SaaS Research: ‘Talk to customers’ is good advice but it’s not enough

Last updated: October 3rd, 2023

SaaS research is one of the most neglected opportunities for marketers. Most SaaS companies can appreciate that understanding their customers helps them provide a better product and service.

But actually doing the work to understand customers can often be challenging for SaaS marketers which leads to marketing output that lacks the punch that using customer insights can bring.

And it’s not only in organizations where there is no effective system for research that the impact of understanding customers is missed.

Even in companies where there’s a relatively good system for running customer interviews, many SaaS companies miss out on a truly rounded research process because they focus entirely on interviews as the form of research.

The advice ‘talk to customers’ is good – but companies should focus on building a framework for understanding their customer that goes beyond simple interviewing and includes both qualitative and quantitative inputs from across their business.

In this article, we’ll look at:

- Why many SaaS companies are leaving money on the table by missing out on high quality signals

- How to avoid these common pitfalls to build a truly great customer research framework

- How to use those customer insights to improve SaaS marketing

By the end of this article, you should have the fundamentals to start building a framework for customer

If you want help understanding your customers and building the insights into your marketing, you should book a SaaS Scale Session. Let’s get you pain point messaging that converts traffic into revenue.

Why many SaaS companies are leaving money on the table by missing out on high quality signals

It’s extremely common to see someone on LinkedIn or Twitter tell marketers that they should ‘talk to customers’ or that ‘your customers are your best marketers’.

Both of these are noble ideas but the reality is: many organizations already feel that they are talking to their customers.

There are three main approaches that we’ve seen B2B SaaS companies who have already passed $5-10M ARR take to customer research.

The first one is that they don’t do anything at all or take an ad hoc approach akin to doing nothing at all. As unbelievable as it may be, it’s extremely common for large companies to have no structure whatsoever in place for talking to their customers and surfacing those insights for the rest of the organization to use.

Organizations where this is the norm may find that the only understanding they have of customers is in the conversations that sales reps had with them prior to them signing up to using the product or from support/customer success conversations.

The challenge is that even if those are incredible insights they’re only in the heads of sales or CS reps who have high turnover rates. Customer insight is literally bleeding out of the company when those reps get new jobs.

It’s not uncommon to see organizations like this hit a real scaling challenge as their product and marketing teams struggle to connect customer pain to product functionality in any meaningful way.

The second approach to customer research is to hire a market research agency to ‘take care of it for them.’

We typically see this in larger SaaS companies or companies that have recently been acquired by private equity firms. Part of the reason, I suspect, is that market research firms are incredibly expensive.

When companies hire research firms to do this kind of work, they’re almost certainly getting a dense, static deliverable in return.

In the past, we have worked with companies who hired a market research firm to compile a customer research report. On one occasion, the firm delivered a 120 page report and a 90 minute video presentation – both incredibly well designed and beautiful – only for the client to ask at the end of the call: “What should we do with this?”

The silence was deafening but the question was really good and indicative of the challenges around hiring a market research firm to do customer development work.

Consultants often bring a scientifically rigorous methodology but aren’t able to help the marketing team to meaningfully apply the conclusions of their research.

The result is that the, albeit impressive, research is a one-off, static document that ends up on a Google Drive and never shows up in marketing conversations.

The third approach many SaaS companies take is to dedicate someone in the team to ‘take care of’ customer development. Of all three approaches we’ve discussed so far this is by far the most common.

In these organizations, a team member will be tasked with or take on under their own initiative, the customer research work.

They’ll go off and run a bunch of customer interviews, maybe build some audience personas but unfortunately, they’ll never manage to get the research into the hands of the people who actually need it.

From time to time, the CMO or VP Marketing will ‘wheel them out’ and ask them for an insight from their customer research. I have occasionally encountered a senior marketing executive who has to defer to a junior team member for the answer to any question involving customers.

This is absolutely wild and a totally dysfunctional way to think about developing marketing that speaks to customer pains.

Similar to the approach where the research is ad hoc and lives in the heads of sales or CS reps, companies who appoint or acquire a ‘research champion’ suffer because their customer research also lives in the head of this one team member who takes it all with them when they inevitably get another marketing job.

How to avoid these common customer research pitfalls

As you’ll have noticed from the previous section, the advice to ‘talk to customers’ is all well and good. It’s a message that we support deeply.

But what most people mean by that is simply: have someone talk to the customers and see what we could be doing better or differently.

When organizations stop at that depth, they will miss huge amounts of nuance from their work:

- What are your customers actually doing with your product?

- How do they perceive you?

- What are the customers of other products saying about you?

- How does what they say to you in an interview compare to their use of a product?

- What are the issues that they have that are sitting in customer support tickets?

These are just a sample of the questions that teams with an ineffective customer research framework won’t be able to answer easily.

‘Understanding your customer’ is significantly less linear than most marketers make it out to be.

In this section, we’ll look at how you can build a system that gets a rounded view of your customers and factors in their qualitative and quantitative actions.

In every business, there are potentially dozens of different sources of customer data and insight.

So before doing anything else, it’s important to get a picture of where these insights might come from.

Let’s look at some of the most common sources of customer insight broken down into two categories:

- What your customers say

- What your customers do

Both of these categories is useful in its own right and it’s only when you combine both of these that you get a true understanding of your customers.

Most SaaS marketers neglect to look at user activity and end up with a shallow understanding of customers/prospects.

How to learn what your customers say

All of the following are qualitative sources of customer insight. Some are active (you have to speak to them directly) and others are passive (you can collect data from existing sources).

Each one of them contributes to building a rich customer research framework.

Customer interviews

The most obvious source of customer insight is in customer interviews.

Many people like jobs-to-be-done (JTBD) style interviews which are about identifying what problems your best customers are ‘hiring’ your product to solve.

At Powered by Search we use this framework when working with client’s customers.

But if you have never run a customer interview before, it’s enough to start with a very simple set of questions.

The important thing is that you use these interviews to try to understand what pains a user of your product is trying to solve and how they talk about those problems.

Here’s some prompts that I use when I talk to customers:

Opening questions

- Tell me a little bit about what you do day to day

- What are you working on right now?

- What does a [JOB TITLE] do? Like… how do you get measured?

Discovering Pain

- Sounds like you’ve got a lot on your plate. What’s the most challenging part of your work?

- I never thought about it like that. What’s the impact of that?

- You mentioned you’re struggling with [problem they mentioned] How common is that problem?

- Let’s say you gathered together with a bunch of people who do the same job as you. What’s the joke you make about your problems that everyone instinctively gets?

- What are your working towards right now? [Wait for answer] What’s stopping you?

Agitation

- Oh. So interesting. Can you say more about that?

- What happens if you don’t solve that?

- Wow. That must be really challenging. How do you deal with that?

- You must have a lot of stories about how this impacts your day-to-day. What’s the one that sticks out?

- Wait a minute. People actually do that/think that? Why?

- Let’s say you could move past this problem you’re having, how would you want to do that?

- You’ve mentioned [problem they mentioned repeatedly] a few times now. Seems like it’s a big problem. Why?

Solution

- So what have you tried so far?

- When you tried [Specific solution], what happened?

- What was happening the day you decided to solve your problem around [Pain Point]?

- You said [Pain Point] was an issue. Why did you think that [Specific solution] might be the way to solve it?

- What were the main lessons for you when you tried to solve [Pain point] with [Specific solution]?

- What would it look like for you, practically speaking, if you could overcome this obstacle?

Go deeper phrases

- Tell me a story about that

- Say more about that

- Why is that a problem for you/the business?

- Why is that such a good thing for the business?

We have a brilliant session with Gia Laudi of Forget the Funnel talking about how to use JTBD style interviews in your marketing.

Customer interviews work best when they are made a part of a regular cadence of customer engagement.

They work worst when they are left down to an individual or team to run on a one-off basis.

Email responses

Your customer base likely emails you dozens or hundreds of times a week (depending on your business model).

For example, we realized that a lot of our ICP read our blog regularly and set up an email that would be sent when someone checks out several SaaS blog posts in short succession.

The email asks: what should we write about next?

Prospects know this is automated but the response rate is still really high

There is gold in these emails.

We have discovered objections to hiring an agency, services that our clients want developed, problems they’re having with their marketing.

All from looking at the responses to this email.

This is just one instance of harvesting customer insight from emails. Your SaaS probably has nurture sequences, win-back sequences and one-off campaign emails that are languishing in Intercom or your ESP of choice.

The responses to those emails or messages can unlock heaps of value for your marketing with very little extra work.

Support requests

The next common place that customer insights go unnoticed is support requests.

Similar to the last section on emails, there’s all sorts of insight sitting in the customer success team’s shared inbox.

For example:

- What is your customer struggling to do that they want to do with your product?

- How clear is your pricing to your customers?

- What are the first problems that customers have? – this can impact activation rates and consequently downstream revenue rates

Those are just three easy to answer questions. But if you think about your support inbox as only interesting to the success teams, then you’re missing out.

One example of this in action: I previously worked on a tool that we thought of internally as a live voting tool for events. Because of that, we didn’t have any functionality to add open text questions. We thought this kind of question might slow down the experience for our users’ end users.

Our customers kept asking questions about how to create open text questions.

As this kept happening, we discovered that for our customers we were positioned alongside SurveyMonkey but with more expensive pricing and fewer features.

Ultimately, we made the choice to lean into that and add the functionality they wanted but we used their feedback to inform the messaging around our positioning to develop a differentiated position in a competitive market.

Sales tapes

My absolute favorite addition to qualitative customer interviews is reviewing sales tapes from Gong or Grain.

Although there’s a common trope that sales and marketing don’t get on, effective sales teams are incredible at uncovering customer needs and pain points.

Now that it’s normal to record sales calls that happen over Zoom, the marketing team can get a steady stream of customer insights directly from the horses mouth.

But in addition to this, when the sales team adds in win/loss insights, marketing teams can filter by prospects who went with competitors. That means you can build incredibly effective competitor comparison pages.

A good way to make this activity part of your natural research workflow is to line up a series of recordings, watch them right through and dump the best things prospects say in these calls into a Google Doc.

An anonymised screenshot of one of our recent sales calls

The goal of this is to get all of the following out of the calls in language as close to the prospect’s as possible:

- interesting sentences

- phrasing

- questions

- ideas

- general feedback

You can move this stuff into a more structured customer research collector document at a different time.

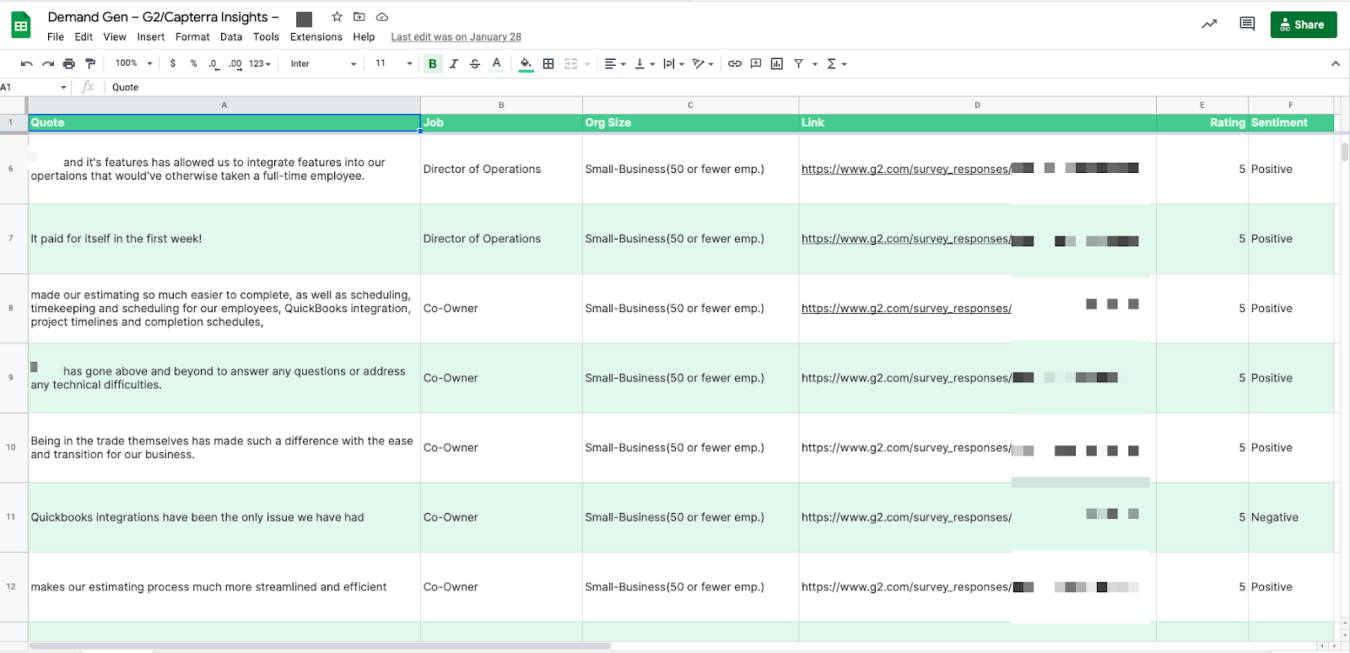

Customer reviews

Customer reviews on sites like G2 and Capterra are a different version of the sales tapes.

Most SaaS products that achieve any kind of scale will eventually get G2 and Capterra reviews from both happy and unhappy customers.

Each one of these reviews is helpful in its own way:

Good reviews from happy customers can be harvested for customer voice.

Bad reviews give insights into how poor fit customers think – they’ll also often share which competitor they chose in the end.

We use a sheet like the one pictured below to run this process:

Example of spreadsheet showing how we mine customer reviews for clients

We add fields for:

- Quote – a new row for each individual insight to make it easy to reference

- Job Title – to understand whether we’re hitting the right notes for our target audience

- Org Size – to understand whether we’re serving the right kinds of company

- Link – in case we want to go back and screenshot these to use on landing pages

- Rating – to make it easy to sort

- Sentiment – to give us a general idea of how people feel overall

Reviews of competitors

An opportunity that marketers often miss when conducting customer research is assigning a little time into trying to understand how customers of other products in the market feel about their product choice.

Why is this helpful? After all: don’t we want to know how our customers feel?

You absolutely do.

But understanding the difference between what your customers are saying about you and what the customers of other companies are saying about their products is meaningful for clarifying your differentiation.

In our SaaS Positioning Canvas we spend a good amount of time talking about the promises that competitors make because it gives us a baseline understanding of how the market as a whole positions itself.

If you’re playing in a competitive marketplace – and almost every SaaS product is these days – then it’s super important to understand general market perception so that you can better differentiate.

How to learn what your customers do

Now that we’ve covered off the qualitative aspects of customer research, let’s look at some more quantitative sources that you should be including in your customer research framework.

When we talk about quantitative research: we’re not necessarily talking about cold, hard numbers. We also think about user activity and product usage.

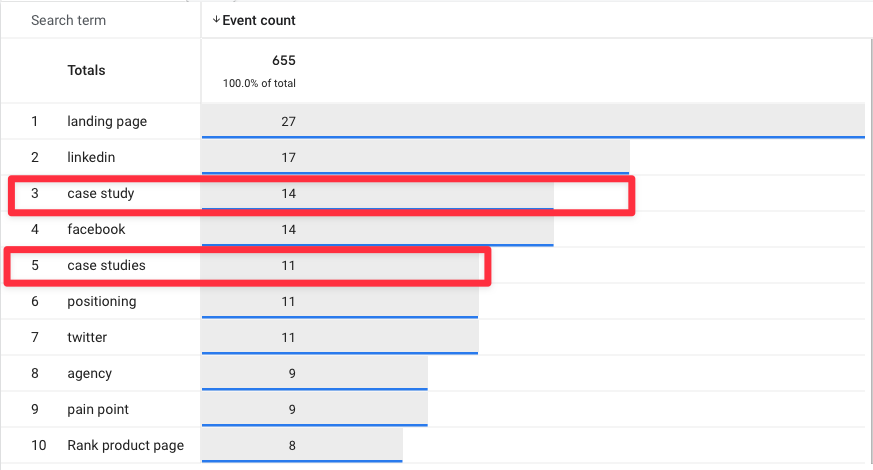

Site search queries

An underappreciated source of customer insight is the site search functionality that many SaaS marketing sites have.

For example, if you’re using WordPress you’ll often have a search input set up on your theme somewhere and, in my experience, you may have forgotten that it’s there at all.

But many people don’t know that if you’re using Google Analytics you can see what your site visitors are searching.

In Universal Analytics, it required a custom setup. But in GA4, site_search is a default event and you can see the queries that your visitors are typing in by creating a report in the Explore section.

In the example above from our own analytics, I can see that the majority of the site searches have come from terms related to case studies.

What will I do with this information?

I’ll make it easier to discover case studies on our site and work on building more of them. It’s clear that people think that’s an important thing to find on a site like ours.

Website usage data

Besides direct customer interviews, I have found that watching user sessions on Hotjar or FullStory is the highest leverage customer research activity for SaaS marketers.

If you’re able to install the Hotjar snippet on both your marketing site and your product, you’ll also be able to watch what users are doing across properties.

This can be incredible.

For example: I once worked on a product where there was incredible engagement but terrible conversion to paid.

In order to solve the problem, I watched sessions for accounts with good engagement and saw that in most cases users didn’t understand that they needed to upgrade their accounts to unlock more information/features.

Once I understood this, I was able to respond by updating messaging around pricing on the website, making the pricing tiers clearer on the /pricing page and also having the product team add in app messaging to make it more obvious how and why to upgrade.

The result was a drastically increased conversion from visitor to paid. It had huge business impact.

If I was only thinking about qualitative insights from customer interviews, it’s unlikely I would have discovered that.

Product usage data

Similar to website usage data from sources like Hotjar or Fullstory, you can also use a tool like Amplitude or Heap to understand what users are actually doing with a product.

Unfortunately, many SaaS companies don’t use products like this.

Product analytics tools like these can give you real insight into customer pains by showing you which features they’re using, how they’re using them, where the friction in using the product is and more.

Taking those insights and revisiting your landing page copy, content plan or even ad creative can boost acquisition, activation, revenue and even retention.

Organizing your research

One of the main reasons that customer research is so poor in SaaS companies is that there’s often no coherent way to store and manage the insights.

To solve this problem, we recommend the following:

- Create a folder called ‘Customer Research’

- Within that folder, create individual folders for all of the sources that we’ve already mentioned

- Everytime you refresh your research, put any relevant screenshots, documents, recordings etc into the relevant folder

- Create a spreadsheet to catalog all of the files you’re referencing

- Summarize each insight as a separate row in this spreadsheet adding metadata for: Link to source document in your folder, customer contact info, timestamps etc.

As well as the above, you may find that it’s really helpful to include some kind of tagging convention to make the research more searchable.

Adding in a column for ‘type’ and including options like the following can be extremely prudent as you scale the system:

- Voice of customer

- Pain point

- Competitor

- Product team

How to use those customer insights to improve SaaS marketing

If you keep contributing to your customer research database in small, but consistent updates, you’re going to quickly build a formidable amount of information about your customers.

This is already a competitive advantage as 99% of your competitors won’t have anywhere close to as clear an understanding of their customers as you do.

But if a customer speaks in a forest and no-one’s around to hear them, do they even make a sound?

What I mean is: you need to take what your customers have told you and apply those insights to your marketing.

There are three ways you can do that immediately and these will work for almost any SaaS business.

Firstly, take the insights and update your overall positioning and messaging.

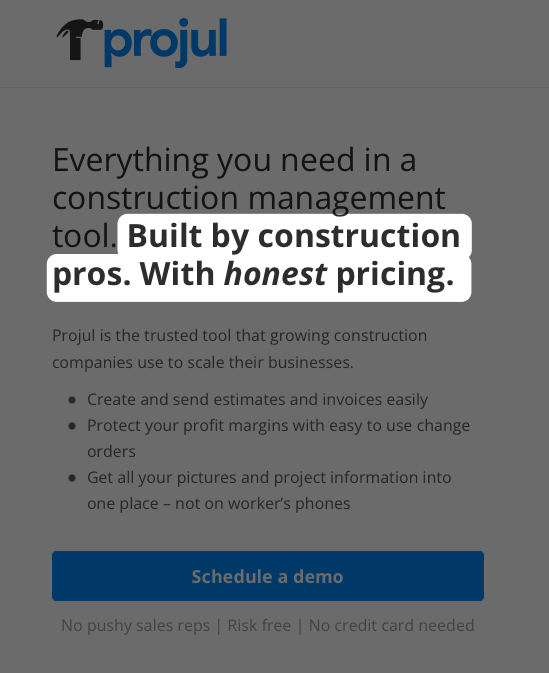

While working with our client Projul, we discovered that their customers wanted a tool that did everything, sure. But what they really cared about was that the tool they were using to run their business was built by people like them who wouldn’t hide costs or make any kneejerk pricing changes.

Here’s how we updated their messaging based on that:

Another way that you can use these insights right away is to create content that helps respond to common objections your prospects have.

Our whole content strategy is based on this play: we listen to what prospects are asking and when people are asking regularly enough we run a masterclass or write an article on the topic.

These articles can be sent directly to prospects in future. But they’re also discoverable through search and our social distribution work.

Finally, marketing and product are usually closely intertwined in SaaS businesses.

It makes sense that product and marketing both contribute insights from customers. But even if that’s not possible, marketing’s performance will improved by sharing customer feedback with the product team.

They can take these insights and improve UI in the product, prioritize the right features and generally improve user experience.

All of this leads to better ‘full-funnel’ performance and makes marketing ROI go up.

In Closing

SaaS marketing teams know that customer research is important. But it’s rare to find a team who are running customer research effectively.

As well as under resourcing it, SaaS companies often take a myopic view of customer research and only do customer interviews in an ad hoc way.

But by building a regular cadence of contributing to a customer research database that takes into account qualitative and quantitative insights, SaaS marketers will drastically improve their chances of finding valuable insights that can help them convert more customers.

If you want help understanding your customers and building the insights into your marketing, reach out to get your free marketing plan. Let’s get you pain point messaging that converts traffic into revenue.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.