Why we use the four I method of reporting on marketing

Last updated: October 3rd, 2023

Marketing can be one of the biggest expenses for a B2B SaaS, and if you don’t measure it correctly, you could be pouring that budget down the drain. Good reporting on marketing is the key to making the best decisions for your business, and it’s near impossible to create an effective strategy without it.

There are a number of approaches SaaS companies take when measuring their marketing, but many are flawed, and focus too much on vanity metrics that aren’t actually providing any value.

At Powered by Search, we’ve developed a way to accurately and efficiently measure marketing in a way that gets a better ROI from your budget.

In this article, we will cover:

- Why it’s important to measure your marketing

- The common pitfalls of measuring marketing

- How to measure your marketing using the four “I”s

By the end of the article, you’ll have a strong idea of how to frame your marketing reporting that makes sense strategically and helps communicate value to stakeholders effectively

Struggling to measure the effectiveness of your marketing? Schedule a Free SaaS Scale Session for more guidance on how you can monitor your progress and report to stakeholders

Marketing isn’t cheap

On average, SaaS companies spend 10% of their annual recurring revenue on marketing, according to SaaS Capital’s 2023 B2B SaaS survey. This can equate to a massive amount of money, depending on the size of the organization, with marketing budgets in the millions for larger SaaS companies.

This is why it’s so important that your reporting is focusing on the right things, to ensure you’re not wasting your money in areas that aren’t effective.

You need to make sure that you’re getting the best return on investment possible, both from your marketing and your reporting.

Otherwise, you won’t have the data available to optimize your existing strategies, or scale your spending effectively.

A spectrum of measurement approaches

From working with various SaaS companies, and seeing how others in the industry approach their marketing reporting, most seem to fit into one of the following three areas on a reporting spectrum:

- Report on everything

- Siloed reporting

- Minimal (or no) reporting

1. Report on everything

On one end of the spectrum are the companies that hoard as much data as they can get their hands on. Their finances are plugged into their sales and marketing, and they’re able to analyze the data on a very granular level.

This has some benefits, like being able to track and measure the full journey from lead to customer, but it also comes with some big downsides.

The primary issue is that this approach nearly always results in information overload, and it becomes increasingly difficult to identify the valuable data among the mass of information.

This makes it difficult to identify where improvements could potentially be made, and it increases the likelihood of missing vital information that could make a huge difference.

2. Siloed

The middle of the spectrum is where a company might be good at monitoring sales, and solid at reporting on their marketing, but there’s no ability to correlate the two sets of data.

This is often the result of the two teams not working together to connect the dots across the whole sales life cycle.

It’s easy for this to happen without causing concern, as both sets of data might look healthy, but the issue is that it’s impossible to identify patterns, or measure any sort of cause and effect.

This is an inefficient approach to measuring your marketing, and removes the ability to really get a clear picture of how your marketing is performing.

3. Minimal (or no) reporting

At the other end of the spectrum we have the SaaS companies that simply don’t track enough data. They might know the high-level numbers around revenue and profit, but not much else.

This means you can’t measure how marketing is contributing to those numbers, and you’re unable to identify areas to improve or scale.

With this approach, your marketing strategy becomes guesswork, and you’re more than likely wasting money on marketing that’s not performing as well as it could.

Why we focus on the key growth drivers for SaaS businesses

To avoid falling into any of the above categories, we are very careful to only focus on driving the right business outcomes. This means staying away from vanity metrics, and avoiding getting overwhelmed trying to report on everything.

Instead, we focus on three key business drivers that we can build our strategies around:

MRR (monthly recurring revenue) growth

B2B SaaS leadership teams will often already be tracking MMR as a KPI or bottom-line metric, but it’s not enough to simply track your current MRR. By tracking the growth, you get a clear picture of how effective your marketing is.

If you have a target MRR, the growth will tell you whether you’re on the right track, and you can even work backwards from your target to find a marketing budget that will get you there.

LTV (Lifetime Value) growth

LTV is a great metric to focus on, as it tells you roughly how much customers are worth to you over their time using your product.

By measuring the growth of your LTV, you are able to see whether customers are becoming more or less profitable in the long-run. If you find your MRR is going up, but your LTV is going down, it’s probably a sign that you’re attracting customers that churn too early as they’re not a good fit.

If you want to know when to use LTV and when to focus on payback periods, you should check out this article.

CAC (Customer Acquisition Cost) reduction

The CAC is the total sales and marketing spend in a period, divided by the number of new customers in the same period. This will give you a figure that represents how much it currently costs you to acquire one new customer.

The reason it’s important to track this, in particular its reduction, is because the lower this number is, the better value you’re getting from your marketing. This figure tends to go up and down, but you want to make sure the trend is reducing, not increasing.

You can read more about these three metrics in this blog post and use the calculator in the post to work out your marketing budget

As well as focusing on these three key business outcomes, it’s also important to ensure we are measuring and attributing performance accurately. One way we do this is by using a CRM like HubSpot or Salesforce, which make it really easy to measure how performance is being attributed to each channel.

They also allow us to see how far each lead gets in the sales process, and measure the quality of each lead. This data is very focused, and gives us insights that we can immediately take action on.

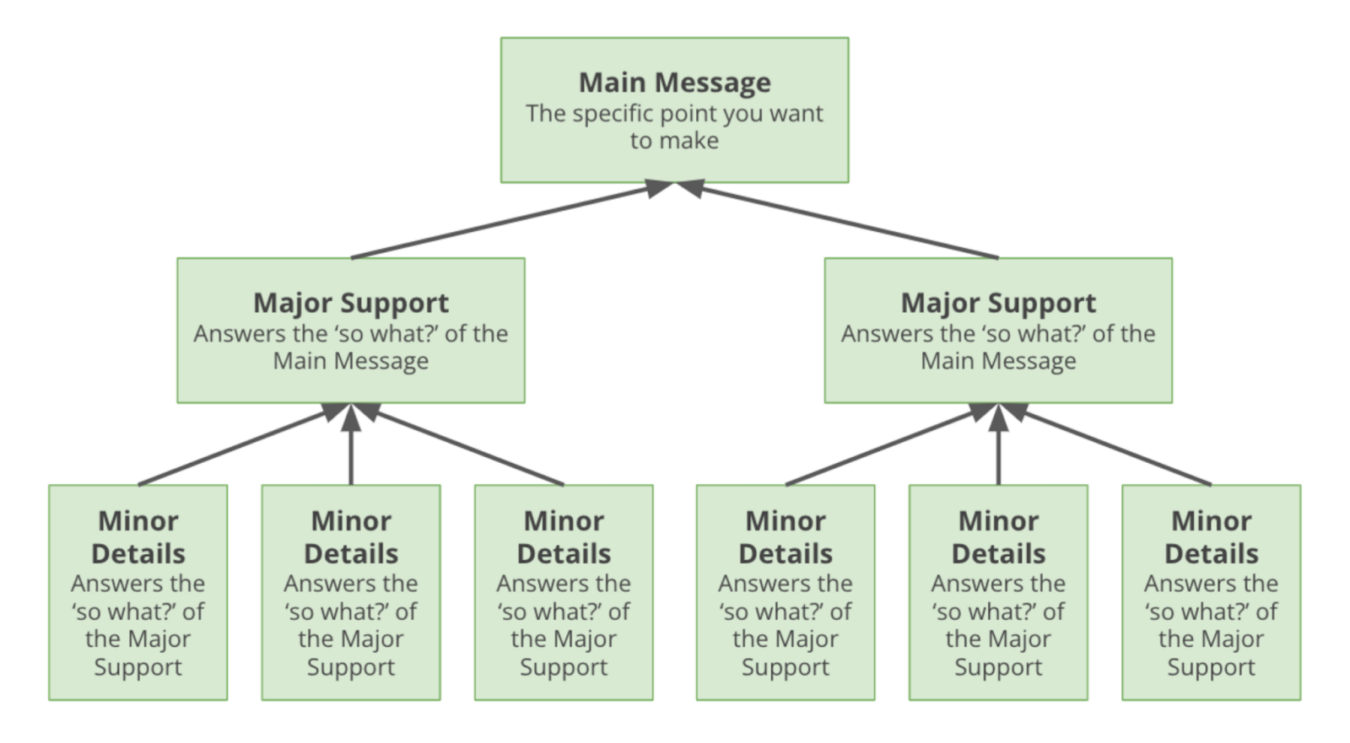

Performance reporting hierarchy

Now you have the data you need, it’s important to then report the right information to different stakeholders.

This will vary company to company, but it’s unlikely that everyone will be interested in all of the data, so we break the information down into three levels when reporting on performance.

Main Message

This is the specific point you want to make, and it’s targeted at executives like the CEO, CMO, or VP of Marketing. It will summarize the points made in the major supports (below), but in a concise and easy to consume way.

Example: “Our PPC efforts last month added $50k in MRR year-over-year.”

Major Support

This information is designed to answer the ‘so what?’ of the Main Message, and will be targeted at the management level, such as Marketing Director or Marketing Manager. It will summarize the minor details (below), while emphasizing the overall marketing impact & KPIs.

Example: “We increased SQLs (demo sign-ups) from Google Ads 10% year-over-year by refreshing ad copy & landing page messaging.”

Minor Detail

Similar to the level above, the minor detail is there to answer the ‘so what?’ of the Major Support statement, and is primarily aimed at the individual contributors such as a Marketing Strategist, or Specialist. It should go into more detail with channel KPIs, supporting data, and technical details.

Example: “This was accomplished by replacing feature-based messaging with pain-point messaging in ad copy & on the landing page.”

It can be useful to create bespoke reporting dashboards for the different key stakeholders, so they can easily dip in to see the information they’re interested in. We use Databox for this.

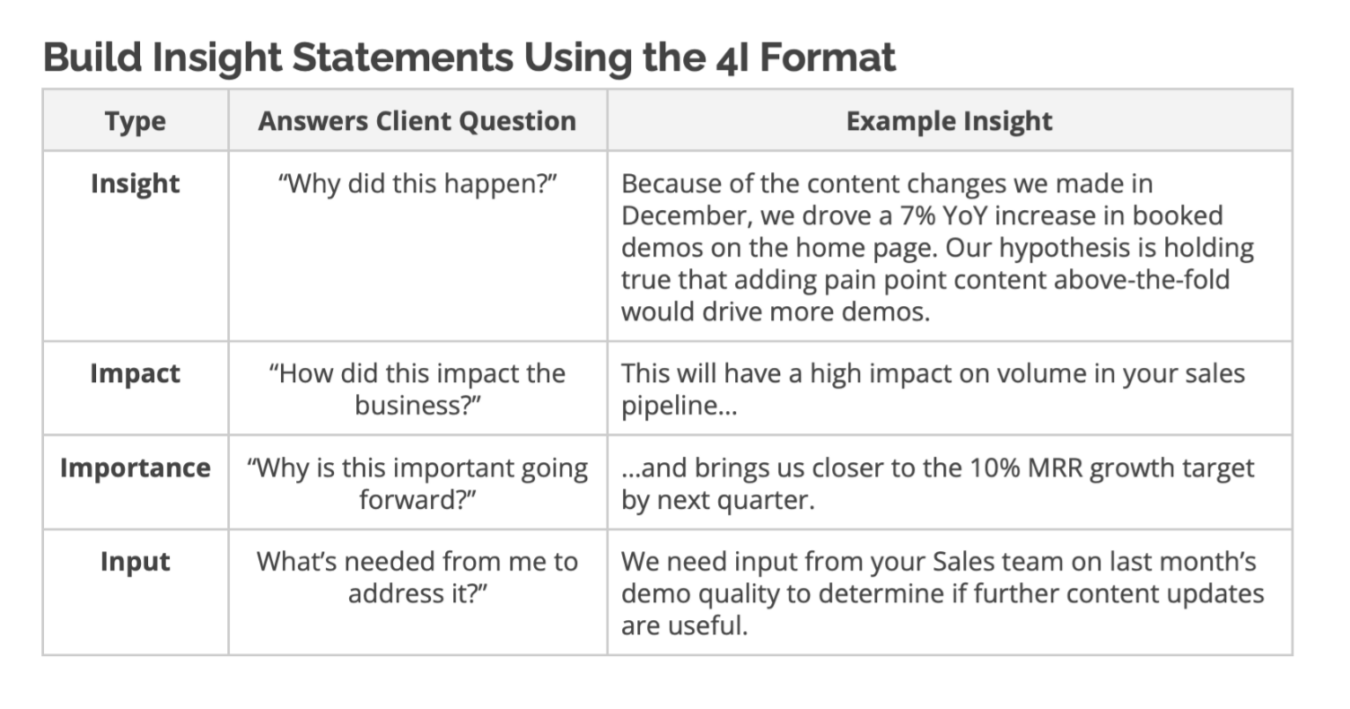

Telling the story behind the data with the four “I”s

Although it is important to report on data points, metrics, and KPIs, especially in a way that’s relevant to the particular stakeholder, it’s not enough to just show numbers. It’s important to also provide context around the numbers you’re reporting on.

This is where the four “I”s come in:

- Insight

- Impact

- Importance

- Input

What we’ve tried to do with this approach is effectively answering key questions from stakeholders before they’ve even been asked. This creates context around the numbers, and building an ‘insight summary.’

An insight summary is essentially a paragraph that explains why the stakeholder should care about the data they’re being presented with. You can create an insight summary by combining the answers to the 4 “I”s.

Insight

The insight is designed to answer the question “Why did this happen?”. In essence, it’s an explanation of what you’ve done to cause the change, and what other factors might have led to the data improving or getting worse.

Example: “Because of the content changes we made in December, we drove a 7% YoY increase in booked demos on the home page. Our hypothesis is holding true that adding pain point content above-the-fold would drive more demos.”

Impact

The next question you want to answer is “How did this impact the business?” To answer this, explain the real-world effects the change has had, and why each stakeholder should care.

Example: “This will have a high impact on volume in your sales pipeline…”

Importance

The next step is to answer “Why is this important, going forward?” Basically, how does it fit within the bigger picture, and what impact does it have on the overall goal or strategy?

Example: “…and brings us closer to the 10% MRR growth target by next quarter.”

Input

Finally, we try to answer “What’s needed from me to address it?” As the marketer, this is directly stating what we need from the client or stakeholder to continue to make these improvements. This might be dependencies, access to data, feedback, etc.

Example: “We need input from your Sales team on the quality of last month’s demos to determine if further content updates are useful.”

Once you have all of these questions answered, you have a solid insight summary that contains meaningful information for the stakeholders:

“Because of the content changes we made in December, we drove a 7% YoY increase in booked demos on the home page. Our hypothesis is holding true that adding pain point content above-the-fold would drive more demos.

This will have a high impact on volume in your sales pipeline and brings us closer to the 10% MRR growth target by next quarter. We need input from your Sales team on the quality of last month’s demos to determine if further content updates are useful.”

Not only do these questions help you to build your insight summary, but it also helps you to validate that you’re looking at the right metrics.

If you struggle to answer any of these questions, the data itself probably isn’t important enough, and it simply won’t be interesting to the stakeholders.

In closing

Reporting is a key way to keep your stakeholders informed, and ensure you’re spending your money effectively. We developed the four “I”s so that there is a framework in place that makes this process as useful, and efficient as possible. Those are:

- Insight

- Impact

- Important

- Input

If you follow this approach, you will only ever be reporting on what’s important to your stakeholders, and you will have confidence that you’re focusing on the data that matters most.

By answering these key questions, you will always be able to give context around your reporting, without needing to dig through endless amounts of data.

Need help improving how you measure your marketing? Schedule a Free SaaS Scale Session for more guidance on how you can monitor your progress and report to stakeholders.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.