Beyond Traffic and Engagement: Why Your B2B Saas Marketing Analytics Must Also Include CRM and Product Data

Last updated: March 26th, 2021

Whenever we talk to prospects about what’s broken in their marketing efforts, 8 out of 10 tell us analytics and attribution.

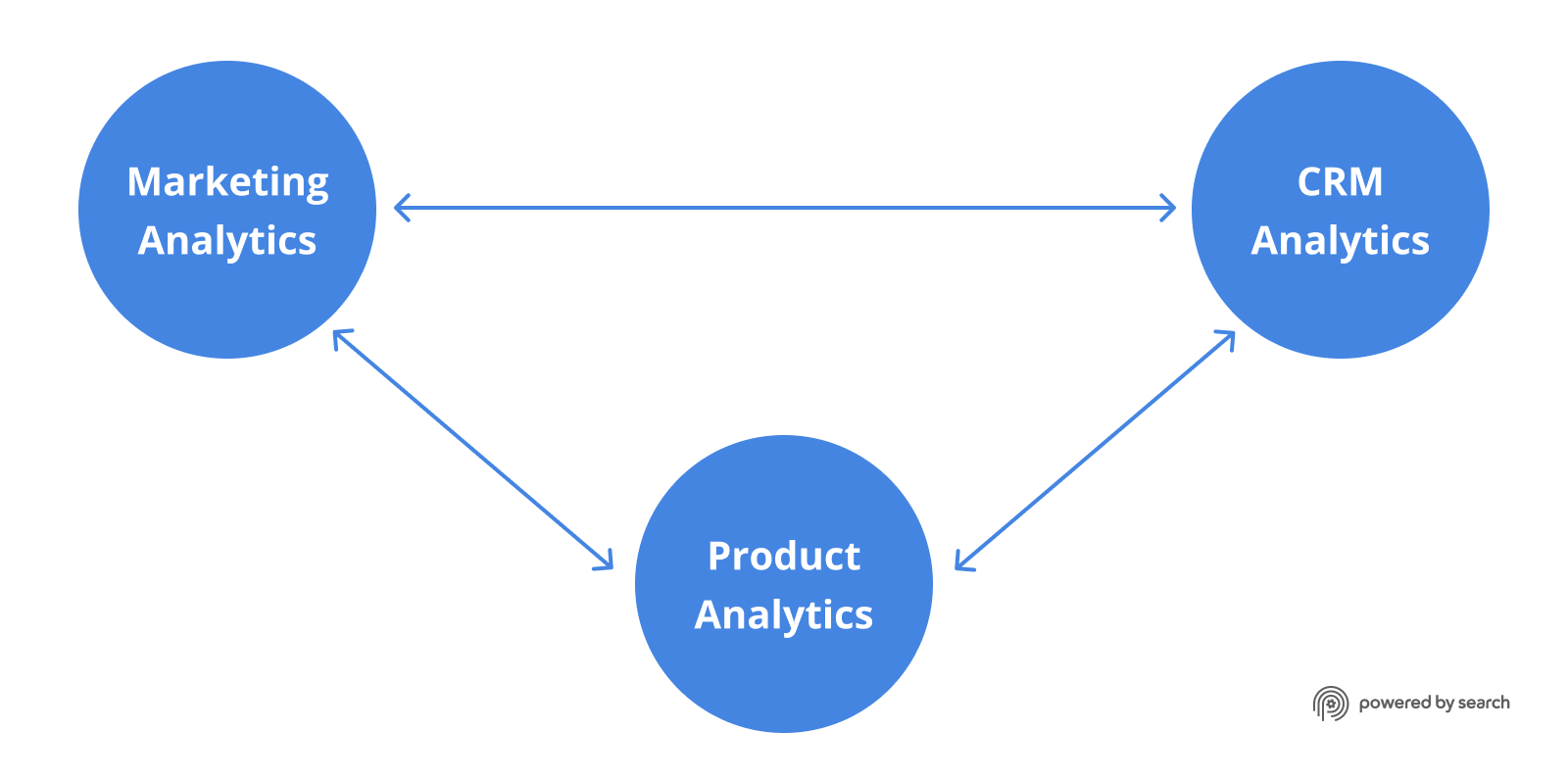

The reason for this is the disconnect between their data sources. In B2B SaaS marketing strategy, the conversation usually begins and ends with traffic and engagement analytics. CRM and product-usage data are managed by different stakeholders. As a result, they rarely enter the conversation for in-house marketers.

The silos formed by these different groups have other consequences as well. One of them is a fragmented view of the customer journey. An incomplete picture often leads to missed opportunities to attract better customers and move a big percentage of deals forward.

To fix this, B2B SaaS companies have to examine these three verticals as a whole rather than disparate parts. But the real question is: How?

We believe that B2B SaaS companies should start by measuring product-qualified KPIs. These are based on product-usage data of both your best and worst-fit customers. Once determined, you must then feed that information back to your sales and marketing teams.

Companies with stakeholders who share in real-time, rather than consolidate internal data are typically better off than companies that don’t. They become empowered to improve their ad targeting, content, and sales calls, which can often lead to:

- More qualified traffic

- Higher conversion rates

- Better prospect leads

- Lower churn rates

- And finally, higher lifetime value customers

In this article, we’ll explain how you can connect the dots between these three areas. But before we do, let’s first look at the mistakes we see many companies make in their SaaS marketing analytics. We’ll also expand on measurement and what product-qualified KPIs your company should start analyzing now.

If you’re a B2B SaaS company struggling to set up the systems necessary to achieve further growth, schedule a Free SaaS Scale Session to find out how we can help.

The Mistakes Made When Measuring B2B SaaS Marketing Analytics

Most B2B SaaS companies obsess over the wrong benchmarks. They tend to worry about improving traffic data, like sessions or conversion rates on form sign ups. They also don’t scrutinize important analytics in their CRM, which leads to fewer sales.

In our experience, for many companies, 1 in 10 demos go completely unanswered.

Measuring the wrong metrics often leads to an inaccurate view of the customer’s journey. For example, most SaaS businesses don’t consider their cost per customer acquisition relative to what stage a customer is in.

Results, like website visits, are often less expensive because only attention, not money, is exchanged. As prospects move closer to becoming customers, these results incrementally start to creep up in cost.

These are only a handful of pitfalls caused by the disconnect between your marketing, CRM, and product data. Below are four bigger mistakes we see companies make early on in the process:

Mistake #1: Tracking the Wrong Conversion Goals

The customer journey often begins with the click of a PPC ad. It then progresses through several more steps, like navigating through different pages on your website. From there, they eventually get to a form to sign up for a demo.

Most B2B SaaS marketers stop measuring there. But on the other side of that form are other important steps, such as your thank you page, the call itself, and what happens after your product is purchased.

Oftentimes, we’ll see B2B SaaS companies place a premium on increasing form fills for demos. But, it’s rare to find them tracking the downstream conversion of those signups.

And without analyzing sales and product-usage data, they’re left with an incomplete picture of who your best and worst customers are. As a result, they might build a strategy that often brings in lower-quality visitors.

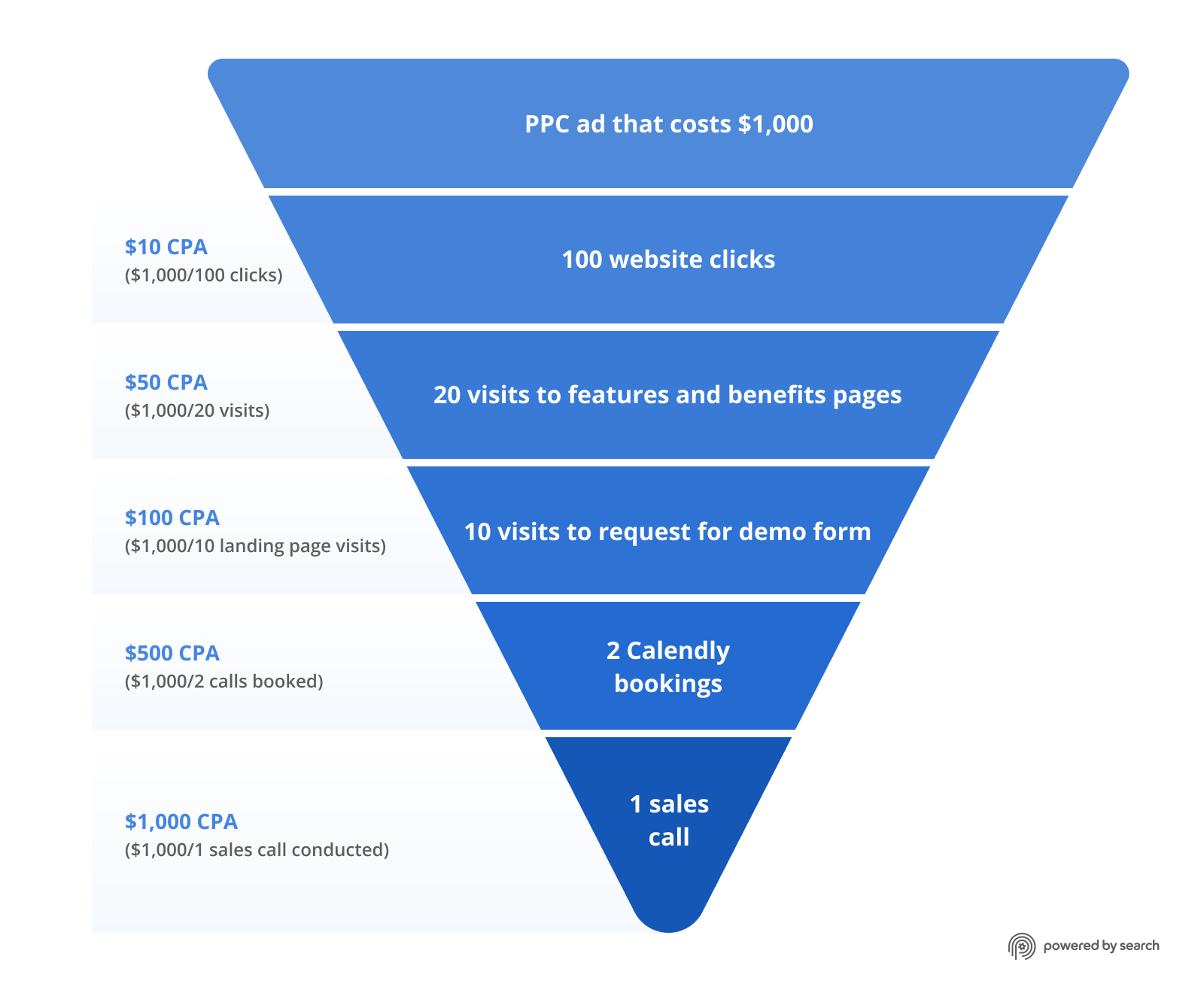

Take for example the hypothetical marketing and sales cycle below. It starts with a PPC campaign that runs for $1,000. But notice the cost per acquisition varies depending on what stage the prospect is in.

We think that companies should:

- Measure conversion goals that track user behavior related to purchase or product expansion.

- Measure how much it costs to drive traffic to content that indicates middle or bottom-of-funnel intent, like pricing or thank pages.

- Take into account purchasing behaviors and actions only active users would take.

Mistake #2: Using Google Analytics’ Default Settings for Conversion Values

Most B2B SaaS companies leave their conversion values set to $1 in Google Analytics. But they should actually adjust this metric relative to what a deal is worth to them.

A conversion value is not so much about what you wish to pay to acquire a customer. Instead, it’s more about the amount you earn at the end of the sales process.

We tell companies to think about their conversion values relative to the outcomes that matter most for them. For many companies, that can mean basing these on calls between sales teams and prospects.

To figure out the optimization for this, work backwards from the end of your customer’s journey.

Look at what happens when someone has become a customer or even expanded their usage of your product. Working with the end in mind enables you to give appropriate values to other actions that occur in your digital marketing and sales phases.

To illustrate, consider this example:

- A sale is worth an annual contract value of $10,000.

- To close one sale, you have to talk to five prospects. One out of five equals a 20% conversion rate.

- Take those two numbers in bold and multiply them to get your conversion value. $10,000 X 20% = $2,000 conversion value

In other words, each sales conversation is worth $2,000 to you. That means you would be happy to pay that exact figure or less to talk with a potential customer.

Mistake #3: Tracking Only Original and Last Referrers in Their CRM

Many B2B SaaS companies only track the first and last touchpoints of a customer’s journey in their CRM. Beyond keeping tabs on the first ad click and final sales call, they don’t examine the interactions a customer has with their business in between and after onboarding.

The reason for this is often because it’s the default way in which most CRMs are configured. It might seem like enough, but crediting only your original and last referrer is a myopic approach. The result is a lopsided attribution that doesn’t give you complete insight into how the buying and expansion process plays out.

We recommend transitioning away from this bi-modal CRM model into one that’s interconnected. The holy grail would be to set up your CRM to provide you with a lifetime history of every interaction prospects and customers have with your business. Platforms like HubSpot allow you to set this up fairly easily.

This would entail tracking engagements such as:

- A prospect or customer’s visit to feature and benefits pages relevant to them

- Sign-ups for demo requests

- Thank you page sessions after they’ve signed up

Mistake #4: Measuring Sales Accepted Leads in Their Cost Per Acquisition

It’s standard practice for many B2B SaaS companies to set their CPAs relative to their sales accepted leads. But instead, we think it’s more effective to connect CPAs to sales qualified leads.

It might sound like these two important metrics are one in the same. But there’s a difference between them that make sales qualified leads much more valuable.

A sales qualified lead is a prospect that moves further down the sales cycle. Meanwhile, sales accepted leads are prospects that may or may not end up being qualified. So many of these end up falling out of the sales process.

Sales cycles, like marketing campaigns, are set up like funnels. They start with a discovery call, move onto a demo conversation, and finally finish with a closed deal. When data isn’t connected between stakeholders, information about how a prospect moved through your sales cycle rarely gets fed back to your marketing activities.

Connecting the Dots Between Your Marketing, Sales, and Product Data

The first step in this whole process is fixing the mistakes we addressed above. To do that, you first need to determine your product-qualified KPIs.

Create a spreadsheet and start asking yourself about all the actions you want to measure. Discuss how much each one is worth to you and work through the math. From there, look at your CRM and each of your funnels that represent the three stages of the customer journey and apply values to them.

Begin with the end in mind. Analyze who your most profitable customers are. Then, consider the following:

- Their interactions with your product.

- What they think and say about you.

- How much they’re paying you.

Take this information and make use of them at the earlier stages of your customer journey. Some of the ways you can incorporate this information are:

Creating and Excluding Negative Lookalike Audiences in Your Ad Targeting

Churned customers have fundamental qualities that make them unfit for your product. Instead of setting that information to the side, give it to your marketers. They can use that data to exclude anyone matching the characteristics of your churned customers from your ad targeting.

How can you measure if this works? The telltale sign will be if you notice higher conversion rates in your analytics tools. By excluding negative lookalike audiences in your targeting, you should generate higher-value incoming traffic.

Better quality traffic should result in better quality leads and better quality customers. It effectively becomes a virtuous cycle of higher retention.

Highlight Popular Features Among Paying Customers at Earlier Stages of the Journey

When you look closely at product data, you’ll discover that you have certain features that drive customers to upgrade. Many companies use that information to create upsells to existing customers. But you can take that a step further by spotlighting these details in marketing and sales material for prospects.

For example, lets say your product’s three main benefits are speed, certainty, and insight. You come to discover that many of your customers who upgrade to premium plans most enjoy its speed. They specifically leave high ratings of your product’s automation capabilities.

Knowing this, you can work that information into other areas of your website. Highlight your automation features in landing pages for form signups or even in the messaging on your thank pages. You can do so by including testimonials that feature customers who rave specifically about the speed of your product.

Your Next Steps

Connecting your traffic and engagement, CRM, and product data is a sequential process. Have the end mind with your product data handy. But start by improving your attribution by attacking traffic and engagement data first.

That means begin by getting your Google Analytics in order. Determine your conversion goals and values. How you’re measuring your traffic and engagement data is the foundation of this entire process. If it’s not solid, the latter two stages of data sharing will suffer.

Once you’ve addressed your web analytics, move onto your CRM. Move away from the bi-modal model we discussed earlier in the article. Set up your CRM to track your touchpoints with customers beyond that first click and the last sales call.

Finally, your last move is to begin funneling your product-usage data back to the previous two stages of your customer journey. This is a matter of sharing details about both your best and worst customers to your marketing and CRM stakeholders. Doing so can help you generate higher qualified traffic.

Getting all your data sources connected isn’t a process that can happen overnight. In our experience with clients, it takes around two quarters to accomplish. The reason why is because people are at the heart of this process.

You need humans to agree on what to measure and how much certain actions are worth. You need humans to tag the right touchpoints with your customers all the way through. You need humans to take that data and interpret what all of it means.

These are three strategic conversations that stakeholders within your company need to have. A commitment to conducting them is an opportunity for you to align their incentives while bringing better quality customers into the fold of your business.

We help B2B SaaS companies better understand their data to grow through SEO and paid media. Schedule a free SaaS scale session to learn more.

What you should do now

Whenever you’re ready…here are 4 ways we can help you grow your B2B software or technology business:

- Claim your Free Marketing Plan. If you’d like to work with us to turn your website into your best demo and trial acquisition platform, claim your FREE Marketing Plan. One of our growth experts will understand your current demand generation situation, and then suggest practical digital marketing strategies to hit your pipeline targets with certainty and predictability.

- If you’d like to learn the exact demand strategies we use for free, go to our blog or visit our resources section, where you can download guides, calculators, and templates we use for our most successful clients.

- If you’d like to work with other experts on our team or learn why we have off the charts team member satisfaction score, then see our Careers page.

- If you know another marketer who’d enjoy reading this page, share it with them via email, Linkedin, Twitter, or Facebook.