — all with the goal of honing in on the people in your target audience who are most likely to purchase and love your product.

These same tactics can also be leveraged to gain valuable insights as you begin your keyword research. As we mentioned in the introduction, for this step to reveal actual insights, you need to have these conversations with real data in front of you.

To sum up how this is done:

- Sales Team Conversations: Sit down with a few of your sales people, pull up your CRM data, and have them walk you through real conversations that they’ve had recently, and ask them to show you the problems, pain points, and questions that customers voice on calls.

- Customer Success Team Conversations: Sit down with a few of your customer success people, pull up your help desk software, and have them walk you through individual support tickets, as well as the different tags they use to categorize common issues that come up. Again, you’re looking for the problems, pain points, and questions that customers voice on calls.

As you go, you’ll note down the specific statements and questions that stand out, overlap with each other, or come up more than once. When you go to use a keyword tool in Step 3 below, you can look these phrases up verbatim, or boil them down to a few words or variations to see the search volume and related search terms.

Step 2: Analyze Your Existing Organic, Paid, and CMS Search Data

In this step your goal is to discover what keywords have already been working for you, which ones haven’t, and what people are searching for through your website’s search bar.

We typically start with looking at organic search data.

Organic Search Data

Google Search Console is a free tool that most websites these days are connected to, and it allows you to see which keywords you’re receiving organic impressions and clicks for. This information allows you to:

- Prioritize focus on keywords that are already getting you organic traffic

- Further optimize content for keywords that are receiving impressions (in an effort to begin seeing actual traffic)

- Discover relevant keywords you may not have realized were valuable to you

Paid Search Data

Platforms like Google Ads are where you can find your paid search data. Since both SEO and paid search ads require target keywords, your PPC data is just as relevant as your organic keyword data.

Here you’ll want to dig in and see which keywords are actually driving business for you and which ones are not. You should seek to answer:

- Which keywords have converted into revenue?

- Which keywords have performed poorly?

- Which keywords are potential opportunities?

Note: You can use Google’s Search Terms Report to see which keywords your ads show up for and find new ideas for keywords to target or avoid.

CMS Search Data

If your website has a search bar, that data is unique to you and you’re the only one with access to it. The keywords typed into your internal search can tell you a lot about what prospects are searching for when they’re already engaged on your site.

If certain queries come up repeatedly, those phrases are worth adding to your list to investigate further in Step 3. If you don’t have content that speaks to the search phrases that come up more than once, it’s an opportunity to create it.

Step 3: Use a Keyword Tool to Validate Current Pool of Keywords

This is the stage when you take the list of keywords you’ve developed in the first two steps, and put them into a keyword research tool like SEMrush or Ahrefs. For all of the phrases you’ve listed so far, you want to look up their monthly search volume and keyword difficulty (or competition) and add those to your spreadsheet.

We like to look for long-tail keyword opportunities like the one described in the mistakes section above, and keywords that show high intent — phrases that reveal the searcher is aware they have a problem and they’re actively looking to solve it.

With this data you can see which terms might make sense to prioritize, and you can begin highlighting these in your list. You might also begin excluding keywords that you determine are not going to be a good fit, separating them or removing them all together.

Once you’ve combed through all of your relevant existing keyword data and used a keyword tool to separate out the potentially good opportunities from the poor ones, it’s time to begin looking outward to external data sources.

Step 4: Perform a Competitive Keyword Analysis

With tools like Ahrefs and SEMrush, performing a competitive analysis to discover keyword opportunities has never been easier. They might seem intimidating at first, but they’re surprisingly easy to use and they have great tutorials.

With Ahrefs for example, just click the “How to use?” icon for any of their features, and a simple-to-follow tutorial pops up to guide you.

In your competitor research, you should look up both organic and PPC keyword data for individual competitor websites, as well as cross reference sites against each other (and your own) to find overlap and “content gaps.” Content gaps are keywords that your competitors are ranking for or bidding on that you are not (or vice versa).

Through this process you will continue adding your newly discovered keyword opportunities to your spreadsheet, and then head to Step 5.

Step 5: Analyze Google Auto-Suggest and SaaS Reviews Data

This step is for expanding your pool to discover new keywords that haven’t shown up in the previous steps of your research process. The two main sources we look to for our B2B SaaS clients are Google auto-suggest and user reviews on popular SaaS review sites.

Mine Google Auto-Suggest Data

Google auto-suggest (pictured above) pulls in low volume terms that are often longer-tail questions and queries that you may not otherwise have thought of or discovered yet. And because Google presents them as suggestions to you, you know people are searching them.

So to mine auto-suggest, you can take keywords that you’ve already identified as promising, type them into Google, and see what Google suggests as you type. When you see phrases that might be relevant, you can plug them into your SEO tool and follow the same process we went through in Step 3.

Comb Through User Reviews on G2, Capterra, and GetApp

The benefit of combing through review sites is it gives you the opportunity to see how people are describing their problems in plain english. It’s worth looking at both your own reviews and the reviews of your competitors.

The process involves looking at the review titles and content, and looking for overlap or anything that stands out as being related to customer pain points and use cases. Then you can plug variations of those statements and questions into your keyword tool to gauge their viability as target keywords.

Note: We sometimes also repeat this process on Quora as well.

Next Up: Organize Your Keywords Into Useful Groups for Implementation

To make the most use of the list of keywords you’ve developed through your research, it’s useful to begin separating them into groups that can give you an understanding of which opportunities you have at the various stages of your funnel.

For example, if you have 100 keywords listed, maybe only 20 of them will be bottom of the funnel keywords (showing relatively high consideration or purchase intent). As we covered in our article on B2B SaaS content strategy, these are the keywords you want to focus on first because they’re the ones that are tied to actual revenue.

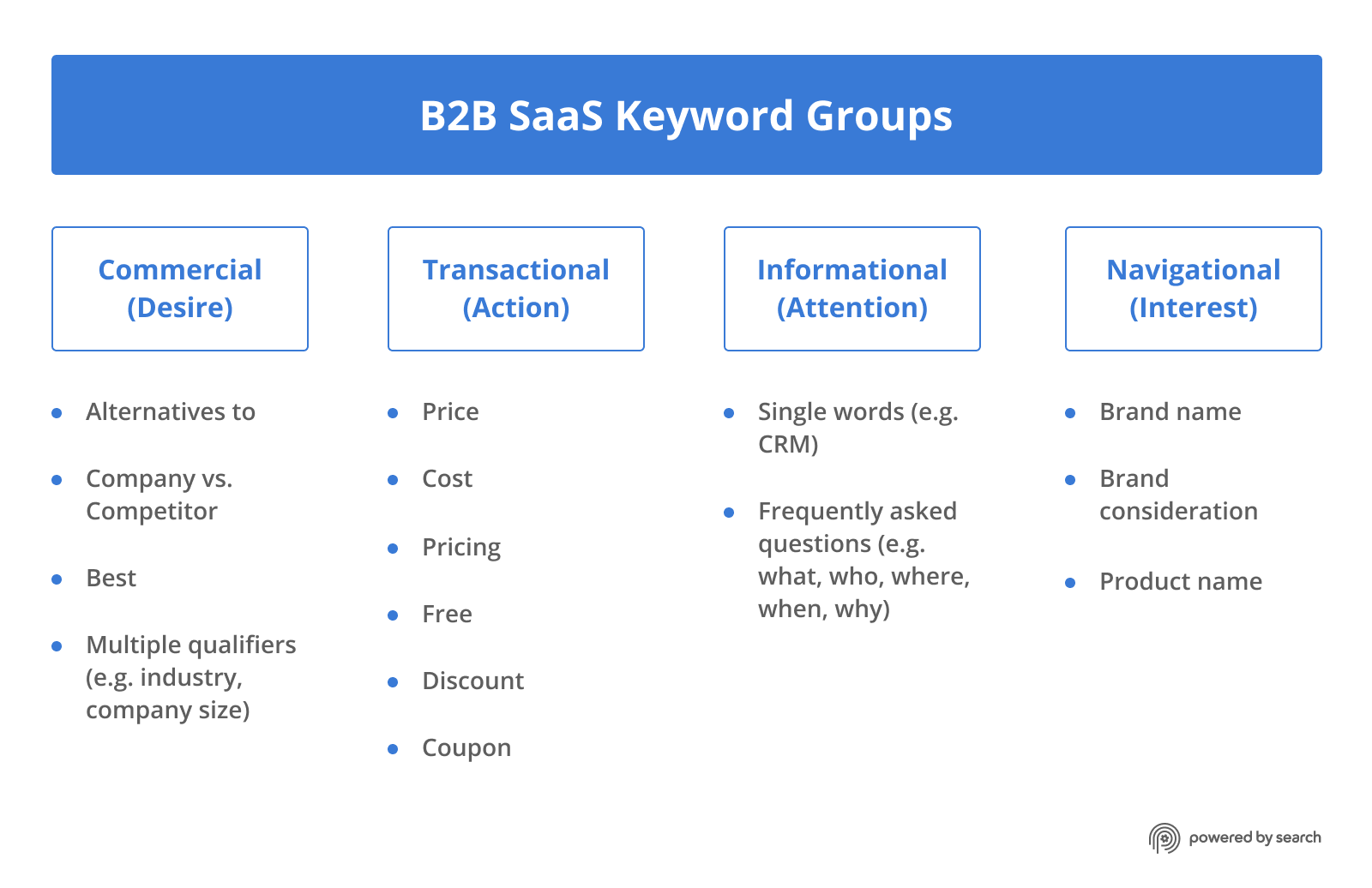

Here are some of the categories we often use to group keywords:

For these categories, commercial and transactional phrasing represents more bottom of the funnel keywords, whereas informational and navigational phrasing represents more middle or top of the funnel keywords.

This is one way to go about grouping your keywords, but it’s not the only way. Depending on your goals, you might also group keywords based on where you want to optimize for them on your website, or the types of content you want to create.

Conclusion

If there is one thing that we can emphasize, performing keyword research is absolutely essential to succeeding at digital marketing. And even though the process can seem daunting, going through it (however imperfectly) is an insightful and useful exercise for your business.

By leveraging the internal data you already have, using keyword tools to validate opportunities and find new ones, and then prioritizing and grouping your results, you can develop at the very least a rough keyword strategy to guide your SEO and PPC efforts.

If you’re in a position where you’re ready to invest in professional help, we do keyword research as part of our search engine optimization (SEO) and PPC services for B2B SaaS companies. Get your Free Marketing Plan to learn more.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.